Casey's (CASY) Q4 Earnings Beat Estimates, Revenues Rise Y/Y

In spite of a tough retail environment, Casey's General Stores, Inc. CASY reported better-than-expected fourth-quarter fiscal 2021 results. While the top line improved year over year, the bottom line declined from the year-ago period. Markedly, this was the third straight quarter of positive sales and earnings surprises. Digital engagements, expanded assortment of private brand products and regained momentum in prepared foods business contributed to the company’s performance.

Meanwhile, Casey's completed the acquisition of Buchanan Energy and is on track to conclude the previously disclosed Circle K acquisition this month.

A Closer Look at Results

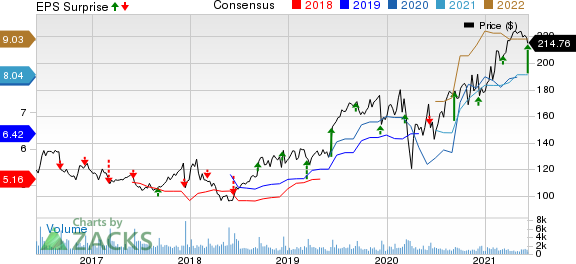

Casey's posted quarterly earnings of $1.12 per share that handily surpassed the Zacks Consensus Estimate of 67 cents but declined from $1.67 reported in the year-ago period. This year-over-year decrease in the bottom line can be attributed to higher operating expenses.

Total revenues of $2,378.2 million surged 31.2% year over year and came ahead of the Zacks Consensus Estimate of $2,159 million. Revenue grew across all the three categories, Fuel, Grocery & Other Merchandise and Prepared Food & Fountain.

Inside sales jumped 14.5% to $913.4 million during the quarter under review. Inside same-store sales increased 12.8% against 5.6% decline witnessed in the year-ago period. The metric improved on account of resurgence in pizza slices, dispensed beverage, and bakery as Casey’s began lapping COVID-19 related traffic disruption. The company informed that whole pizza pie sales remained solid in the quarter.

Shares of this Zacks Rank #3 (Hold) company have advanced 20.5% in the past six months compared with the industry’s growth of 18.2%.

Margins & Expenses

Gross profit increased 6.8% year over year to $561 million, courtesy of higher revenues. However, gross margin contracted 540 basis points to 23.6%. Inside gross profit grew 17.4% to $364.9 million. Meanwhile, Inside margin improved 100 basis points to 39.9% owing to strategic sourcing endeavors and previous merchandise resets, coupled with a favorable mix shift of private brands, packaged beverage and prepared foods.

We note that Casey's registered an increase of 16% in operating expenses of $426.3 million due to rise in store-level operating hours and costs, as the company lapped COVID-19 related shutdowns in the year-ago period. The metric also increased on account of operating 36 more stores compared with the same period last year, $8 million in incremental incentive compensation costs, and higher credit card fees due to the rising retail price of fuel and increased volume. Same store operating expenses, excluding credit card fees, were up 6.5% in the quarter under review.

Performance by Categories

We note that Fuel sales surged 44.6% year over year to $1,445.1 million during the quarter. Well, Fuel gallons sold jumped 9.8% to 535.3 million. Same-store gallons sold increased considerably in the back half of the quarter due to the favorable comparison to the start of the COVID-19 pandemic a year ago. Fuel gallons same-store sales rose 6.4% during the quarter against 14.7% decline in the year-ago period. Fuel gross profit fell 11.1% to $176.7 million. This is because of the unprecedented high fuel margin attained last year via supply and demand shocks from the pandemic and overall macroeconomic conditions in the oil sector. Again, Fuel margin declined to 33 cents per gallon from 40.8 cents per gallon in the prior-year period.

Grocery & Other Merchandise sales rose 14.4% to $649.8 million. Same-store sales increased 12.5% against a decline of 2% in the year-ago quarter. We note that Grocery & Other Merchandise margin expanded 140 basis points to 31.8%. Again, gross profit increased 19.4% to $206.5 million during the quarter.

Prepared Food & Fountain sales rose 14.7% to $263.5 million. Same-store sales increased 13.4% against 13.5% decline witnessed in the year-ago quarter. Again, Prepared Food & Fountain margin improved marginally by 10 basis points to 60.1%. We note that gross profit jumped 14.9% year over year to $158.4 million.

Store Update

During fiscal 2021, the company constructed 40 new stores and closed 11. As of Apr 30, 2021, the company operated 2,243 stores.

Other Financial Aspects

Casey's ended the quarter with cash and cash equivalents of $336.5 million, long-term debt and finance lease obligations (net of current maturities) of $1,361.4 million and shareholders’ equity of $1,932.7 million. During the quarter, the company did not make any share repurchases and still has $300 million under authorization.

FY22 Outlook

Casey's envisions same-store fuel and inside sales to rise by mid-single digit percentages during fiscal 2022. Management estimates mid-teen percentage increase in total operating expenses driven primarily by adding about 200 units during fiscal 2022, expenses related to adding back operating hours to the stores and likely wage pressures. Moreover, the company expects to make an investment of roughly $500 million in property and equipment in the fiscal year.

3 Picks You Can’t Miss Out On

Target TGT, a Zacks Rank #1 stock (Strong Buy), has a long-term earnings growth rate of 13.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores BURL has a trailing four-quarter earnings surprise of 74.7%, on average. The stock sports a Zacks Rank #1.

Walmart WMT has a trailing four-quarter earnings surprise of 17.8%, on average. The stock carries a Zacks Rank #2 (Buy).

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Caseys General Stores, Inc. (CASY) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance