Chemours (CC) Earnings Top, Revenues Miss Estimates in Q3

The Chemours Company CC reported profit of $76 million or 46 cents per share in the third quarter of 2019, down roughly 72.4% from profit of $275 million or $1.51 per share a year ago.

Adjusted earnings were 59 cents per share for the quarter, which surpassed the Zacks Consensus Estimate of 56 cents.

Net sales fell around 14.6% year over year to $1,390 million, hurt by lower volume in the company’s Titanium Technologies unit, and reduced volume and prices in the Fluoroproducts unit. Revenues lagged the Zacks Consensus Estimate of $1,393 million.

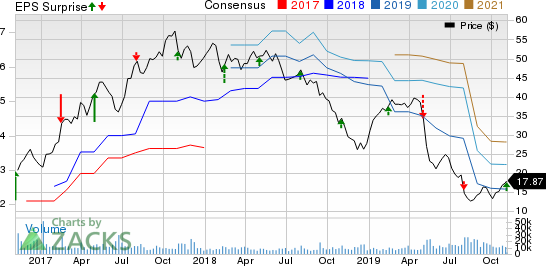

The Chemours Company Price, Consensus and EPS Surprise

The Chemours Company price-consensus-eps-surprise-chart | The Chemours Company Quote

Segment Highlights

Revenues in the Fluoroproducts segment fell 6.8% year over year to $636 million in the reported quarter. The favorable impact of the adoption of Opteon refrigerants was more than offset by illegal imports of HFC refrigerants into the European Union and weaker demand for base refrigerants.

Revenues in the Chemical Solutions unit were $140 million, down 9.7% year over year. The company saw lower prices in the quarter mainly on account of mix and lower cost pass-throughs in Performance Chemicals and Intermediates.

Revenues in the Titanium Technologies division were $614 million, down around 22.4% from the prior-year quarter. The decline is attributable to lower volume of Ti-Pure TiO2.

Financials

Chemours ended the quarter with cash and cash equivalents of $694 million, down roughly 45.6% year over year. Long-term debt was $4,007 million, up around 0.6% year over year.

Cash flows provided by operating activities were $288 million for the third quarter of 2019, down 15.8% year over year.

Outlook

The company expects to witness weaker economic activity, moving ahead. It anticipates initiatives such as application development work in Fluoroproducts and Ti-Pure Value Stabilization to strengthen its relationship with customers.

Price Performance

Chemours’ shares have lost around 36.7% year to date, underperforming roughly 17.1% decline recorded by its industry.

Zacks Rank & Stocks to Consider

Chemours currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Kinross Gold Corporation KGC, Franco-Nevada Corporation FNV and Agnico Eagle Mines Limited AEM, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross has an expected earnings growth rate of 210% for 2019. The company’s shares have surged 77.1% in the past year.

Franco-Nevada has a projected earnings growth rate of 39.3% for 2019. The company’s shares have rallied 47.6% in a year.

Agnico Eagle has an estimated earnings growth rate of 168.6% for the current year. Its shares have moved up 65.7% in the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Chemours Company (CC) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance