What Is China SXT Pharmaceuticals's (NASDAQ:SXTC) P/E Ratio After Its Share Price Tanked?

To the annoyance of some shareholders, China SXT Pharmaceuticals (NASDAQ:SXTC) shares are down a considerable 31% in the last month. The bad news is that the recent drop obliterated the last year's worth of gains; the stock is flat over twelve months.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that long term investors have an opportunity when expectations of a company are too low. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for China SXT Pharmaceuticals

Does China SXT Pharmaceuticals Have A Relatively High Or Low P/E For Its Industry?

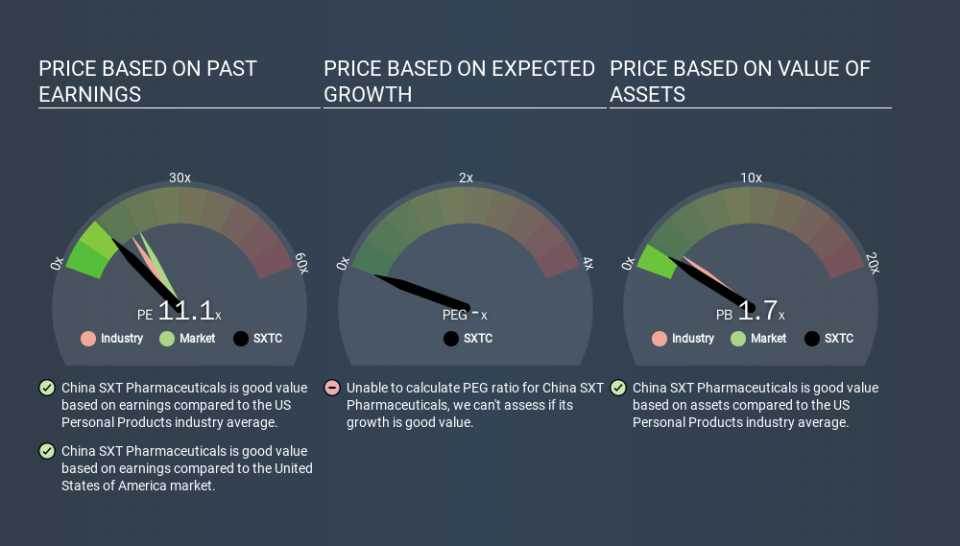

We can tell from its P/E ratio of 11.09 that sentiment around China SXT Pharmaceuticals isn't particularly high. If you look at the image below, you can see China SXT Pharmaceuticals has a lower P/E than the average (15.5) in the personal products industry classification.

China SXT Pharmaceuticals's P/E tells us that market participants think it will not fare as well as its peers in the same industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. And in that case, the P/E ratio itself will drop rather quickly. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Notably, China SXT Pharmaceuticals grew EPS by a whopping 26% in the last year. And it has bolstered its earnings per share by 60% per year over the last five years. With that performance, I would expect it to have an above average P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting China SXT Pharmaceuticals's P/E?

With net cash of US$6.4m, China SXT Pharmaceuticals has a very strong balance sheet, which may be important for its business. Having said that, at 29% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Bottom Line On China SXT Pharmaceuticals's P/E Ratio

China SXT Pharmaceuticals's P/E is 11.1 which is below average (18.1) in the US market. Not only should the net cash position reduce risk, but the recent growth has been impressive. The relatively low P/E ratio implies the market is pessimistic. What can be absolutely certain is that the market has become significantly less optimistic about China SXT Pharmaceuticals over the last month, with the P/E ratio falling from 16.2 back then to 11.1 today. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for a contrarian, it may signal opportunity.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course you might be able to find a better stock than China SXT Pharmaceuticals. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance