Canoo's (GOEV) New Oklahoma Vehicle Unit to Boost Prospects

Canoo Inc. GOEV recently announced that it has signed an agreement to acquire a vehicle manufacturing facility in Oklahoma City.

The new facility will be used for producing Canoo’s electric Lifestyle Delivery Vehicle (LDV) and the Lifestyle Vehicle (LV), which is an electric SUV.

The company CEO stated that production for the LDV is expected to commence on Nov 17, and the final certification is to be completed in the first quarter of 2023. Canoo aims to build 15 production vehicles this year that will go to committed order customers like NASA and Walmart.

The infrastructure at the sprawling Oklahoma City facility is equipped to begin production, and its location is of strategic importance, with easy access to road and rail. The unit will be powered by clean energy and it will be transformed to accommodate a full vehicle assembly line with robotics, a paint shop and upfitting center.

Once the preliminary preparations are completed, Canoo will shift all the equipment and focus on the new facility during the first and second quarters of 2023. The first sellable vehicle deliveries are expected to be in the latter half of the first quarter and a production ramp-up will take place in the second half of 2023, with the run rate reaching 20,000 units by year-end. On a long-term basis, the facility will steer focus toward defense and specialty products. Canoo has been selected by NASA and the U.S. Army to provide for their operations.

Canoo has set out a number of plans to scale up production.

The latest news follows Canoo’s announcement of an EV battery module manufacturing facility at MidAmerica Industrial Park in Pryor, the company’s first factory in Oklahoma. This unit will produce Canoo’s proprietary battery modules, energy management system and thermal control technology for its MPP platform.

Plans for the MidAmerica Industrial Park unit, termed a “mega microfactory” by the company, were announced in June this year as the factory caught attention for its strategic location. It will house a paint shop, body shop and general assembly plant and is expected to open in 2023. Although the Pryor unit is a bit delayed, the company hopes to catch up once resources are shifted.

Along with the Oklahoma City news, Canoo reported third-quarterly results.

Canoo incurred an adjusted loss of 43 cents a share, narrower than the Zacks Consensus Estimate of 48 cents but wider from the prior-year loss of 35 cents. The company has not yet generated any meaningful revenues. Canoo recorded a negative adjusted EBITDA of $80.8 million in the quarter compared with $85.8 million in the year-ago period. For the reported quarter, the firm incurred operating expenses (R&D and SG&A) of $105.8 million, up from $104.8 million in third-quarter 2021.

Net cash used in operating activities was $92.3 million during the quarter under discussion compared with $71.8 million in the year-ago period. As of Sep 30, Canoo had cash and cash equivalents of $6.8 million, significantly down from $224.7 million as of Dec 31, 2021. For fourth-quarter 2022, GOEV projects operating expenses in the $70-$90 million range. Capital expenditures are projected in the band of $30-$50 million.

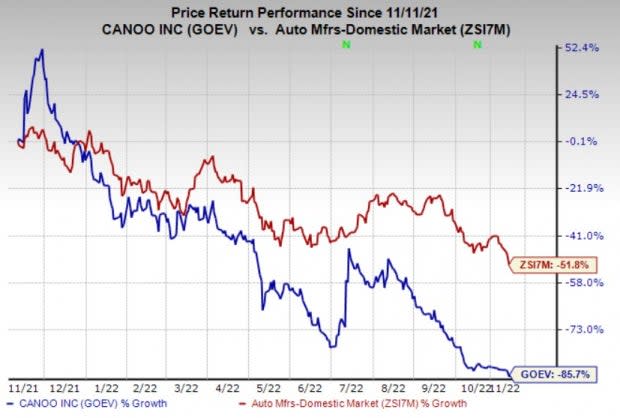

Shares of Canoo have lost 85.7% over the past year compared with its industry’s 51.8% decline.

Image Source: Zacks Investment Research

Zacks Rank & Peer Releases

GOEV currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Here’s a snapshot of some recent earnings releases of some EV makers.

EV magnate Tesla Inc. TSLA reported earnings of $1.05 a share in the third quarter, up from the year-ago figure of 62 cents and surpassing the Zacks Consensus Estimate of 95 cents. Tesla delivered its seventh consecutive beat this earnings season. Total revenues came in at $21,454 million, witnessing year-over-year growth of 56%. However, the top line lagged the consensus mark of $22,323 million.

Nikola NKLA incurred an adjusted loss per share of 28 cents in the third quarter, narrower than the Zacks Consensus Estimate of a loss of 56 cents but wider than the year-ago loss figure of 25 cents. It recorded revenues of $24.2 million, which crossed the consensus figure of $23 million.

Fisker Inc.’s FSR net loss per share of 49 cents in the third quarter was wider than the Zacks Consensus Estimate of a loss of 43 cents and the year-ago loss of 37 cents. It recorded revenues of $14 million, decreasing from the year-ago figure of $15 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Fisker Inc. (FSR) : Free Stock Analysis Report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Canoo Inc. (GOEV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance