Celanese (CE) To Beef up Engineered Materials Capacity in Asia

Celanese Corporation CE recently announced its plans to commence a three-year plan to expand engineered materials compounding capacities in Asia. The expansion will take place at the company’s Asia sites including the locations of Nanjing and Suzhou in China and Silvassa, India.

It is expected that the expansion will add roughly 52KT of compounding and long-fiber thermoplastics capacity at the company’s Nanjing integrated chemical complex by the second half of 2023. It would also add roughly 7KT of nylon compounding capacity at the company’s Suzhou facility by the second quarter of 2022 and roughly 7KT of annual compounding capacity at the company’s Silvassa facility by early 2022.

Celanese is adapting to local customer needs and gaining competitive advantage by continuing to boost its Asia presence in the engineered materials market. It is focused on expanding its leadership position in the region by increasing both compounding and polymer manufacturing capacities as well as capabilities through greater investments and additions in its network in Asia, the company noted.

The financial details of this project have not been released yet. Additional details of the project will follow later.

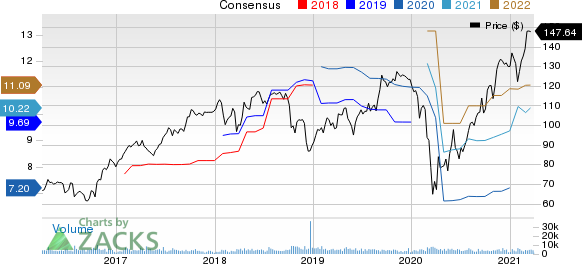

Shares of Celanese have surged 122.6% in the past year compared with 77.3% rise of the industry.

Celanese’s outlook for 2021 adjusted earnings is pegged at $11.00-$11.50 per share. The company stated that it also expects adjusted earnings of roughly $3 per share for the first quarter. It expects this momentum to continue through the first half of 2021 as increased demand for Acetyl Chain and Engineered Materials products is met. Celanese is uniquely positioned to reliably supply markets, which it projects will remain tight in mid-year post the winter storm.

Celanese Corporation Price and Consensus

Celanese Corporation price-consensus-chart | Celanese Corporation Quote

Zacks Rank & Key Picks

Celanese currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Fortescue Metals Group Limited FSUGY, Ashland Global Holdings Inc. ASH and Impala Platinum Holdings Limited IMPUY.

Fortescue has a projected earnings growth rate of 107.8% for the current fiscal. The company’s shares have surged 155.2% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ashland has an expected earnings growth rate of 83.2% for the current fiscal. The company’s shares have gained 89.2% in the past year. It currently sports a Zacks Rank #1.

Impala has an expected earnings growth rate of 197.6% for the current fiscal. The company’s shares have skyrocketed 374% in the past year. It currently flaunts a Zacks Rank #1.

5G Revolution: 3 Stocks to Make Your Move

With super high data speed, it will make current cell phones obsolete and unlock the full potential of big data, cloud computing, and artificial intelligence. In the next few years this industry is predicted to create 22 million jobs and a stunning $12.3 trillion in revenue.

Today you have an historic chance to pursue almost unimaginable gains like Microsoft, Netflix, and Apple in their early phases. Zacks has released a Special Report that reveals our . . .

• Smartest stock for 5G telecom

• Safest investment in 5G hardware

• Single best 5G buy of all!

Download now. Today the report is FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ashland Global Holdings Inc. (ASH) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance