Catalent (CTLT) to Acquire New CDMO Facility for $475 Million

Catalent, Inc. CTLT announced that it has reached an agreement with Australia-based Mayne Pharma to acquire the latter’s full-service specialty Contract Development and Manufacturing Organization (CDMO), Metrics Contract Services (Metrics) for $475 million in an all-cash deal. The acquisition will provide Catalent with access to Metrics’ 333,000 square-foot in Greenville that can strengthen Catalent’s capabilities in integrated oral solid formulation development, manufacturing, and packaging.

Catalent expects the acquisition to be completed by the end of 2022. The company will fund the buyout through a combination of cash on hand and existing credit facilities as well as a potential new debt financing.

It is worth noting that Catalent is already among one of the leading CDMO service providers, supporting more than 1,000 partner programs and launching over 150 new products every year across more than 50 global sites.

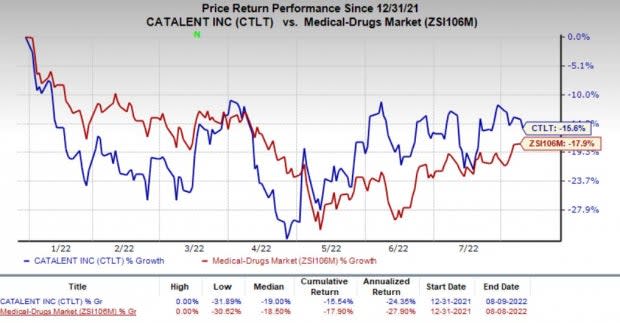

Shares of Catalent have lost 15.6% so far this year compared with the industry’s decline of 17.9%.

Image Source: Zacks Investment Research

Significance of the Acquisition

Catalent believes that the acquisition will boost the company’s services delivery in fast-growing areas of the business and patient needs. The company anticipates that the Metrics Greenville facility to cater to Catalent’s customers, especially biotech companies developing treatment options featuring accelerated, orphan, and rare disease programs for oncology and other important therapeutic areas. It will help the company’s customers with immediate, fit-for-scale capacity for in-demand highly potent drugs and other oral solid small-to-mid-size batch needs.

In the past five years, Metrics has invested more than $100 million in capital improvements at the Greenville facility. The facility has grown over these years and now includes 16 manufacturing suites, with 11 designed to handle highly potent compounds, as well as two packaging lines that can support a large variety of development and commercial supply programs. The facility has a production capacity of more than one billion oral solid dose units in a year.

Catalent believes that Metrics’ facility will integrate with its existing industry-leading oral development and manufacturing network seamlessly.

The CDMO services represent a broad opportunity with many pharma and biotech companies engaged in developing new therapies for treating existing and novel diseases. The addition of Metrics will likely boost Catalent’s top line going forward, with its supporting development of orally administered drugs.

Notable Developments

Year to date, Catalent has been actively pursuing expansion plans through acquisitions as well as organically.

The company completed a project at its facility in Limoges, France to handle large molecule programs, with additional capacity for small molecule injectable dosage form development, expanding its global footprint. It completed the installation and commissioning of four new high-throughput high-bay cGMP or current good manufacturing practices manufacturing suites at its facility in Kansas City, MO in April, boosting its capabilities for producing oral solid-dose forms. In June, Catalent expanded its primary packaging capabilities at its clinical supply facility in Shiga, Japan. It is currently working on expanding its flagship U.S. manufacturing facility for large-scale oral dose forms in Winchester, KY. The project is expected to be completed in January next year.

In March, Catalent inked a collaboration with TFF Pharmaceuticals TFFP to generate, test and manufacture dry powder formulations for a variety of biotherapeutics. These formulations will use TFF Pharmaceuticals’ patented Thin Film Freezing technology. Catalent will offer its scaled-up expertise and manufacturing capabilities to TFF Pharmaceuticals as its preferred development and manufacturing partner. This will enable Catalent to provide its customers access to the TFF technology.

Catalent acquired a biologics development and manufacturing facility currently under construction near Oxford, U.K. from Vaccine Manufacturing and Innovation Centre UK Limited in April to expand its presence in the United Kingdom and across Europe.

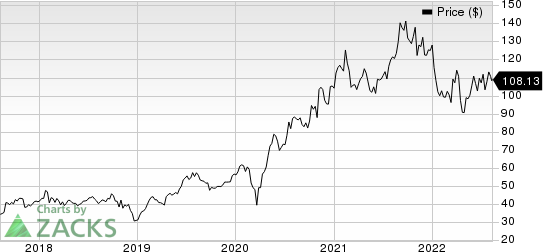

Catalent, Inc. Price

Catalent, Inc. price | Catalent, Inc. Quote

Zacks Rank and Stock to Consider

Currently, CONMED has a Zacks Rank #4 (Sell).

Some better-ranked stocks from the pharma/biotech sector include ShockWave Medical SWAV and Patterson Companies PDCO. While ShockWave Medical sports a Zacks Rank #1 (Strong Buy), Patterson Companies carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ShockWave Medical’s earnings per share estimates have improved from $1.84 to $2.02 for 2022 and from $2.82 to $2.95 for 2023 in the past 60 days. SWAV has gained 23% so far this year.

ShockWave Medical delivered an earnings surprise of 189.99%, on average, in the last four quarters.

Estimates for Patterson Companies have improved from earnings of $2.25 to $2.30 for 2022 and $2.42 to $2.48 for 2023 in the past 60 days. PDCO stock has risen 7.9% so far this year.

Patterson Companies delivered an earnings surprise of 16.49%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

TFF Pharmaceuticals, Inc. (TFFP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance