Take Care Before Diving Into The Deep End On Evolva Holding SA (VTX:EVE)

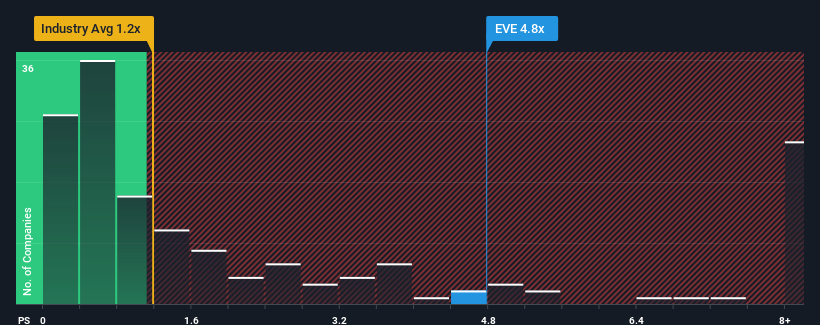

It's not a stretch to say that Evolva Holding SA's (VTX:EVE) price-to-sales (or "P/S") ratio of 4.8x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Switzerland, where the median P/S ratio is around 4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Evolva Holding

What Does Evolva Holding's P/S Mean For Shareholders?

Recent times have been advantageous for Evolva Holding as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Evolva Holding.

Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Evolva Holding's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 57% last year. Pleasingly, revenue has also lifted 34% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 46% per year as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 7.1% per year growth forecast for the broader industry.

With this information, we find it interesting that Evolva Holding is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Evolva Holding currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Evolva Holding (of which 2 don't sit too well with us!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance