Charlie Munger once revealed how investors can beat the stock market — here are 3 of his essential tips

Investing your money in the stock market is one of the most effective methods of growing your wealth. But is there a “right way” for Americans to invest?

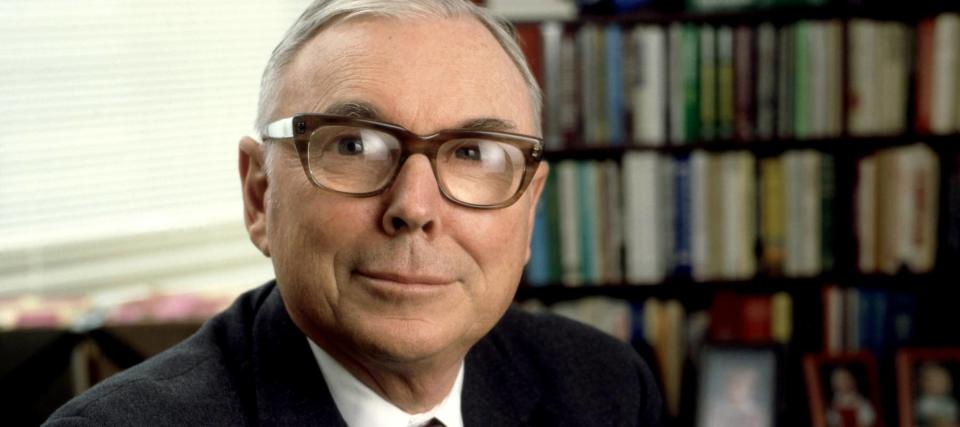

While investing always carries a level of risk, some of the most successful investors operate in a particular manner. One person in particular who understood some of the most effective investment strategies was the late billionaire investor Charlie Munger.

Don't miss

Jeff Bezos told his siblings to invest $10K in his startup called Amazon, and now their stake is worth over $1B — 3 ways to get rich without having to gamble on risky public stocks

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

At the time of his passing in November 2023, Munger had an estimated net worth of approximately $2.2 billion, according to Forbes. He was the vice chairman of Berkshire Hathaway and Warren Buffett's longtime friend and business partner. The dynamic duo had great investing success over the years.

In 1994, Munger gave a speech at USC’s business school in which he expressed his belief that there are relatively few quality companies on the market. He believed that investors should concentrate their time, effort and money on the small handful of companies that fall into this category.

Here are some of Charlie Munger’s tips and tricks revealed during the renowned speech.

Understanding the business

Munger underscored the significance of having an understanding of the business into which you are putting your money. You should be well aware of how the company functions, its competitive edge and relevant industry dynamics. Munger suggested that investors direct their attention to businesses focused on their "circle of competence" — areas where they possess a considerable understanding and can make informed decisions.

“So you have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don't, you're going to lose. And that's as close to certain as any prediction that you can make. You have to figure out where you've got an edge. And you've got to play within your own circle of competence,” highlighted Munger.

Staying within this “circle” means betting on high-quality businesses that increase your chances of picking the right investments. One prime example is Berkshire Hathaway’s investment in Coca-Cola, which he and Buffett identified as a business with a durable competitive advantage in the soft drink industry. He generally advised against investing in companies that fall outside this “circle” as it only exposes investors to unnecessary risks.

Read more: Who says you can’t beat the market consistently? Meet the team of market experts whose stock picks outperformed the S&P 500 by 12% — four years running

Valuation discipline

Another point that Munger emphasized is the need for valuation discipline. Even if the company seems outstanding, it’s important not to overpay for its stock and instead focus on quality. He was big on the significance of a “margin of safety” — purchasing securities at a considerably lower cost than their actual value as a hedge against unpredictable market swings.

“We've really made the money out of high-quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money's been made in the high-quality businesses. And most of the other people who've made a lot of money have done so in high-quality businesses,” said Munger.

Implementing an investment strategy that focuses on a company’s quality and cost can yield better investment results on the whole.

Maintaining a long-term mindset

Having a long-term mindset when it comes to investments can lead to more financial success. Being patient and sticking with good investments for long periods was an important pillar of success for Berkshire Hathaway.

“So, there are risks. Nothing is automatic and easy. But if you can find some fairly-priced great company and buy it and sit, that tends to work out very, very well indeed, especially for an individual,” explained Munger.

This strategy lets investors take advantage of compounding earnings along with capital appreciation over time. Not only that, Munger advised against the dangers that come with short-term thinking or trading frequently, which can result in more losses and less profit as a result of transaction costs and market-timing mistakes.

Metaphorically, Munger said, “You have to eat the carrots before you get the dessert.”

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance