Carrier (CARR) Aids Cold Chain Solutions With Berlinger Buyout

Carrier Global CARR is benefiting from its recent acquisition of the Berlinger & Co.’s Monitoring Solutions business, facilitated through its Sensitech division.

The move enhances Carrier’s capabilities in supply chain visibility, particularly in the pharmaceutical and life sciences sectors.

Berlinger’s advanced suite of hardware and software solutions, such as the SmartSystem platform and Fridge-tag for vaccine fridges, significantly enhances Sensitech’s cold chain monitoring portfolio.

The recent acquisition bolsters Carrier’s position as a global leader in intelligent climate and energy solutions, poised to deliver comprehensive, real-time monitoring solutions for temperature-sensitive goods across diverse industries.

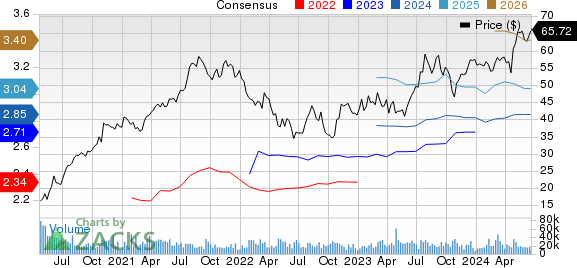

Carrier Global Corporation Price and Consensus

Carrier Global Corporation price-consensus-chart | Carrier Global Corporation Quote

Strong Portfolio Aids Prospect

The latest move bodes well for CARR’s commitment to expanding its cold chain monitoring capabilities through its recent acquisition, enhancing Carrier’s leadership in supply chain visibility and intelligent climate solutions.

The company’s acquisition of Viessmann Climate Solutions has been a major positive. The buyout is benefiting Carrier’s position as a global leader in sustainable climate and energy solutions, showcasing its commitment to portfolio transformation.

In first-quarter 2024, Carrier registered a reported sales increase of 17% year over year to $6.2 billion. The upside was driven by organic sales growth of 2% and a significant contribution from acquisitions, notably Viessmann Climate Solutions, which added 15% to net sales growth.

Expanding portfolio has been noteworthy. Carrier recently announced its collaboration with the Department of Energy to advance high-efficiency heat pump technologies, aiming to reduce energy costs and greenhouse gas emissions in commercial buildings.

Divestitures Helps Core Business Focus

Apart from strategic acquisitions and expanding portfolio, Carrier is also enhancing its focus on advancing intelligent climate and energy solutions through divestitures.

In March, Carrier announced a definitive agreement to divest the Industrial Fire business for $1.42 billion to Sentinel Capital Partners.

Carrier also announced the completion of the sale of its security business, Global Access Solutions, to Honeywell International HON.

In June, Carrier completed the sale of its security business, Global Access Solutions, to Honeywell for $4.95 billion, with plans to use the proceeds to reduce debt and resume share repurchases by the end of 2024.

The divestitures will allow Carrier to introduce innovative products aligned with sustainability goals and contribute to decarbonizing the planet for future generations.

CARR’s 2024 Guidance Strong

Carrier’s 2024 guidance remains strong due to its robust portfolio strength. It expects sales of $26 billion. The Zacks Consensus Estimate for 2024 revenues is pegged at $25.64 billion, indicating 16.05% growth year over year.

It anticipates earnings to be $2.80-$2.90 per share. The Zacks Consensus Estimate is pegged at $2.85, which remained unchanged in the past 30 days.

Zacks Rank & Stocks to Consider

Currently, Carrier Global has a Zacks Rank #3 (Hold).

The stock has increased 14.4% against the Zacks Computer & Technology sector’s growth of 25.7% year to date.

Some better-ranked stocks in the broader technology sector are Arista Networks ANET and Alphabet GOOGL, each sporting a Zacks Rank #1(Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arista Networks’ shares have gained 44.5% in the year-to-date period. The long-term earnings growth rate for ANET is pegged at 15.68%.

Alphabet’s shares have gained 25.4% in the year-to-date period. The long-term earnings growth rate for GOOGL is currently projected at 17.51%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Carrier Global Corporation (CARR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance