Citigroup (C) Plans Mexico Banamex IPO, To Resume Buybacks in Q2

More than a year after announcing plans to exit its consumer, small business and middle-market banking operations in Mexico — Banco Nacional de México (“Banamex”), Citigroup Inc. C has decided to pursue an initial public offering (IPO) of the business.

The wall street biggie will continue to operate a locally-licensed banking business in Mexico through its Institutional Clients Group (“ICG”), and Citi Private Bank for ultra-high-net-worth individuals and families.

Citigroup has been pursuing a carve-out of the ICG business since announcing the plan to exit the business through a sale or a public market alternative. The company expects the separation of the businesses to be completed in the second half of 2024 and the IPO to take place in 2025.

Banamex will continue to be reported as part of the bank’s continuing operations until ownership falls below a 50% voting interest, at which point it will be deconsolidated.

The bank suspended common share repurchases from third-quarter 2022 through first-quarter 2023 in anticipation of any temporary negative capital impacts related to potential sales. But now, Mark Mason, CFO of Citigroup, remarked that the company would resume “a modest level of share buybacks” in second-quarter 2023. However, owing to the uncertainty regarding regulatory capital requirements, the bank will continue to assess buybacks on a quarterly basis.

Jane Fraser, CEO of Citigroup, noted, “After careful consideration, we concluded the optimal path to maximizing the value of Banamex for our shareholders and advancing our goal to simplify our firm is to pivot from our dual path approach to focus solely on an IPO of the business. Citi has operated in Mexico for over a century, and we will further invest and grow our industry-leading institutional franchise in this critical global hub, delivering the full power of Citi’s global network to our institutional and private banking clients in this priority market.”

Our Take

Since the announcement of the broader strategic actions to exit consumer banking across 14 markets in Asia, Europe, the Middle East and Mexico, Citigroup has signed deals to divest consumer businesses in nine markets and completed sales in seven markets, including Australia, Bahrain, Malaysia, the Philippines, Thailand, Vietnam and India.

The company is also in the process of winding down its consumer business in China and Korea, whereas, in Russia, it is wrapping up all its business.

Such exits will free up capital and help the company pursue investments in wealth management operations in Singapore, Hong Kong, the UAE and London to stoke growth. These efforts will likely help augment the company’s profitability and efficiency over the long term.

Also, supported by decent capital metrics and earnings strength, C’s capital deployment activities seem sustainable and will stoke investor confidence in the stock.

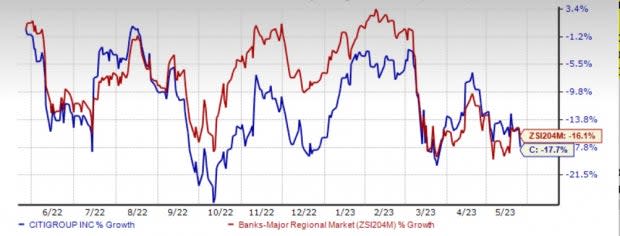

Over the past year, shares of Citigroup have lost 17.7% compared with a decline of 16.1% recorded by the industry.

Image Source: Zacks Investment Research

Currently, Citigroup carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Expansion Efforts by Other Banks

Amid a challenging operating backdrop due to expectations of economic slowdown, banks are undertaking expansion moves through acquisitions. Recently, LCNB Corp. LCNB entered an agreement to acquire Cincinnati Bancorp, Inc. CNNB in a stock-and-cash transaction. Closing of the deal (subject to regulatory approval, CNNB shareholder approval and other customary conditions) is expected in the fourth quarter of 2023. The approval of LCNB shareholders is not required.

The deal is expected to significantly increase LCNB’s existing presence in the Cincinnati market and expand its community banking franchise across the Ohio River into the compelling Northern Kentucky market. Excluding one-time transaction costs, LCNB expects the transaction to be 18.2% and 26.2% accretive to 2024 and 2025 fully diluted earnings per share, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

LCNB Corporation (LCNB) : Free Stock Analysis Report

Cincinnati Bancorp, Inc. (CNNB): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance