5 upstart cities where ultra-rich people can park their money

The most attractive property markets are five somewhat unlikely cities, according to a new report by Knight Frank.

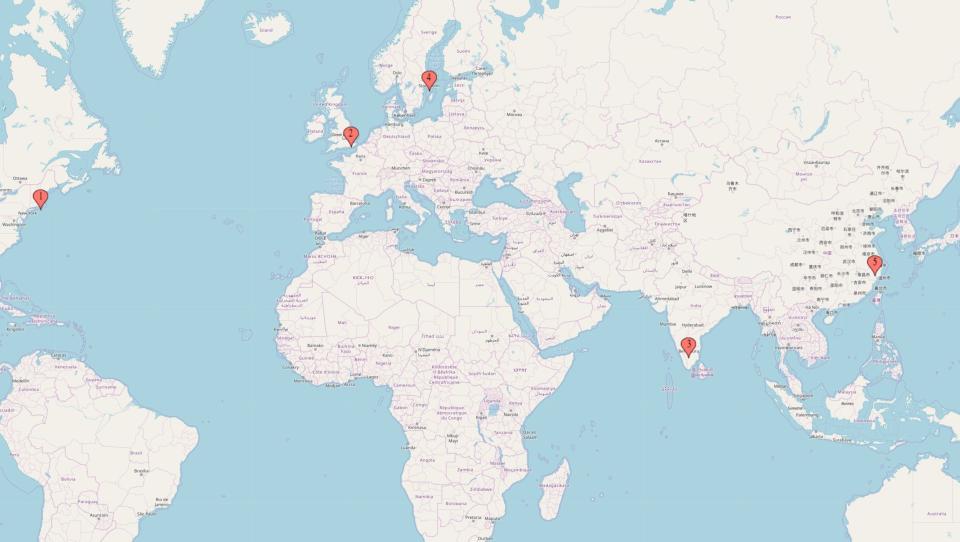

Bengaluru in India, Hangzhou in China, Stockholm in Sweden, Cambridge in the U.K., and Boston in the U.S. were named as the “cities of the future” in the global real estate firm’s ‘The Wealth Report.’ The cities were highlighted based on their ability to support wealth creation, innovation, economic growth and infrastructure.

Bengaluru, India

Known as the Silicon Valley of India, Bengaluru is home to a large number of big technology companies that are expanding quickly — earning the city the top spot on Knight Frank’s list.

Indian companies like Flipkart, Infosys, and Wipro — as well as multinationals like Microsoft, Hitachi, and Samsung — have laid down their bases in Bengaluru. And the city is poised to take on even more, according to the report, as it has been “grossing the country’s highest office absorption volume consecutively for the last ten years.”

Hangzhou, China

Home to Chinese e-commerce giant Alibaba, Hangzhou is also singled by out as a hotspot for property investors in the coming years.

The report said that the city’s economy has boomed thanks to its 26 unicorn-level startups — BABA being one of them — as well as various other sectors like transport, storage and communication services taking off.

Knight Frank also said that the city’s location — which was “in the middle of the Yangtze River delta, just an hour from Shanghai by high-speed train,” as well as its “infrastructure in the form of extensive rail, road and air routes” means that the city is well-positioned to reap the benefits from China’s overall success.

The report added that Hangzhou’s rapid growth has also “resulted in an increase in its [ultra-high net worth] population of 25% over the same period,” referring to individuals who have a net worth that exceeds $30 million beyond their primary residence.

Stockholm, Sweden

The “most innovative city in Europe,” according to the European Commission, Knight Frank believes Stockholm is going to become a “prominent centre for wealth and creation.”

The report said the “value placed on welfare and sustainability” has an effect of nurturing “pioneering ideas” that result in the birth of companies like music streaming platform Spotify and global fast-fashion chain H&M.

Knight Frank’s team also estimated that there may be a 23% surge in Stockholm’s number of ultra-high net worth people — those with net worth upwards of $30 million — between 2018 and 2023.

Cambridge, U.K.

Knight Frank said university city Cambridge is the “U.K.’s answer to Silicon Valley,” giving it a spot on the list.

“The world-class talent coming out of the University of Cambridge, combined with the city’s renowned research facilities and pre-existing network of tech businesses, encapsulates its appeal,” the report explained, adding that as a testament to the city’s importance was the fact that tech giants like Apple, Amazon and Microsoft also have a presence.

Boston, U.S.

The last of the cities chosen for presenting the biggest opportunities for the property market is in Boston, Massachusetts.

Boston is currently home to industrial giant General Electric and is also starting to attract a large number of Gen Zers (those aged between 1997 and 2012).

“The city of Boston is an attractive and relatively affordable alternative investment destination to New York and San Francisco,” said the report, adding that “unlike these established markets, Boston is less densely populated by startups, making the competition for attracting capital less fierce.”

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

$1,000,000 will buy you shockingly little prime property in the world's richest cities

Gen Z workers are flocking to New York City’s tech scene: Glassdoor

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance