Catalent (CTLT) Surges on Rumors of Acquisition by Danaher

Shares of Catalent CTLT gained 19.5% on Monday on rumors of a potential acquisition by a life sciences company — Danaher DHR. The CTLT stock started its upward journey during pre-market trading on Feb 6, following a Bloomberg report on DHR’s interest in taking over the contract development and manufacturing company (CDMO).

Per the same report, Bloomberg claims that Danaher has valued Catalent at a significant premium but hasn’t disclosed it yet. The expectation of a premium valuation for the CDMO company is likely to have sparked investors’ sentiments, causing a nearly 20% gain in stock price for CTLT in the last trading session.

However, the report also states that it remains uncertain about any imminent acquisition deal and whether Catalent will be interested in any sale of its business.

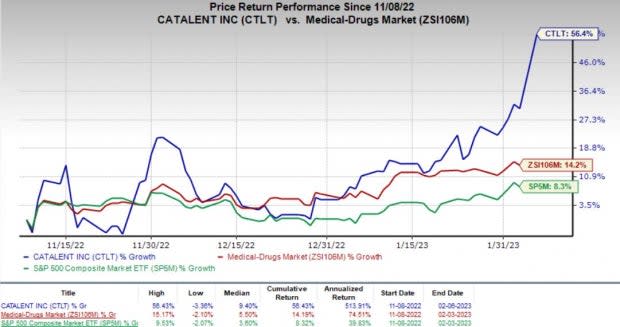

In the past three months, shares of Catalent have gained 56.4% compared with the industry’s growth of 14.2%. The S&P 500 Index was up 8.3% in the period.

Image Source: Zacks Investment Research

Significance of an Acquisition

Catalent has placed itself as a reliable CDMO partner for pharmaceutical/drug-maker companies in the past few years, especially after the COVID-19 outbreak. The company had formed partnerships with multiple COVID-19 vaccine makers — Johnson & Johnson JNJ, Moderna and AstraZeneca. Catalent provided several services supporting the speedy rollout of COVID-19 vaccines.

Meanwhile, Danaher has relied on inorganic activities to boost its competency. The company acquired several companies in the past couple of years to gain a strong foothold in the life sciences field. It is also planning to spin out its Environmental & Applied Solutions segment to focus more on its core Life Sciences segment. Hence, addition of a CDMO company like Catalent looks in line with DHR’s goals. The acquisition may also help Danaher in becoming a one-stop solution for biopharma companies and competing well with its near competitor — Thermo Fisher Scientific TMO.

We note that Thermo Fisher Scientific is one of the key players in the Life Sciences Solutions segment. TMO had already integrated a CDMO company — Patheon — that it acquired in 2017.

Recent Key M&A Deals

Merger and acquisition deals (M&A) had been slow last year with deals and their size declining year over year. However, the fourth quarter of 2022 saw two major M&A offers — the acquisition of Abiomed by J&J for $16.6 billion and the buyout of Horizon Therapeutics by Amgen for $27.8 billion. JNJ completed its acquisition in December last year, while Amgen’s deal is expected to be closed in the first half of 2023.

After a dry patch of M&A activities last year, the two blockbuster deals have boosted investors’ sentiments for an anticipated rise in M&A activities in 2023. If all parties agree, a potential offer from Danaher for Catalent will also be a major deal as the latter is currently valued at approximately $12 billion.

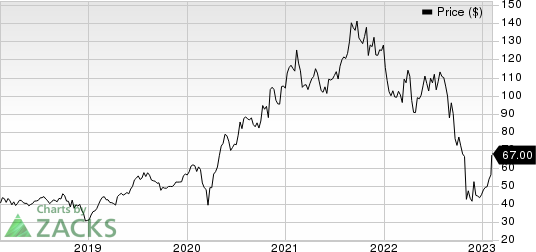

Catalent, Inc. Price

Catalent, Inc. price | Catalent, Inc. Quote

Zacks Rank

Catalent currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance