The suburbs where it’s cheaper to buy than rent

Australian households could save hundreds every month by switching from renting to buying in hundreds of suburbs, new research has shown.

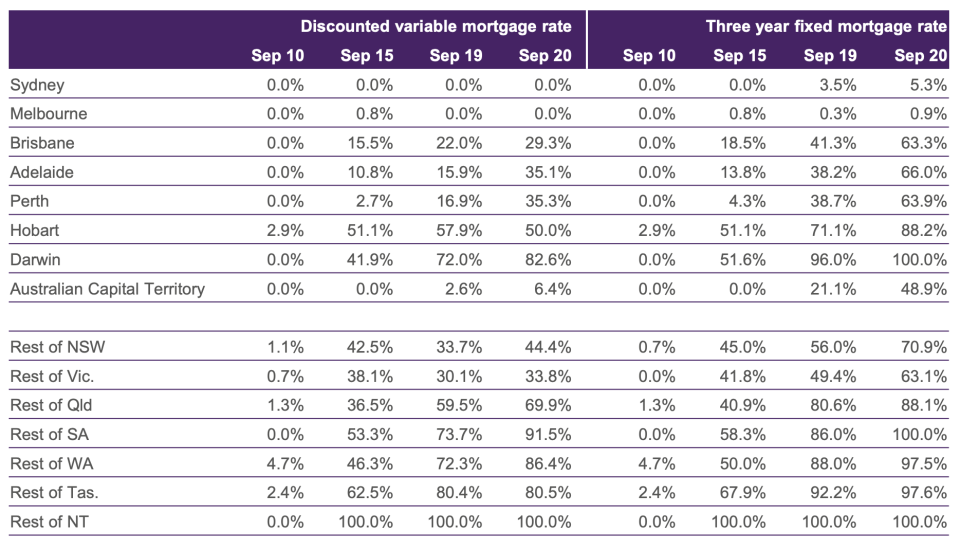

The number of suburbs where it’s cheaper to buy a house than rent has rocketed in recent years from only 0.4 per cent of suburbs in a three-year fixed rate scenario in 2010, to 39.9 per cent in 2019.

Now, in 2020, it’s cheaper to buy than rent in more than half of all suburbs, based on that fixed rate scenario.

And under the discounted variable mortgage rate for houses, it’s cheaper to buy than rent in 32.9 per cent of suburbs, up from 0.5 per cent a decade ago, the research from broker group Aussie found.

“Right now, 8 million Australians rent their home – and they’re renting for longer. Today’s low rates, coupled with generous first home buyer incentives, could be the key that allows aspiring home-owners to break out of the rent cycle and into their own home,” Aussie CEO James Symond said.

The Reserve Bank of Australia took the official interest rate to 0.10 per cent earlier this month, the lowest rate in Australian history.

This in turn has forced interest rates on home loans lower, with some now in the 2 per cent region.

“In many suburbs across Australia, especially those outside the major capital cities, on a monthly basis, it is cheaper to buy than rent,” Symond said.

Going deeper

While on average it’s cheaper to buy a house than rent in 52.2 per cent of suburbs across Australia, the figures differ by state, territory, region and city.

Under the fixed rate scenario, only 5.3 per cent of Sydney suburbs are cheaper to buy in than rent. It’s a similar case in Melbourne, where only 1 per cent of suburbs satisfy that definition.

Proportion of suburbs where paying down a mortgage is cheaper than paying rent

Up in Darwin, however, it’s cheaper to buy in every suburb. And in Brisbane, Adelaide, Perth, Hobart and Darwin, there’s a more even split between suburbs where it’s cheaper to rent or buy.

Regional areas are much more friendly to buyers than renters, with 79.8 per cent of regional suburbs recording lower monthly fixed interest repayments than rental rates.

For units, that jumps to 87.4 per cent of regional suburbs.

Where should I look?

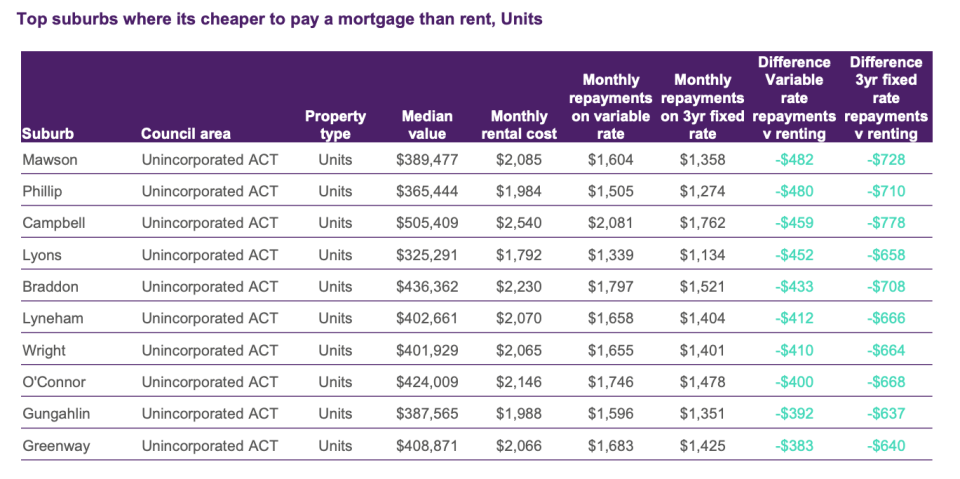

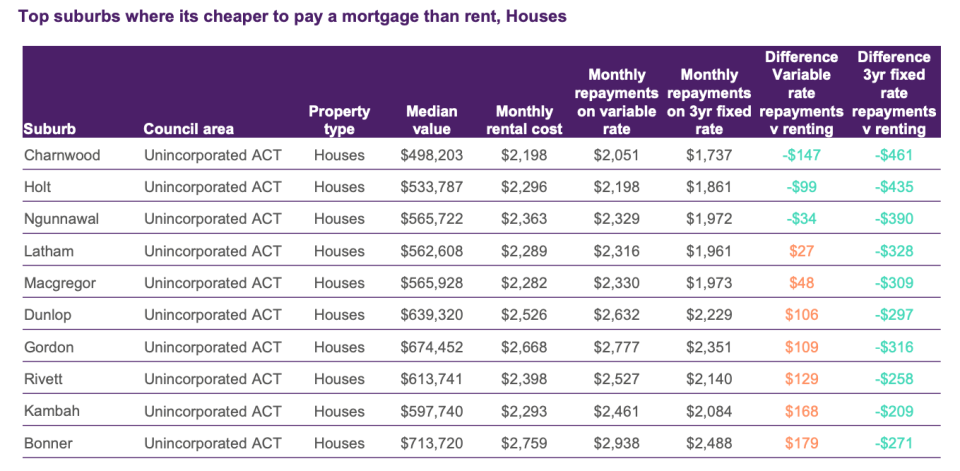

Australian Capital Territory

Here are the top suburbs where it’s cheaper to buy than rent in the Australian Capital Territory.

Australians renting a unit in the ACT’s Campbell suburb would save $778 a month by purchasing, using a three-year fixed interest rate.

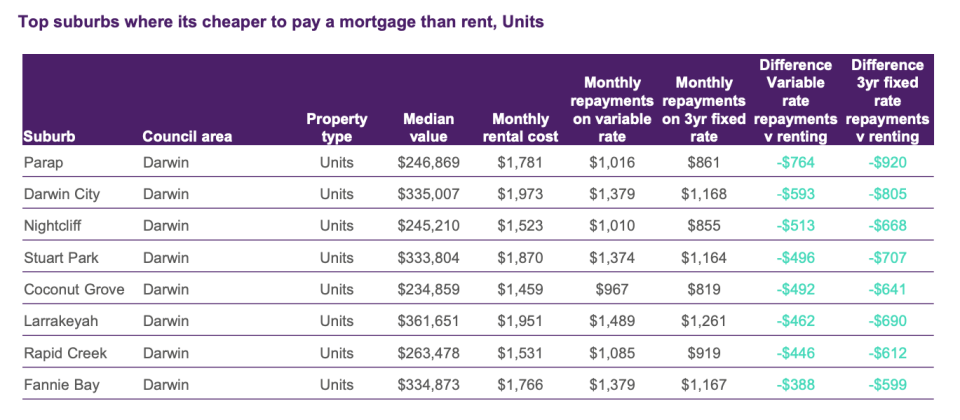

Darwin

Here are the top suburbs where it’s cheaper to buy than rent in Darwin.

Renters in the Northern Territory’s steamy capital could save an eye watering $822 a month by instead purchasing their Zuccoli house. Here, the monthly rental cost is $2,391, while the average monthly repayment on a three-year fixed rate is $1,569.

But even that saving is small compared to the monthly $920 those in Parap could save by purchasing their unit.

Hobart

Here are the top suburbs where it’s cheaper to buy than rent in Hobart.

While Hobart has a rapidly accelerating housing market, there are still bargains to be had. Renters who switch to purchasing their house in Rokeby would see an average monthly saving of $626.

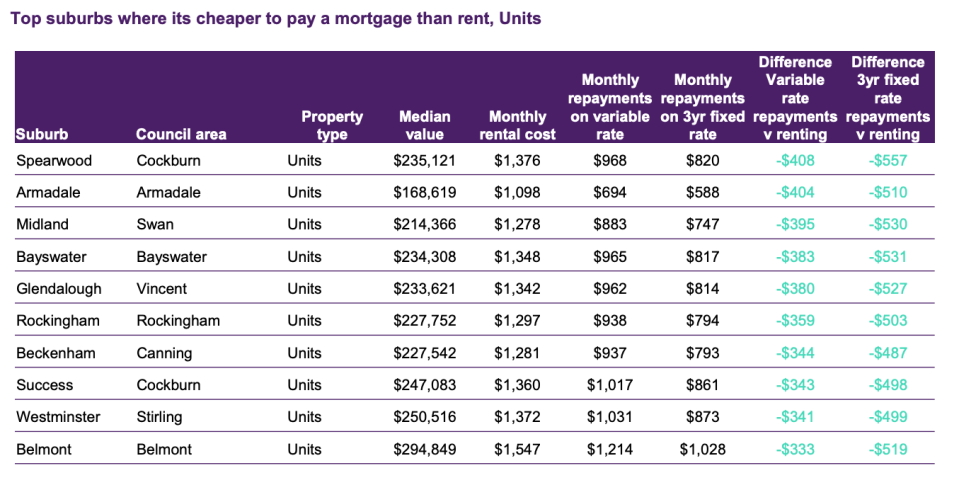

Perth

Here are the top suburbs where it’s cheaper to buy than rent in Perth.

Australians renting in Perth’s Cooloongup would save a huge $597 a month if they purchased a house on a fixed interest plan, with the average rent coming to $1,473, compared to $876 monthly repayments.

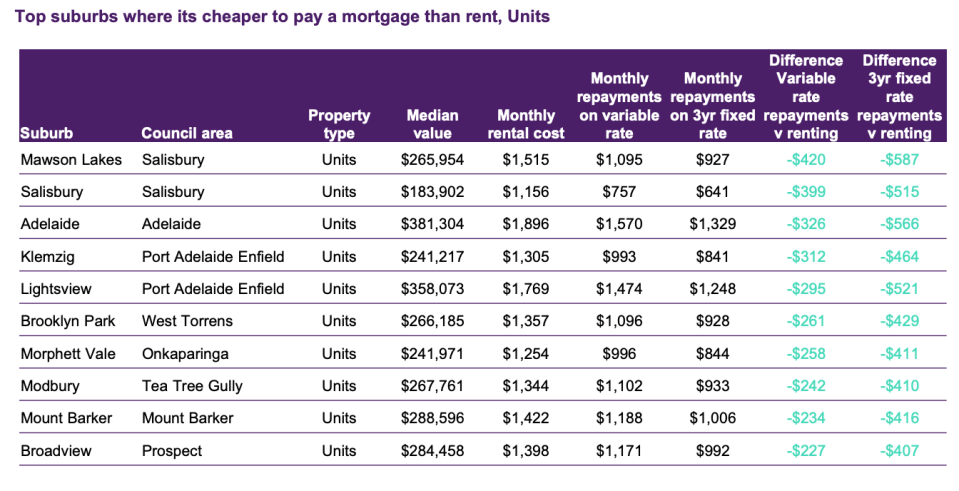

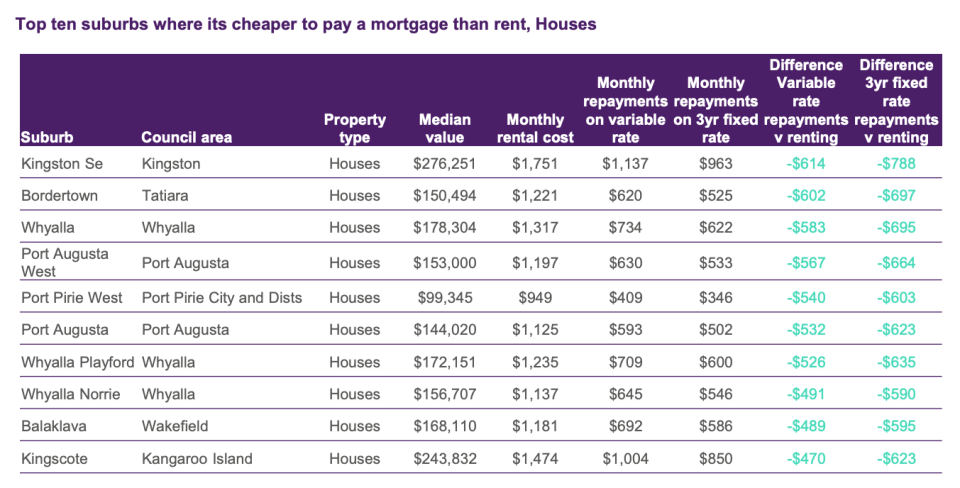

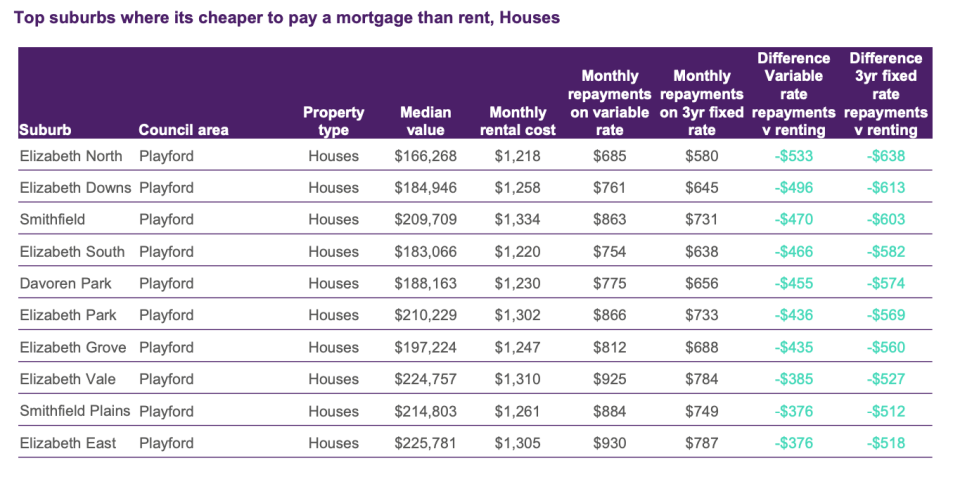

Adelaide

Here are the top suburbs where it’s cheaper to buy than rent in Adelaide.

Mortgage holders in Elizabeth North in Adelaide’s Playford council will see their fixed interest repayments are $638 than their monthly rental payments, should they choose to purchase a house.

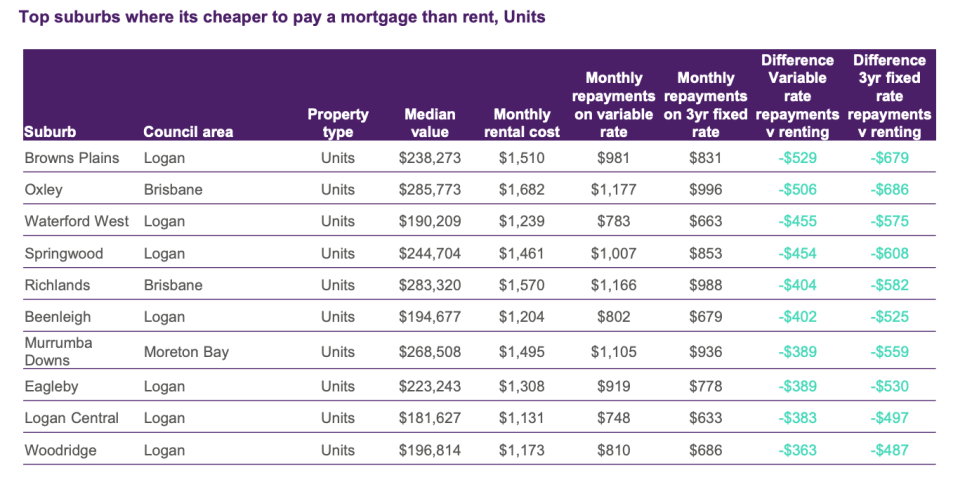

Brisbane

Here are the top suburbs where it’s cheaper to buy than rent in Brisbane.

It’s significantly easier to find a bargain in Brisbane. Those who switch from renting to purchasing a unit in Oxley will find their monthly fixed rate repayments are $686 cheaper than renting.

Melbourne

Here are the top suburbs where it’s cheaper to buy than rent in Melbourne.

Monthly rental payments are generally cheaper than mortgage repayments in Melbourne, although those who choose to purchase a house in the Mornington Peninsula can save $257 a month on their fixed rate repayments.

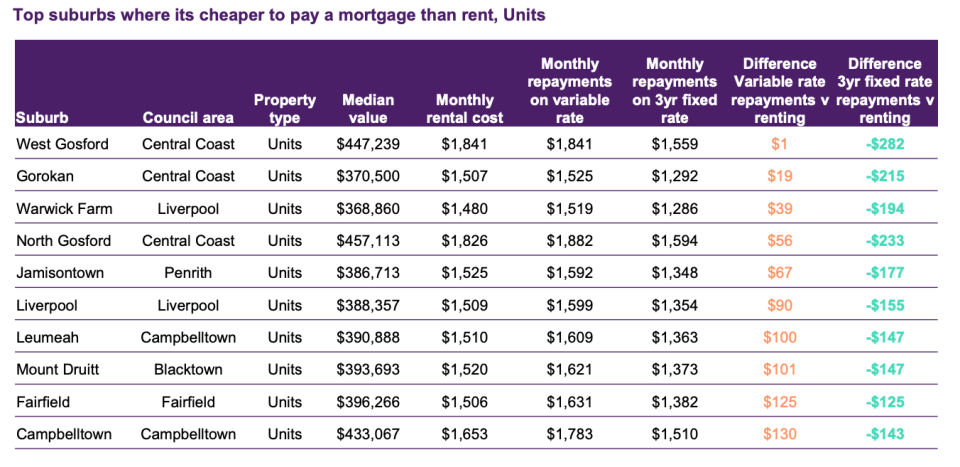

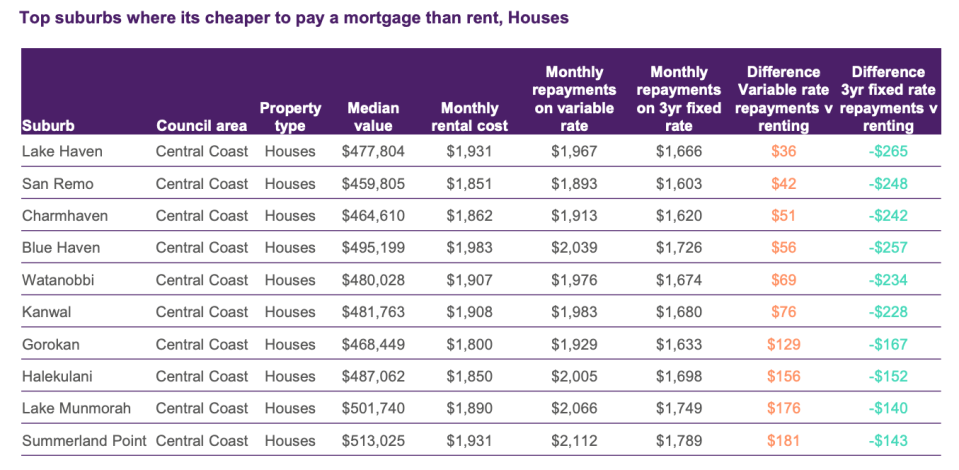

Sydney

Here are the top suburbs where it’s cheaper to buy than rent in Sydney.

Most Sydney suburbs are cheaper for renters than buyers, but buyers on fixed rate repayments can save as much as $282 a month by buying a unit in West Gosford, or $143 in Campbelltown.

Want to get better with money and investing in 2021? Sign up here to our free newsletter and get the latest tips and news straight to your inbox.

Yahoo Finance

Yahoo Finance