'Charity muggers' raised $120 million last year, but do people like them?

Australia’s face-to-face fundraisers — or ‘charity muggers’ (‘chuggers’) as they’re more commonly known — brought in more than $120 million for charity last year.

But while they’re a handy fundraising stream for charities, they’re widely disliked by Australians, including those who donate.

Research from the Public Fundraising Regulatory Association (PFRA), and released to the ABC, revealed ‘chuggers’ signed 320,000 donors while raising $120 million last year.

The research also found that for every $1 invested in raising money this way, charities received $2.30 in return.

“Compared to other investment options, face-to-face fundraising remains a very attractive avenue for charities,” PFRA chief Peter Hills-Jones told the ABC.

But we don’t like them

A report from the Queensland University of Technology found 65 per cent of people don’t like being approached by the fundraisers.

Despite this, nearly 20 per cent donated anyway.

According to actor and cancer fundraiser, Samuel Johnson, ‘chuggers’ are “slugs, they’re dogs”.

“If you’re not prudent about how you give, if you don’t know about the organisation you’re giving to, then I’d be pretty cynical about how much is ending up at the cause,” he told the Today Show in May last year.

And in some parts of the UK, the form of fundraising has been completely banned.

Most of these fundraisers are carried out by agencies contracted by the charity, and the workers will often receive a commission for sign-ups.

But as a 2017 report from the Australian Competition and Consumer Commission featuring research by Frost & Sullivan noted, 53 per cent of respondents believe their donation shouldn’t fund commission payments. Only 13 per cent wholly supported it, while 28 per cent said it’s acceptable depending on the commission size.

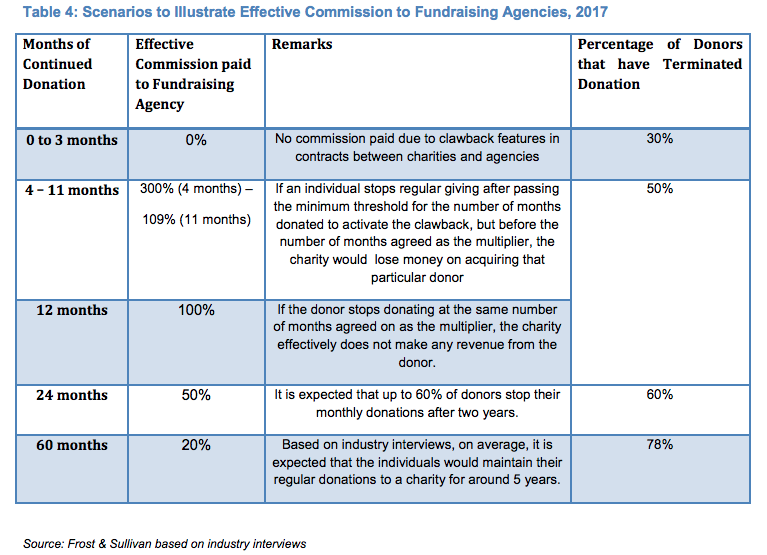

The report also found that most charities won’t receive the benefit until the donor has donated for longer than a year. And if the donor pulls out early, the charity even stands to lose money.

Concerningly, 50 per cent of donors will end their donations within a year. After five years, 22 per cent of regular giving donors remain.

But it’s not cut and dry

The charities themselves often build in clawback arrangements to protect themselves from losing money should the donor not make a single donation or cancel their donations within the first few months.

It’s a complex arrangement, but as one charity told the ACCC, there’s often no way for charities to carry out this type of fundraising themselves.

“Only large charities can have the resources to run a robust in-house program with some level of success,” another charity explained.

As the ACCC noted, outsourcing allows the charities to focus on service delivery.

And while Australians have strong feelings on the fundraising process, only 5 per cent said their last interaction with a face-to-face fundraiser was negative.

“However, it is important to note that Frost & Sullivan only surveyed individuals who have made a donation as a result of being personally solicited. If individuals that had been solicited but not made a donation are included, the proportion of negative experiences is likely to be much higher,” the ACCC said.

Now read: Richard Branson: this $US100bn industry is ‘particularly ripe’ for disruption

Yahoo Finance

Yahoo Finance