Cisco (CSCO) Q1 Earnings Beat, Shares Down on Grim Outlook

Cisco Systems CSCO reported first-quarter fiscal 2020 non-GAAP earnings of 84 cents per share that beat the Zacks Consensus Estimate by 3.7% and grew 12% year over year.

Revenues climbed 0.7% year over year to $13.16 billion and surpassed the consensus estimate by 0.6%. Excluding the Service Provider Video Software Solutions (SPVSS) business that was divested in second-quarter fiscal 2019, revenues increased 2% year over year.

Acquisitions contributed 50 basis points (bps) to the top line. Notably, Cisco completed four acquisitions, all in the applications space, in the reported quarter.

Cisco’s shares were down almost 6% in pre-market trading, primarily due to unimpressive first-quarter fiscal 2020 results and weak second-quarter guidance.

The company blamed sluggish macro-economic conditions (due to the U.S.-China trade, Brexit and others) and a slowing China economy for the weakness in the service provider, enterprise and commercial end markets. Management expects growth in these markets to be muted in the near term.

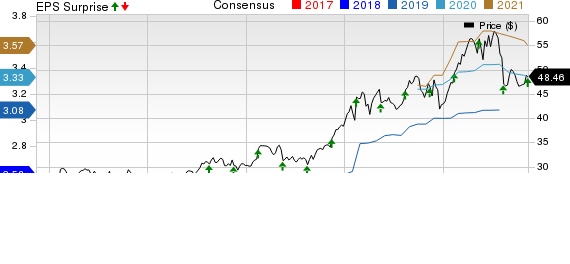

Cisco Systems, Inc. Price, Consensus and EPS Surprise

Cisco Systems, Inc. price-consensus-eps-surprise-chart | Cisco Systems, Inc. Quote

Top-Line Details

Product revenues (75.1% of total revenues) were flat on a year-over-year basis at $9.88 billion.

Service revenues (25%of total revenues) increased 3.1% to $3.28 billion, driven by growth in software and solutions services. Software subscriptions represent 71% of Cisco’s software revenues.

Region-wise, Americas and EMEA revenues decreased 3% and 2% year over year, respectively. Moreover, revenues from APJC decreased 9%. Total emerging markets declined 13% and the BRICs plus Mexico fell 26%.

In terms of customer segments, both enterprise and commercial revenues declined 5% each. Moreover, service provider revenues were down 13%. However, public sector revenues rose 6%.

Remaining performance obligations (RPO) at the end of the reported quarter were $24.9 billion, up 11%. The metric represents total committed non-cancelable future revenues.

Total product orders were down 4% on a year-over-year basis.

Segment Details

Infrastructure Platforms (57.3% of total revenues) comprise Switching, NGN routing, Wireless and Data Center solutions. Revenues fell 1% year over year to $7.54 billion.

While routing declined due to weakness in service provider, Switching grew in both campus and data center end markets, driven by strong demand for Catalyst 9000 family of switches and Nexus 9K solutions.

Additionally, Wireless solution grew owing to Meraki. Data Center witnessed solid growth, led by HyperFlex.

Applications (11.4% of total revenues) consist of the Collaboration portfolio of Unified Communications (UC), Conferencing and TelePresence, IoT and application software businesses such as AppDynamics and Jasper.

Revenues increased 6% year over year to almost $1.50 billion, driven by double-digit growth at AppDynamics.

Security revenues (6.2% of revenues) improved 22% to $815 million. The growth can be attributed to solid demand witnessed by web security, unified threat, network security and advanced threat solutions.

Other Products segment contains service provider video, cloud and system management, and various emerging technology offerings. Revenues plunged 85% to $26 million.

Operating Details

Non-GAAP gross margin expanded 210 bps from the year-ago quarter to 65.9%. On a non-GAAP basis, product gross margin expanded 290 bps but service gross margin contracted 30 bps.

Management stated that the gross margin benefited from increasing software content in the revenue mix.

Non-GAAP operating expenses were $4.26 billion, up 2.1% year over year. As a percentage of revenues, operating expenses increased 40 bps to 32.4%.

Non-GAAP operating margin expanded 170 bps year over year to 33.6%.

Balance Sheet and Cash Flow

As of Oct 27, 2019, Cisco’s cash & cash equivalents and investments balance were $28 billion, down from $33.41 billion as of Jul 27, 2019.

Total debt, as of Oct 27, was $18.50 billion compared with $24.67 billion as of Jul 27.

The company generated $3.6 billion in cash flow from operations during the quarter under review.

In the fiscal first quarter, Cisco returned $2.3 billion to shareholders through share buybacks and dividends. The company has $12.7 billion remaining under its current share buyback program.

Guidance

For second-quarter fiscal 2020, revenues are expected to decline 3-5% on a year-over-year basis.

Non-GAAP gross margin is expected in the range of 64.5-65.5%, while operating margin is anticipated between 32.5% and 33.5% for the quarter.

Cisco expects pricing pressure in the server market to accelerate in the fiscal second quarter. Moreover, the company expects the gross margin to continue benefiting from lower DRAM prices (in the server market). Further, lower operating expenses are expected to boost operating margin.

Non-GAAP earnings are anticipated between 75 cents and 77 cents per share. The Zacks Consensus Estimate for earnings is pegged at 80 cents per share.

Zacks Rank & Stocks to Consider

Cisco currently carries a Zacks Rank #3 (Hold).

Alteryx AYX, Cirrus Logic CRUS and Marchex MCHX are a few better-ranked stocks in the broader computer and technology sector. All three companies sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

While the long-term earnings growth rate for Alteryx is pegged at 39.9%, both Cirrus Logic and Marchex’s earnings are expected to grow 15% each.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Marchex, Inc. (MCHX) : Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance