Mum’s ‘anger’ after Centrelink hits son with $6,700 bill – six months after his death

Concerns have been raised in the past about Centrelink’s automated debt recovery system, ‘robo-debt’, with one woman contracting an unwarranted $4,000 bill and another copping a debt to the tune of $2,754 - and the errors still haven’t ceased.

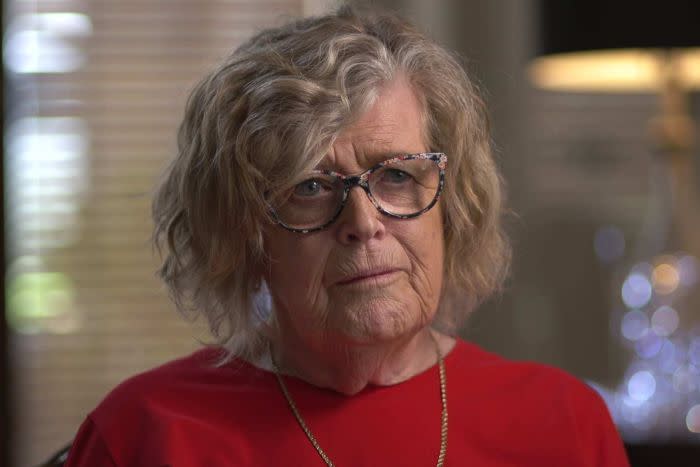

As reported by ABC’s 7.30, Anastasia McCardel, the mother of a disability pensioner – who had died six months earlier – received a call from Centrelink and was informed her son Bruce owed $6,744.52.

Related story: What can I do if Centrelink sends me a debt notice?

Related story: Centrelink facing mounting criticism for ‘unfair’ robo-debt system

Related story: Melbourne nurse takes on Centrelink’s ‘robo-debt’ in landmark case

Bruce McCardel, who was born with a genetic condition that affects vital organs, died in November 2018 at 49 years old.

“She [the Centrelink officer] made out that I was responsible for those payments,” McCardel told 7.30.

In May, she received debt notice in the mail from Centrelink that thanked Bruce McCardel for checking his income information, ABC reported.

“I wanted to know how they thought Bruce would have worked his way through his paperwork when he actually was dead,” she said.

“I actually got quite angry.”

Her son would have accurately declared his income, McCardel believes. “Bruce always was very careful with what he did with his Centrelink.”

Centrelink did not seem to acknowledge that Bruce had died, McCardel said, adding that she felt the government social security agency handled the situation insensitively.

“They've actually not noted that Bruce died last November, presuming from the way they address that letter.”

Robo-debt scheme is ‘extortion’, ‘like the Mafia’

Over the weekend, Terry Carney – a former member of the Administrative Appeals Tribunal (AAT) of 39 years – described the Centrelink scheme as “extortion”.

"At no stage does Centrelink ever seek to defend the unlawful basis on which it's raising those debts,” he told 7.30.

“[It's] a bit like the Mafia saying... ‘You owe me money. Do I have to prove that you owe me money? No I don’t.’”

“That … is what we usually say is extortion.”

Since Carney’s term ended in September 2017, he has become a critic of Centrelink’s scheme, according to the ABC.

In February, executive director of Civil Justice Access and Equity at Victoria Legal Aid Rowan McRae said a “fairer, smarter and more accurate” system was needed.

“It’s clear robo-debt is deeply flawed and continues to cause people distress and hardship,” she said.

How is Centrelink’s robo-debt calculated?

The debts are calculated based on a fortnightly average and doesn’t take into account the actual hours worked.

Income data from the ATO is matched up with income reported to Centrelink by welfare recipients, and if a discrepancy is found, people are automatically sent a letter asking them for information such as payslips and bank statements.

People are often asked to provide information from several years earlier, and if people don’t respond or are unable to find proof of their details, they are sent another letter of debt.

Crucially, the onus is on the individual to prove they do not own money.

McRae said robodebt assumes people work “neat, regular hours” throughout a year.

“We know people work part time or sporadically throughout the year, because they’re studying, can’t get regular work, have multiple jobs or are unwell,” she pointed out.

“This means the calculation of alleged ‘overpayments’ is often inaccurate.”

The Department of Human Services – which operates Centrelink – told Senate Estimates in February that it had raised 410,000 debts from July 2016 (when the scheme began) to October 2018.

But of these, roughly 70,000 robo-debts ended up being reduced, wiped to zero, or “written off permanently”, The Guardian reported.

“We should not be subjecting people on income support to a system which has such a huge rate of error,” Greens senator Rachel Siewert said at the time. Siewert was the chair of a Senate inquiry calling for the scheme to be suspended.

Have you been sent a debt notice from Centrelink that doesn’t seem right? Here’s what you can do about it.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance