Getting mums back to work could boost the economy by nearly $700m

Bringing mums back to full-time work through greater government investment in childcare subsidies could unlock part of the workforce, boost productivity and boost GDP by nearly $700 million.

According to KPMG’s new report Unleashing our potential – the case for further investment in the child care subsidy, released today, ‘secondary earners’ – often women – are being disincentivised away from paid work, because it’s simply not financially worth it for them due to the costs of childcare.

Related story: Some new mums are actually losing money by coming back to work

Related story: How to save $20,000 on childcare

Related story: 100 Sydney childcare centres are scamming $750 million

Previous research from KPMG showed that mothers who were working five days a week were actually losing money compared to those who were working fewer days. That research is based on calculations using the ‘Workplace Disincentive Rate’ (WDR), which calculates the ratio of extra earnings from going back to work against the benefits lost to income tax, family payments and childcare.

Now, KPMG is arguing that reforming the government’s child care subsidy (CCS) would see the economy better off.

What’s the problem with childcare subsidy right now?

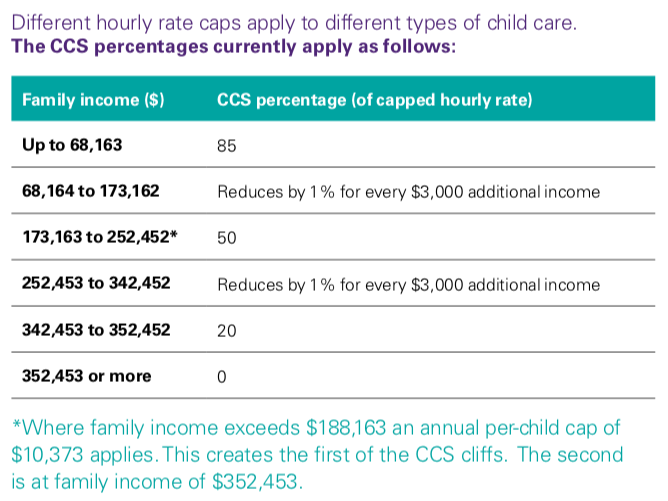

At the moment, the CCS is means-tested according to family – not individual – income, and is calculated as a percentage of either the hourly rate paid to the childcare provider or an hourly capped rate (whichever is lower).

The CCS percentages are tied to family income brackets in such a way where earning just $1 more than that bracket could see up to $5,000 of childcare subsidy lost, according to KPMG.

“This is an inherent quirk in the system and could be addressed by replacing the cliffs with tapering of the rate of CCS as a family’s income increases,” said KPMG Australia chairman Alison Kitchen.

What is KPMG proposing?

The report outlines two options, but the one KPMG prefers is to have the Federal government cap the WDR at the secondary earner’s marginal income tax rate, plus 20 percentage points.

“There would then be a top-up payment through the CCS system. This would benefit households across the income scale, but especially those at modest incomes who can least afford to be prevented from working more hours,” explained Kitchen.

Here’s an example of how much parents would get under this proposal:

Under this plan, an estimated 29,805 working days per week would be added to the economy, costing the government $438 million in CCS expenditure.

But this would bring $678 million back to the Australian economy.

Even conservative projections would see about 21,595 additional work days at the cost of $396 million, contributing an extra $491 million in GDP.

Is this the boost to productivity Australia needs?

Treasurers both past and present have pinpointed productivity – or lack thereof – as a chief economic issue for Australia.

In a recent speech, Federal Treasurer Josh Frydenberg told Australian businesses of the importance of increasing productivity in order to raise wages and thereby Australia’s standards of living.

“Our productivity growth over the last decade has slowed and we cannot simply rely on high commodity prices to boost national income,” he said.

“What is in our control is our ability to influence productivity with the right policy settings and business practices.”

And speaking at the Yahoo Finance All Markets Summit last month, Australia’s longest-serving Treasurer Peter Costello highlighted the importance of structural policy – not interest rate cuts – in boosting the economy.

KPMG economics & tax centre partner Grant Wardell-Johnson said the workforce disincentives – which hit women hardest – will persist without major policy shifts.

“Given Australia’s weak productivity performance, it is crucial that we make better use of the skills and experience of many parents who have taken time out of the workforce to bring up children,” he said.

“The support the proposals give to closing the workforce participation gap will also contribute to reducing the current gender pay and superannuation gaps which women experience.”

In the report, Wardell-Johnson said parents who take time out of the workforce have the experience and skills that can increase the productivity of others – and therefore they’re needed to contribute as much as they can without being hindered by “steep financial disincentives”.

“Addressing the cost of child care will contribute to the social goal of parental equality of opportunity for vocational and professional growth, and to the health and resilience of the economy,” he said.

Late last month, Deakin University Business School chair in economics Chris Doucouliagos proposed another idea to boost productivity: profit-sharing.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance