Cisco (NASDAQ:CSCO) is on Track to Dividend Aristocracy

This article first appeared on Simply Wall St News.

After a turbulent 2020, Cisco Systems, Inc. (NASDAQ: CSCO) stock has been doing well in 2021, outperforming the broad market and staying in line with the expectations.

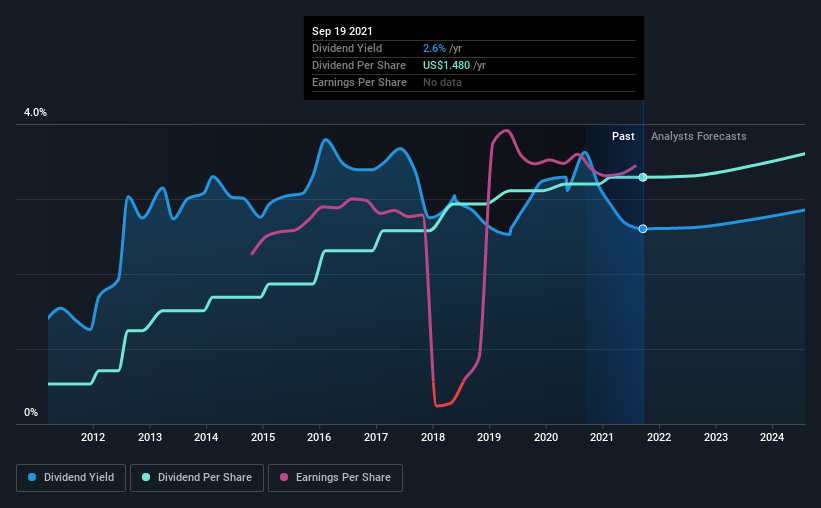

Yet, investment banks are divided on the future of the stock. In this article, we will examine those standpoints and take a closer look at the dividend that currently yields 2.6%.

Upgrades and Downgrades

Cisco just held a virtual investor day, with the CEO Chuck Robbins reflecting on the previous goals. He proclaimed success as the company grew subscription software revenues to almost US$12b from US$3.4b at the start of his tenure.

As the market matures and the compound annual growth slows down, the company remains committed to returning the value to shareholders through dividend and share buybacks. Management reassured the plan to return at least half of the company's free cash flow to shareholders and aim for the dividend increases.

Most of the analysts took notice and raised the expectations. Credit Suisse lifted the price target from US$56 to US$74, raising the outlook from Neutral to Outperform. Jefferies boosted it from US$63 to US$65, while Raymond James moved the goal post from US$57 to US$64.

However, not everyone shares optimism. Morgan Stanley downgraded the stock from Overweight to Equal-Weight, with a price target of US$59. Interestingly, it was Morgan Stanley that took Cisco public back in 1990, at a valuation of US$224m, inflation-adjusted US$468.85m in 2021.

Analyzing the Dividend

While a 2.6% yield is hard to get excited about, the long payment history is respectable. At an attractive price or with solid growth opportunities, Cisco Systems could fit many yield-oriented portfolios.

The company also bought back stock during the year, equivalent to approximately 1.2% of the company's market capitalization at the time. When buying stocks for their dividends, you should always run through the checks below to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Cisco Systems.

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable relative to its net profit after tax.

Cisco Systems paid out 58% of its profit as dividends over the trailing twelve-month period. This is a healthy payout ratio, and while it does limit the earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

Another essential check is to see if the free cash flow generated is sufficient to pay the dividend. Of the free cash flow it generated last year, Cisco Systems paid out 42% as dividends, suggesting the dividend is affordable. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally indicates the dividend is sustainable, as long as earnings don't drop.

While the above analysis focuses on dividends relative to a company's earnings, we note Cisco Systems' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Cisco Systems' latest financial position by checking our visualization of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point in buying a stock if its dividend is regularly cut or is not reliable. For this article, we only scrutinize the last decade of Cisco Systems' dividend payments.

The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was US$0.2 in 2011, compared to US$1.5 last year. This works out to be a compound annual growth rate (CAGR) of approximately 20% a year over that time, which is respectable.

It's rare to find a company that has grown its dividends rapidly over 10 years and not had any notable cuts, but Cisco Systems has done it.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) grew, as this is essential to maintaining the dividend's purchasing power over the long term.

Earnings have grown at around 3.4% a year for the past five years, which is not much but certainly better than nothing. 3.4% per annum is not an exceptionally high rate of growth, but then again, we have to take the size into account as well. If the company is struggling to grow, perhaps that's why it elects to pay out more than half of its earnings to shareholders.

Conclusion

To summarise, shareholders should always check that the dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend.

Cisco Systems' payout ratios are within a normal range for the average corporation, and we like that its cash flow was more robust than reported profits. Earnings growth has been limited, but we like that the dividend payments have been fairly consistent.

Although Cisco Systems has some positive attributes, to satisfy our high standards, we'd have to conduct further research into its competitive advantages or wait for it to achieve a more attractive valuation.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analyzing stock performance. For example, we've picked out 1 warning sign for Cisco Systems that investors should know about before committing capital to this stock.

Are you looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance