CBAK Energy Technology Inc (CBAT) Reports Strong Q1 2024 Financial Results

Revenue: Reported $58.8 million, up 38.7% year-over-year, below estimates of $62.78 million.

Net Income: Achieved $9.6 million, significantly above the estimated loss of $0.89 million.

Earnings Per Share (EPS): Recorded at $0.11, above the estimated EPS of -$0.01.

Gross Margin: Increased to 31.9% from 6.9% a year ago, with the battery business gross margin surging to 41.2%.

Operating Income: Turned positive at $10.3 million, compared to an operating loss of $2.9 million in the same period last year.

Annual Net Income Forecast: Expected to be between approximately $30.5 million and $34.6 million for the full year of 2024.

Segment Performance: Battery business revenue grew by 51.5% year-over-year, driving overall financial improvements.

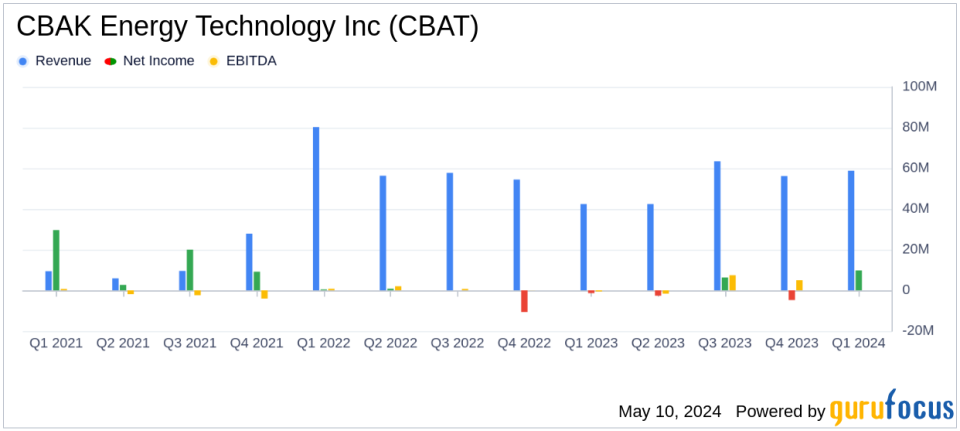

CBAK Energy Technology Inc (NASDAQ:CBAT) released its 8-K filing on May 10, 2024, unveiling its unaudited financial results for the first quarter ended March 31, 2024. The company, a leading lithium-ion battery manufacturer and electric energy solution provider in China, showcased a remarkable improvement in financial performance, with a notable surge in revenue and profitability, particularly from its battery business.

Company Overview

CBAK Energy Technology Inc operates primarily through two segments: its core battery business and Hitrans, which focuses on the development and manufacturing of NCM precursor and cathode materials. With the majority of its revenue generated from Mainland China, CBAK Energy also maintains a significant presence in Europe, the United States, Korea, and other countries.

Financial Highlights

The first quarter of 2024 was marked by a robust 38.7% increase in net revenues, amounting to $58.8 million, up from $42.4 million in the same period last year. This growth was driven by a 51.5% increase in revenues from the battery business, which totaled $44.8 million. The gross margin in this segment impressively jumped from 10.9% to 41.2%, reflecting enhanced profitability and operational efficiency.

Operational and Net Income Improvements

Net income for Q1 2024 stood at $9.6 million, a significant turnaround from a net loss of $1.4 million in Q1 2023. This improvement is attributed to the strong performance of the battery business, which alone generated a net income of $11.7 million. The company's gross profit surged by 546.3% to $18.8 million, with overall gross margin increasing to 31.9% from 6.9% in the previous year.

Strategic Developments and Future Outlook

Yunfei Li, Chairman and CEO of CBAK Energy, highlighted the strategic expansions and operational optimizations that have fortified the company's market position. Looking ahead, CBAK Energy anticipates its net income from the battery business to reach between RMB220 million and RMB250 million ($30.5 million to $34.6 million) for the full year of 2024.

Analysis of Financial Statements

The balance sheet of CBAK Energy remains solid with total assets increasing to $286.5 million as of March 31, 2024, up from $281.2 million at the end of 2023. The company has effectively managed its liabilities, which slightly decreased to $165.2 million from $167.7 million. These figures underscore CBAK Energys financial resilience and strategic management's effectiveness in navigating market challenges.

Conclusion

The first quarter results of 2024 reflect CBAK Energy Technology Inc's successful execution of its growth strategies and its ability to significantly enhance profitability in a competitive industry. With strong revenue growth, improved profit margins, and a positive outlook for the year, CBAK Energy is well-positioned to maintain its trajectory and deliver value to its shareholders.

For detailed financial figures and future updates, investors and interested parties are encouraged to visit CBAK Energy's investor relations page.

Explore the complete 8-K earnings release (here) from CBAK Energy Technology Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance