Is Centuria Capital Group (ASX:CNI) A Good Dividend Stock?

Could Centuria Capital Group (ASX:CNI) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

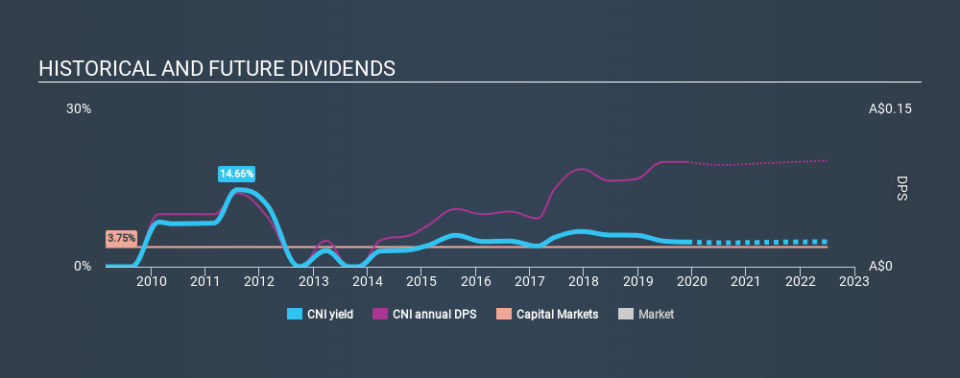

A high yield and a long history of paying dividends is an appealing combination for Centuria Capital Group. We'd guess that plenty of investors have purchased it for the income. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 169% of Centuria Capital Group's profits were paid out as dividends in the last 12 months. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

Remember, you can always get a snapshot of Centuria Capital Group's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Centuria Capital Group's dividend payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was AU$0.05 in 2009, compared to AU$0.10 last year. Dividends per share have grown at approximately 7.2% per year over this time. Centuria Capital Group's dividend payments have fluctuated, so it hasn't grown 7.2% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

Dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Over the past five years, it looks as though Centuria Capital Group's EPS have declined at around 14% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Centuria Capital Group's earnings per share, which support the dividend, have been anything but stable.

We'd also point out that Centuria Capital Group issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with its high payout ratio. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. With any dividend stock, we look for a sustainable payout ratio, steady dividends, and growing earnings. Centuria Capital Group has a few too many issues for us to get interested.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Centuria Capital Group stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance