Centene (CNC) Q4 Earnings Miss on High Costs, '23 Premium View Up

Centene Corporation CNC reported fourth-quarter 2022 adjusted earnings per share (EPS) of 86 cents, which missed the Zacks Consensus Estimate by 1.2% but came higher than our estimate of 79 cents. The bottom line fell 14.9% year over year.

Revenues of CNC improved 9% year over year to $35,561 million in the quarter under review. The top line lagged the consensus mark by a whisker but outpaced our estimate of $35,167.9 million.

The quarterly results were dampened by an elevated expense level that primarily resulted from increased medical costs. The inclusion of Magellan escalated selling, general and administrative (SG&A) costs for Centene. Nevertheless, membership growth within Medicaid and Medicare businesses partly offset the downside.

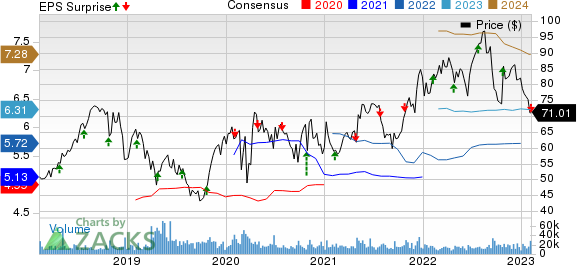

Centene Corporation Price, Consensus and EPS Surprise

Centene Corporation price-consensus-eps-surprise-chart | Centene Corporation Quote

Quarterly Operational Update

Revenues from Medicare climbed 24% year over year in the fourth quarter, while Medicaid revenues advanced 8% year over year. However, commercial revenues dropped 4% year over year.

Premiums of Centene amounted to $31,884 million, which grew 10.4% year over year. The metric also came higher than the Zacks Consensus Estimate of $31,697 million and our estimate of $30,976.9 million. Service revenues advanced 3.7% year over year to $1,669 million in the quarter under review, which however, fell shy of the consensus mark of $1,736 million and our estimate of $2,039.7 million.

CNC’s total membership came in at 27.1 million as of Dec 31, 2022, which increased 4.8% year over year and matched our estimate. The growth came on the back of strength in Medicaid and Medicare businesses.

Health Benefits Ratio (HBR) deteriorated 80 basis points (bps) year over year to 88.7% in the fourth quarter. Increased Medicaid utilization, elevated flu costs and increased quality investments exerted pressure on the HBR.

Centene reported a net loss of $219 million in the quarter under review, against the prior-year quarter’s net earnings of $593 million.

Total operating expenses escalated 12.1% year over year to $35,843 million, higher than our estimate of $34,774.5 million.

Medical costs of $28,268 million increased 11.3% year over year, while SG&A expenses rose 18.8% year over year to $3,198 million.

Adjusted SG&A expense ratio of 9.3% deteriorated 60 bps year over year in the fourth quarter. The metric took a hit from the inclusion of Magellan, divestiture of PANTHERx and expenses linked with Medicare marketing as well as value creation investment.

Financial Update (as of Dec 31, 2022)

Centene exited the fourth quarter with cash and cash equivalents of $12,074 million, which slipped 8% from the figure in 2021 end. Total assets of $76.9 billion decreased 1.9% from the 2021-end level.

Long-term debt amounted to $17,938 million, which dropped 3.4% from the level as of Dec 31, 2021. The current portion of long-term debt was $82 million.

Total stockholders’ equity fell 10.2% from the 2021-end figure to $24,181 million.

During 2022, net operating cash flow surged 48.9% from the prior-year comparable period’s figure to $6,261 million.

Share Repurchase Update

Centene bought back 17 million shares worth $1.4 billion. As of Feb 7, 2023, CNC had a leftover share buyback capacity of $2.5 billion. Also, as of the same date, its senior note debt buyback program had an available capacity of $700 million.

2023 Guidance for Premium and Service Revenues Hiked

Premium and service revenues are currently anticipated to lie between $131.5 billion and $133.5 billion, higher than the prior guidance of $129.5-$131.5 billion. However, the mid-point of the revised outlook indicates a fall of 2.2% from the 2022 reported figure of $135.5 billion.

Other Projections for 2023

Management reiterates its guidance for the 2023 adjusted EPS outlook. The metric is estimated within $6.25-$6.40, the mid-point of which suggests 9.4% growth from the 2022 figure of $5.78.

Earlier, revenues were forecasted to lie between $137.4 billion and $139.4 billion, the midpoint of which indicates a 4.2% fall from the 2022 figure of $144.5 billion.

HBR was estimated in the 87.2-87.8% band for 2023. Adjusted SG&A expense ratio was expected within 8.2-8.7% this year. It also expected an adjusted effective tax rate of 24.4-25.4%.

Diluted shares outstanding were anticipated within 557.5-560.5 million.

Zacks Rank

Centene currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported fourth-quarter results so far, the bottom lines of Avantor, Inc. AVTR, Elevance Health Inc. ELV and Edwards Lifesciences Corporation EW beat the Zacks Consensus Estimate.

Avantor reported fourth-quarter 2022 adjusted EPS of 32 cents, down 11.1% year over year. However, the bottom line topped the Zacks Consensus Estimate by 6.7%. Revenues grossed $1.79 billion in the reported quarter, down 5.9% year over year. The metric beat the Zacks Consensus Estimate by 0.3%. The Americas segment reported net sales of $1.05 million, reflecting a reported decline of 3.6% year over year.

Elevance Health’s fourth-quarter 2022 earnings of $5.23 per share beat the Zacks Consensus Estimate of $5.20 by 0.6%. Additionally, the bottom line advanced 1.8% year over year. ELV’s operating revenues improved 10.1% year over year to $39,667 million in the quarter under review. The top line missed the consensus mark by a whisker. Medical membership totaled 47.5 million as of Dec 31, 2022, which rose 4.8% year over year in the fourth quarter.

Edward Lifesciences delivered fourth-quarter 2022 adjusted earnings per share of 64 cents, beating the Zacks Consensus Estimate by 4.9%. The figure also increased 25.5% year over year. Fourth-quarter net sales were $1.35 billion, up 1.4% year over year on a reported basis. The metric topped the Zacks Consensus Estimate by 1.3%. In the fourth quarter, global sales in the Transcatheter Aortic Valve Replacement (TAVR) product group of EW amounted to $867.7 million, down 0.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance