Is Change Financial's (ASX:CCA) Share Price Gain Of 107% Well Earned?

Unless you borrow money to invest, the potential losses are limited. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Change Financial Limited (ASX:CCA) share price has soared 107% return in just a single year. Also pleasing for shareholders was the 91% gain in the last three months. Unfortunately the longer term returns are not so good, with the stock falling 72% in the last three years.

Check out our latest analysis for Change Financial

Change Financial isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, Change Financial's revenue grew by 70%. That's well above most other pre-profit companies. Meanwhile, the market has paid attention, sending the share price soaring 107% in response. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

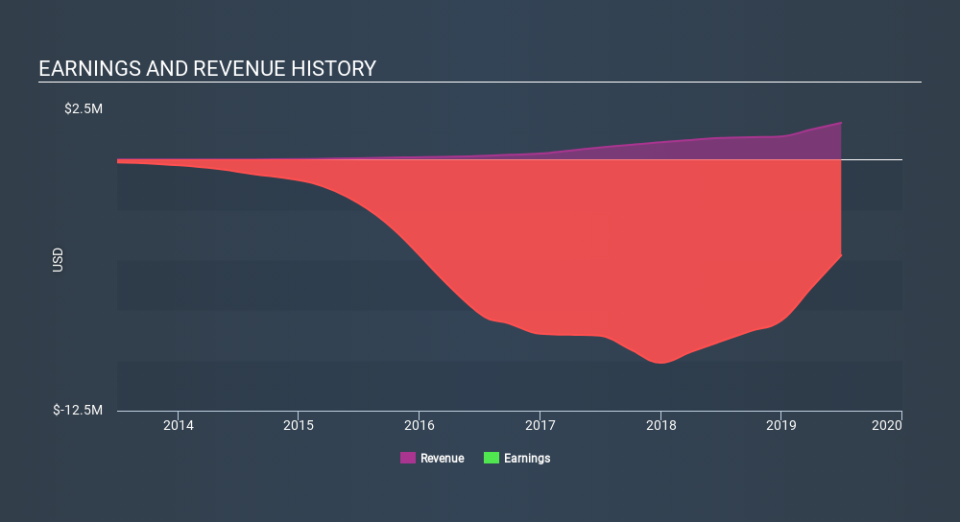

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Pleasingly, Change Financial's total shareholder return last year was 107%. This recent result is much better than the 34% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. If you would like to research Change Financial in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance