Cardiovascular Systems (CSII) Misses Q4 Earnings Estimates

Cardiovascular Systems, Inc. CSII reported loss per share of 43 cents for fourth-quarter fiscal 2020 against earnings per share of 4 cents in the prior-year period. The reported loss however was a penny narrower than the Zacks Consensus Estimate.

Full-year loss per share was 79 cents compared with a loss of a penny a year ago.

Net Sales

Cardiovascular Systems’ revenues of $42.5 million declined 37.6% year over year. However, the top line exceeded the Zacks Consensus Estimate by 10.5%.

In fiscal 2020, revenues declined 4.6% to $236.5 million.

Segment Details

In the quarter under review, global Coronary device revenues decreased 41% year over year to $11.9 million. Domestic coronary revenues declined 44% from the year-ago period, primarily due to lower atherectomy unit volumes.

Global peripheral revenues decreased 36% to $30.6 million. Domestically, peripheral unit volumes decreased 35%.

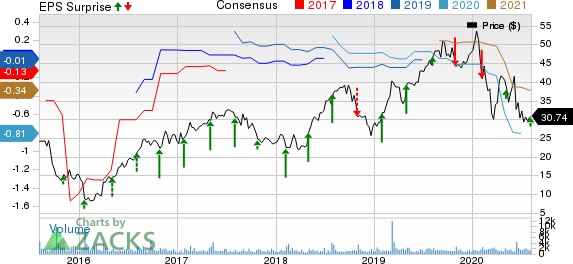

Cardiovascular Systems, Inc. Price, Consensus and EPS Surprise

Cardiovascular Systems, Inc. price-consensus-eps-surprise-chart | Cardiovascular Systems, Inc. Quote

Total U.S. revenues declined 38% to $40.5 million, while International revenues totaled around $2.1 million, a 17% decline.

Margin

Gross margin in the reported quarter was 76.2%, down 411 basis points (bps) year over year due to 40.8% fall in gross profit.

Meanwhile, selling, general and administrative (SG&A) expenses were down 20.5% to $34.9 million. Research and development (R&D) expenses escalated 25.1% to $11.8 million. Operating expenses overall declined 12.4% to $46.8 million. Operating loss in the reported quarter was14.4 million against operating profit of $1.3 million in the year-ago period.

Financial Position

The company exited the fiscal with cash and cash equivalents of $185.5 million, compared with $69.6 million at the end of third-quarter fiscal 2020.

Q1 Fiscal 2021 Guidance

The company provided guidance for the first quarter of fiscal 2021.Revenues are expected in the band of $55 million to $58 million, indicating sequential revenue growth of 29% to 36%.

Gross margin is expected in the range of 76% to 77%. The company expects to incur operating expenses in the range of $50 to $52 million.

Our Take

Cardiovascular Systems reported dismal sales performance for its fiscal fourth quarter. According to the company, amid the pandemic, there was a significant decline in STEMI activations as patients avoided hospitals and stayed home even when they were having a heart attack. However, worldwide peripheral revenues performed better than expected as hospital-based critical limb ischemia and limb salvage programs remained active throughout the quarter.

The company currently anticipates coronary procedures to steadily improve throughout the remainder of the calendar year.

Cardiovascular Systems currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings of MedTech Majors at a Glance

West Pharmaceutical WST reported second-quarter 2020 adjusted EPS of $1.25, beating the Zacks Consensus Estimate by 37.4%. Net revenues of $527.2 million outpaced the consensus estimate by 6.9%.

Thermo Fisher TMO reported second-quarter 2020 adjusted EPS of $3.89, beating the Zacks Consensus Estimate by 45.7%. Revenues of $6.92 billion outpaced the consensus mark by 0.1%.

Hologic HOLX reported third-quarter fiscal 2020 adjusted EPS of 75 cents, surpassing the Zacks Consensus Estimate by a stupendous 108.3%. Net revenues of $822.9 million exceeded the Zacks Consensus Estimate by 37.1%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Cardiovascular Systems, Inc. (CSII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance