CF Industries (CF) Gains on Strong Nitrogen Demand & Prices

CF Industries Holdings, Inc. CF is well-positioned to capitalize on the rising nitrogen fertilizer demand in major markets and higher nitrogen prices amid headwinds from a spike in natural gas costs.

CF Industries, a Zacks Rank #3 (Hold) stock, is gaining from strong nitrogen fertilizer demand. Global demand for nitrogen is expected to remain strong in 2022. Higher crop commodity prices are contributing to healthy demand globally. Industrial demand has also recovered from the pandemic-related disruptions. In 2022, demand for nitrogen is expected to be driven by favorable industrial and economic activities and high levels of corn planted acres in the United States. Demand for urea imports from Brazil and India is also expected to be strong this year. Higher crop prices, high levels of planted corn acres and improved farm economics are likely to increase demand in Brazil.

The company, on its first-quarter call, said that it sees strong global nitrogen industry dynamics for the foreseeable future with robust global nitrogen demand along with tight nitrogen supply worldwide and wide energy differentials between North America and marginal production in Europe and Asia.

The company is also benefiting from higher nitrogen prices on the back of lower supply resulting from reduced operating rates across Europe and Asia due to higher energy prices. Higher nitrogen prices are driving its sales as witnessed in the last-reported quarter. The positive pricing environment is expected to continue moving ahead. Global nitrogen supply is expected to remain challenged due to higher energy prices in Europe and Asia along with export restrictions across certain countries.

CF Industries also remains committed to boosting shareholders’ value by leveraging strong cash flows. It generated cash flow from operations of $1,391 million in the first quarter, up around 141% year over year. The company repurchased around 1.3 million shares for $100 million during the quarter. Its board also raised its quarterly dividend by 33% to 40 cents per share.

However, the company is facing headwinds from higher natural gas costs, stemming from an increase across Europe and Asia. The average cost of natural gas reflected in its cost of sales increased to $6.48 per million British thermal units (MMBtu) in the first quarter of 2022 from $3.22 per MMBtu in the year-ago quarter. Gas costs are expected to remain elevated in Europe through the end of 2022 due to the uncertainties over the supply from Russia. High natural gas costs are expected to increase the company’s cost of sales.

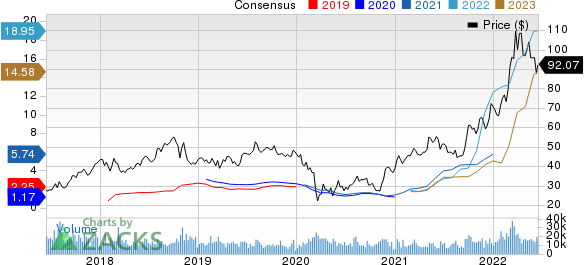

CF Industries Holdings, Inc. Price and Consensus

CF Industries Holdings, Inc. price-consensus-chart | CF Industries Holdings, Inc. Quote

Stocks to Consider

Some better-ranked stocks worth considering in the basic materials space include Nutrien Ltd. NTR, Albemarle Corporation ALB and Cabot Corporation CBT.

Nutrien, sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 174.6% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 31% upward over the last 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 5.8%, on average. NTR has rallied roughly 42% in a year.

Albemarle has a projected earnings growth rate of 231.7% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 111.2% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 22.5%. ALB has rallied roughly 30% in a year. The company sports a Zacks Rank #1.

Cabot, currently carrying a Zacks Rank #1, has an expected earnings growth rate of 29.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 5.2% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 12% over a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance