The ‘obscure fees’ costing Aussies $876

As many as one in four Australians don’t challenge unknown, unfair or incorrect banking fees, new research has revealed, with experts describing this as “surprising” given the coronavirus financial downturn.

Australian card holders spend $876 a year on bank fees on average, or $73 a month, Canstar data revealed, with money expert Effie Zahos calling on Australians to keep a closer eye on sneaky fees.

Also read: How to save $1,400 during the recession

Also read: The ‘very convenient’ shopping centre staple set to disappear

“Whether it’s a $5 or $50 fee, always question your bank if you’re unsure as to what you’re being charged for. There are some fees that will be unavoidable, but for other fees there’s no harm in querying them if it means you could be better off by saving some money,” Zahos said.

“We’re going through a global pandemic and a lot of people will be looking for ways to cut costs, so it's surprising to see so many people let fees go unchallenged.”

Younger Australians incur the most fees, with millennials copping $155 in fees a month and Gen Z receiving a $139 monthly sting. These younger groups are also the least likely to ask their bank about the fees.

Zahos said that while it might be easy to believe that digital banking comes without fees, the reality is the opposite.

“With most of us using card over cash during the current pandemic we could be facing fees we weren’t previously aware of, such as eftpos transaction fees,” she said.

In fact, Canstar data found 18 per cent of transaction accounts, not including major banks, on its database charge spenders a fee. The average transaction fee is $0.86, meaning that over the course of the month, you could be looking at $17.20 in eftpos transaction fees.

“There could also be more obscure fees if you’re doing things like cardless cash withdrawal at the ATM, counting coins at a bank branch or obtaining a bank cheque; it’s things like this where you need to query your bank on the costs,” Zahos added.

Where’s my money going?

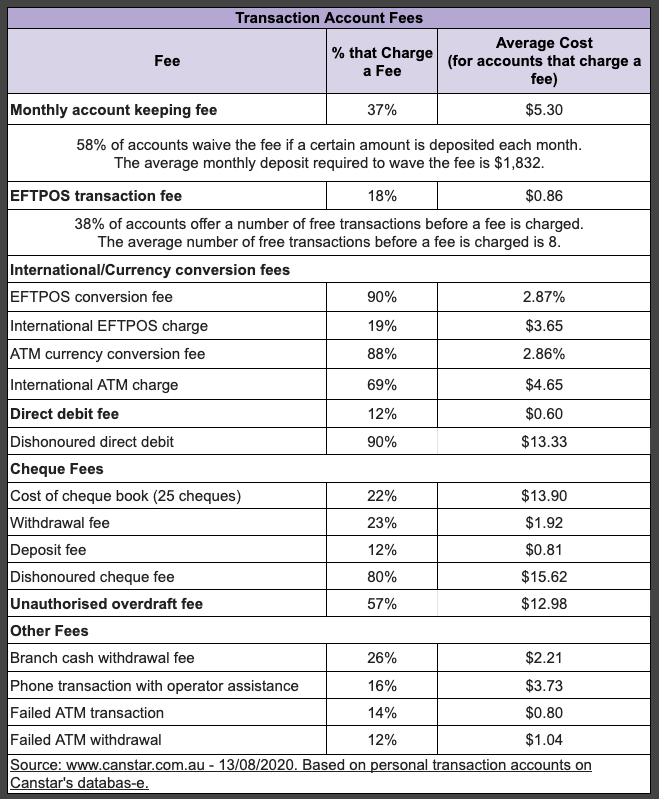

Canstar highlighted the transaction fees you may be paying.

It found that 37 per cent of bank accounts charge a monthly account keeping fee, with 58 per cent waiving the fee provided a certain amount is put into the account each month. The average monthly deposit required to waive those fees is $1,832.

Nearly one in five (18 per cent) of accounts will also cop eftpos transaction fees, although 38 per cent of providers offer a certain number of free transactions before they start charging fees. The average number of free transactions is eight.

Among the more painful fees, 57 per cent of accounts will charge a fee if users’ accidentally overdraw on their account. The average overdraw fee is $12.98.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance