Cheniere Energy Q1 Earnings, Revenues Top on Solid LNG Volumes

Cheniere Energy, Inc. LNG recently reported strong first-quarter 2020 results.

This largest U.S. liquefied natural gas exporter delivered earnings per share of $1.43, beating the Zacks Consensus Estimate of 47 cents. The bottom line also skyrocketed 165% from the year-ago figure of 54 cents per share. Solid contribution from LNG sales led to this outperformance.

Moreover, revenues from LNG came in at $2,568 million, increasing 19.8% from the year-ago number of $2,143 million.

Owing to higher LNG volumes, quarterly revenues rose 20% to $2,709 million from $2,261 million a year ago. The top line also beat the Zacks Consensus Estimate of $2,544 million in the quarter under review.

The company posted adjusted EBITDA of $1,039 million with DCF of around $250 million. During the quarter, Cheniere shipped 128 cargoes, jumping 47% from the year-earlier figure. Total volumes of LNG exported were 455 trillion British thermal units (TBtu) compared with 309 TBtu in the prior year.

Costs & Balance Sheet

Overall costs and expenses fell 17.6% from the corresponding quarter of last year to $1,363 million. This drop is mainly attributed to lower cost of sales expenses that plummeted 40.4% from the year-ago quarter to $724 million.

As of Mar 31, Cheniere had approximately $2,399 million in cash and cash equivalents. Its net long-term debt was $28,940 million (with a debt-to-capitalization of 91.4%).

In the quarter ending March, the company repurchased an aggregate of 2.9 million shares of its common stock for $155 million under its share buyback program.

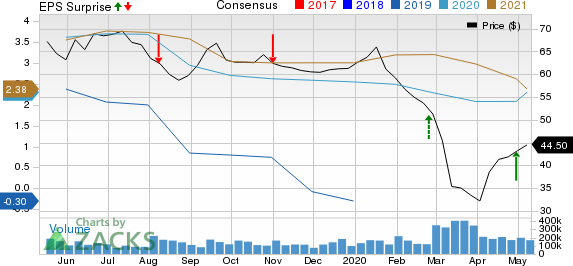

Cheniere Energy Inc Price, Consensus and EPS Surprise

Cheniere Energy Inc price-consensus-eps-surprise-chart | Cheniere Energy Inc Quote

2020 Guidance

In a 10-Q filing with the SEC, management stated that the worldwide LNG consumption was up by around 10% year over year in the first quarter. However, the company cautioned that demand for the fuel is expected to take a hit over the next few quarters as slowdown in global economic activity and high-storage inventory builds lower the requirement for imports.

Cheniere reiterated its guidance for the full year. It anticipates adjusted EBITDA within $3.8-$4.1 billion with distributable cash flow between $1 billion and $1.3 billion.

Project Updates

Sabine Pass Liquefaction Project (SPL): Sabine Pass is North America’s first large-scale liquefied gas export facility. Cheniere intends to construct up to six trains at the Sabine Pass with each train’s expected capacity to be 4.5 million tons per annum (Mtpa). Notably, run-rate of LNG production is anticipated within 4.7-5 Mtpa. While Trains 1 through 5 are functional, Train 6 is currently under construction with completion estimated within the first half of 2023.

Corpus Christi Liquefaction Project (CCL): Under this project, the company aims to build three trains, each with a nominal production capacity predicted to be 4.5 Mtpa of LNG. Notably, Train 1 and 2 are functional while Train 3 is under construction. In June 2019, the first commissioned cargo from Train 2 was dispatched. Train 3 is expected to come online in the first half of 2021.

Corpus Christi Expansion Project: Cheniere looks to develop seven midscale liquefaction trains adjacent to the CCL Project. Total production capacity of these trains is assumed to be 10 Mtpa.

Zacks Rank & Other Key Picks

Cheniere has a Zacks Rank #2 (Buy). Other top-ranked players in the energy space include CNX Resources Corporation CNX, EQT Corporation EQT and KLR Energy Acquisition Corp. ROSE, each carrying the same Zacks Rank as Cheniere. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EQT Corporation (EQT) : Free Stock Analysis Report

CNX Resources Corporation (CNX) : Free Stock Analysis Report

Cheniere Energy Inc (LNG) : Free Stock Analysis Report

KLR Energy Acquisition Corp (ROSE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance