Cisco Systems: Beware the Value Trap

Cisco Systems Inc. (NASDAQ:CSCO) was once a hyped up tech stock, particularly during the dot-com bubble. Its peak was at a time when the market was elevating its networking services, akin to the current spotlight on Nvidia (NASDAQ:NVDA) amidst the artificial intelligence boom.

CSCO Data by GuruFocus

The company's dominant market presence has solidified its position as a leader in the networking industry, continuously expanding its product portfolio through strategic acquisitions. The business model includes recurring elements, particularly in its services segment, where customers subscribe regularly. The company's software solutions also involve subscription-based licensing models, contributing to recurring revenue streams.

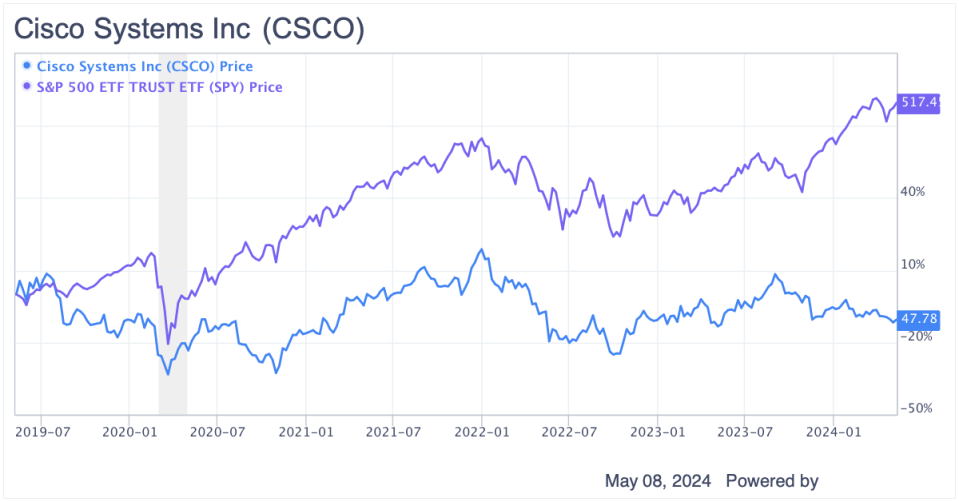

Through its business model, Cisco has demonstrated respectable growth in earnings per share, efficient ratios and gross margins above the technology industry average, making it a robust dividend-paying tech stock compared to its peers. However, the lack of growth power has negatively affected its share performance, with Cisco's share price falling by 11% in the last five years, reflecting a decline in investor enthusiasm.

Despite the stock's underperformance, Cisco's revenues are expected to remain stable given the industry's maturity reaching its peak and the potential impact of AI on its operations. While taking a vehemently bullish stance on Cisco may be complex, it may not be considered a bad investment. Based on its business fundamentals, the company still embodies all the principles of a value stock pick, aligning with Warren Buffett (Trades, Portfolio)'s philosophy.

However, Cisco's lackluster stock performance over the last five years raises questions about the relevance of value investing in the current market landscape. Is this yet another instance of falling into a value investing trap? Let's delve into the details.

Cisco's disappointing performance has nothing to do with its fundamentals

Cisco's business is somewhat cyclical and tends to correlate with broad economic trends, particularly during periods of stability. Not surprisingly, the company has a five-year beta of 0.85, indicating a moderate level of correlation in line with major indexes. However, the nature of the network solutions industry allows financial results to be somewhat forward-looking and thus disconnected from the economic activity of end consumers. Consequently, Cisco's performance significantly lags behind the S&P 500 over the past five years.

CSCO Data by GuruFocus

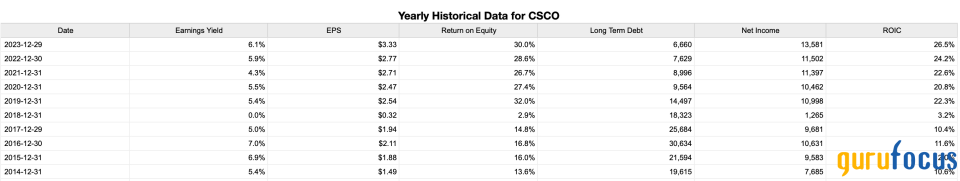

Despite the underperformance in stock prices, Cisco's fundamentals tell a different story. The company boasts an enviable track record of profitability, with generally increasing earnings per shrare over the last five years and no negative earnings years. Efficiency metrics further highlight Cisco's strength, with an average return on equity of 30% over the last five years, indicating its ability to generate significant net profits relative to its net assets.

Additionally, Cisco has managed its capital investments effectively, with an average return on invested capital exceeding 20% over the same period. In the last decade, the company's long-term debt has not exceeded five times its annual earnings, and even in 2023, its net income was double its long-term debt.

Furthermore, when considering the earnings yield, Cisco stands at 6%, surpassing the long-term Treasury yield of 4.60%. This is positive as it suggests a higher potential return for investors and a favorable balance between risk and return. It may also indicate the company's shares are undervalued in terms of its profits.

Source: Stock Rover

Cisco's growth potential in check

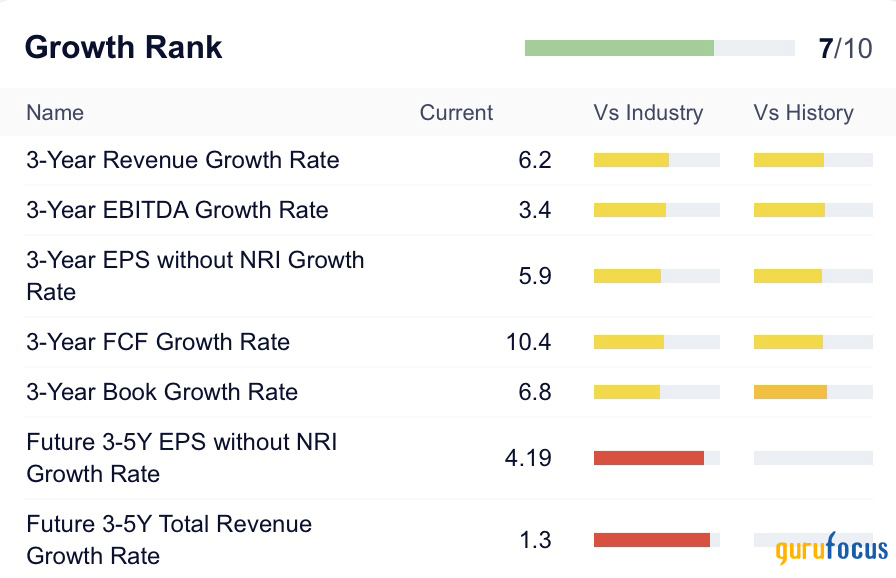

Over the past few years, Cisco's growth trajectory has been modest, nearly aligning with the industry average and exhibiting an average performance compared to its historical trends. As the business model may have reached full maturity, acquisitions have been the main driver for growth. These acquisitions have ranged from networking hardware and software companies to cybersecurity and cloud computing providers. Notable acquisitions include purchasing companies like Meraki, WebEx and Duo Security.

Source: GuruFocus

As AI has become the main driver of growth in technology over the past year, Cisco is also potentially positioned to benefit more significantly from this trend. The networking device sector is underscored by the establishment of the Ultra Ethernet Consortium, which emphasizes its crucial role in modern AI jobs.

Large language models and recommendation systems rely on GPU clusters and, in this case, Cisco finds itself in that position, considering its ability to scale and its position of dominance in networking.

An example is the collaboration with Nvidia (NASDAQ:NVDA), which plans to deliver AI infrastructure solutions. These solutions, sold through Cisco's global channel, will offer professional services and support for deploying GPU clusters via Ethernet infrastructure.

In any case, Wall Street's growth projections for Cisco are for forward revenue growth of just 4.10%, half the industry average, and Ebitda growth of a tiny 1.60%. When factored into annual projections, the consensus predicts the company should report a yearly decrease in earnigs per share of 6.50% in the fiscal period ending July 2024.

Don't be fooled by cheap valuation multiples

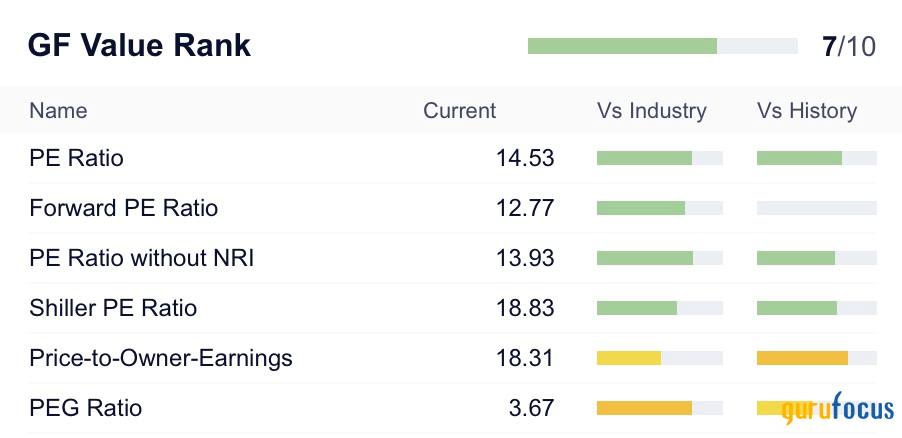

Another pertinent question is whether Cisco's multiples suggest a favorable value opportunity. The stock trades at a forward price-earnings ratio of 14, 45% below the tech industry average. Despite offering a dividend yield of 3.30%, which momentarily falls below the 10-year Treasury yield, the company may not hold much appeal as a good income stock option at present.

Furthermore, when considering Cisco's earnings potential with its current share price, the company trades at a forward PEG ratio of 3.60, compared to 1.90 above the industry average. This metric doubts whether Cisco's shares are undervalued, as initially suggested by earnings multiples alone.

Source: GuruFocus

The bottom line

The performance of Cisco's shares in recent years reflects investors' impatience as the company has shown little growth in a mature industry like communications equipment. Despite its stable value generation and potential dividends, particularly when compared to the long-term treasury yield, the company's attractiveness as an investment is diminished.

While Cisco maintains strong business fundamentals that align with value investing principles, the outlook is muted due to the stagnant networking market and limited earnings growth potential at its current valuation. Therefore, caution is advised, as Cisco may be evolving into a value trap scenario.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance