‘Huge’: Alarming detail in fresh China data spooks experts

Australian experts have expressed alarm over a detail in fresh data out of China, warning the economic fallout of coronavirus will be ‘huge’.

The PMI – purchasing managers’ index – measures economic trends and business sentiment among the manufacturing and service sectors, and is generally an indicator of business activity.

And given that coronavirus has brought China, or the ‘world’s factory’, to a standstill, a fall in China’s PMI has been expected.

Related story: Aussie stock markets tumble more than 2 per cent at open

Related story: RBA cut tipped for both March and April

But the extent of its fall had not been anticipated by economists – and it’s got some Australian experts worried.

A sign of things to come globally?

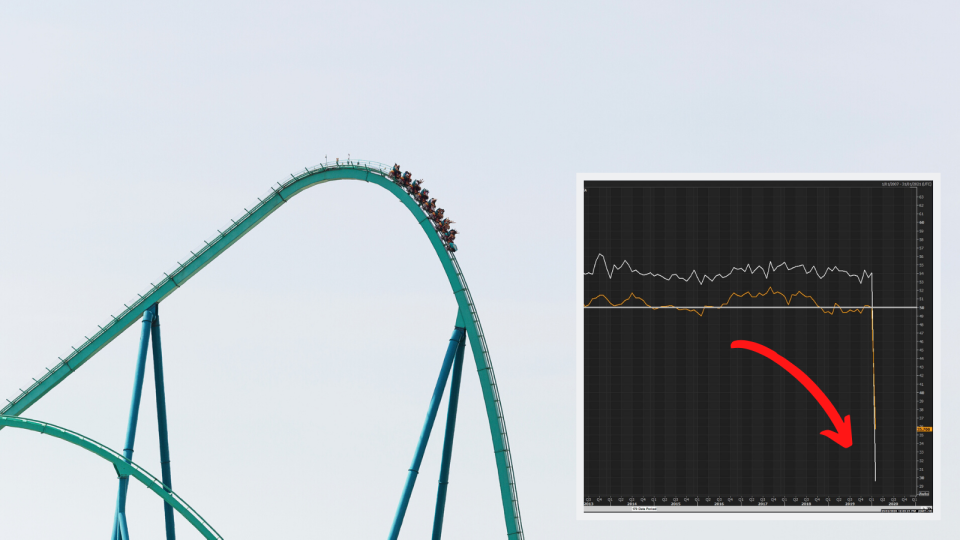

China manufacturing (35.7) and non-manufacturing (28.9) #PMI fall to record lows in February pic.twitter.com/m8CIcFaoYr— David Scutt (@Scutty) February 29, 2020

What does this mean for Australia?

Australia’s economy is closely tied with China’s. In essence, if China sneezes, Australia tends to catch a cold.

“China is Australia’s largest trading partner so its health is important to Australian exporters and importers,” explained CommSec chief economist Craig James.

Independent economist Stephen Koukoulas told Yahoo Finance: “If the number is a true reflection of the Chinese economy, and it is not a statistical blip, then the fallout for Australia will be huge.

“China takes around one-third of Australia's exports and the effects through the rest of Asia and the world will feed back to the other two-thirds.”

Burman Invest chief investment officer Julia Lee said Australia would be directly impacted by China’s weaker manufacturing figures in several ways.

“Australians can expect to see weak consumer confidence, weak business investment, falling interest rates, lower Australian dollar, and loss in jobs.”

Australia’s employment market is already struggling: January saw another 31,000 Aussies out of a job.

JP Morgan Asset Management global market strategist Kerry Craig said the drop was higher than experts had anticipated.

“It was expected that the figure would decline but the magnitude of the fall is larger than expected. The consensus figure from FactSet was for a reading closer to 45, but instead the final reading was 35.7,” he said.

“China accounts for approximately 30 per cent of global economic growth, however the ramifications for Australia are perhaps higher than other developed economies because of our reliance on trade with China.

“If there is little economic activity in China then demand for commodities, like iron ore, will be weaker.” On top of that, given that many parts in Australian products are supplied from China, factory closures could mean disrupted supply to local companies.

The flow-on effect from this is lower corporate earnings in Australia, and a bruised stock market.

What can we do about it?

For Koukoulas, the answer is clear: we should cut interest rates.

“As a warning sign for local policy makers, the effect is clear – policy easing is needed now,” he said. This means the Reserve Bank of Australia will have to slash interest rates again, and fiscal easing is needed.

“That easing should be in the form of immediate cash into the economy – don’t wait until the budget in May.”

For Kerry Craig, an RBA cut is all but expected.

“As the outlook for global growth and disruption from COVID-19 widens out, there is greater chance of both a fiscal and monetary response. We fully expect the RBA to cut rates tomorrow and then again in the coming months should the outlook not improve.”

Westpac and the Royal Bank of Canada also expect the Reserve Bank to cut tomorrow.

AMP Capital chief investment officer Shane Oliver said coronavirus had added to the growing list of Australia’s economic woes.

“Concerns around Covid-19 though have since gone global so the risk is increasing that the hit to the Australian economy will continue into the June quarter, hence the sharp fall in share markets and the need for more policy stimulus, like rate cuts and tax cuts eventually.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance