Health care 'Cadillac Tax' repeal bill up for vote Wednesday

Congress will be voting Wednesday on a repeal of what is known as the “Cadillac Tax”—a provision of the Affordable Care Act which would place a 40% tax on employer-sponsored health care plans which provide excess benefits.

Think tanks and industry advocates have been fighting the implementation of the tax for years, and successfully delayed it until 2023.

The tax was supposed to be a funding source and would include 40% on anything greater than the value of health insurance benefits surpassing approximately $11,200 for individuals and $30,150 for families in 2022, according to the Tax Foundation.

If the bill passes, it would bring a moment of stability during a continuously unpredictable time in health care policy and politics.

Opponents of the tax

The tax has been delayed twice in the past few years, but insurers have been preparing for its implementation in 2023.

Over time, insurers and employers have braced for the tax, by increasing the cost sharing of the employee or plan enrollee.

The National Association of Health Underwriters discussed the vote and market conditions last week in a podcast.

“We are seeing the detrimental effects on the health care market already,” said NAHU Vice President of Congressional Affairs Chris Hartmann.

“One of the things we’ve definitely seen is higher deductibles as everyone starts preparing for the Cadillac Tax to come into place.”

The tax was created to help continue funding the marketplace and support enforcement of the health care law.

But after the law was signed, studies showed the 40% excise tax would actually affect a wide range of insured individuals—not all of which were necessarily excessive.

A coalition of more than 500 stakeholders, the Alliance to Fight the 40, has been lobbying for the repeal.

In a letter Monday, the Alliance sent a letter to Senate and House leaders, calling for the bill to pass both houses and be sent to the president before the end of the year.

“A significant majority of voters – across party lines – oppose this tax because it increases out-of-pocket costs for older, sicker and underserved communities,” the letter said.

“Taxing workers trying to manage chronic conditions fails to address our most urgent health care challenges. At 40%, the tax is twice the top corporate rate and will have significant consequences. Waiting to address the tax forces employers to adjust benefits now in anticipation of the tax. Several studies have shown that the [tax\ would have a direct and negative impact on the continued affordability of employer-provided health insurance because employers will be compelled to reduce benefits and increase deductibles and other out-of-pocket costs to avoid the tax.”

Supporters of the tax

But there have been some supporters.

Katherine Hempstead, senior policy adviser with the Robert Wood Johnson Foundation, told Yahoo Finance she is among the health policy experts who are in the camp of supporting the tax.

That is because of its role in helping to curb health care costs.

“Employer-sponsored health care makes people not sufficiently sensitive to what health care costs, and it is regressive,” she said.

“It gives more of a break to people in higher tax brackets. So I’ve always thought that curbing that was going to be a good thing for getting some control,” she continued. “I think people agree with that basic content. (But) there are a lot of stakeholders that didn’t want to see that much disruption, so they’ve delayed it. And now it seems like it’s headed for the chopping block.”

On one hand, repealing the tax is a political one and maintains the status quo, she said.

On the other hand, the current Congress, despite its focus on health care broadly, is unlikely to come up with an alternative solution that would both curb costs and help fund the ACA provisions and infrastructure.

“Maybe you clear the decks and you come back with another approach, something that is maybe a little more palatable,” Hempstead said. “The activity you see right now is a lot of bipartisan agreement that health care spending needs to be reduced, and a lot of focus on hospital costs and prescription drug costs. You see a keen awareness of the problem and a strong motivation to do things to actually reduce what health care costs. Maybe if the Cadillac Tax is actually eliminated we will start to see a new discussion about it. But I also think it’s very hard right now in this Congress to really move forward on any kind of health care (initiative).”

The bill only addresses the tax part of the ACA, which was lumped together with a provision that requires W-2 reporting on the value of the health plans. Because it was written into the same subsection, the repeal bill adds back the W-2 requirement.

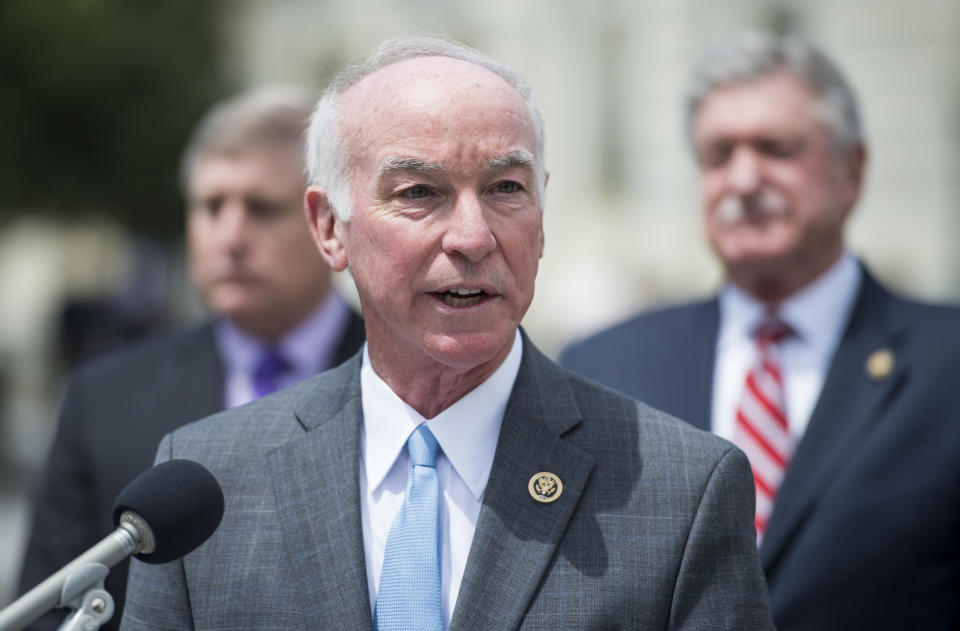

The bill, sponsored by Rep. Joe Courtney (D-CT) now has more than 360 cosponsors—both Republicans and Democrats—and is shaping up to be one of the largest bipartisan vote in this Congress on a standalone piece of legislation.

The vote in the Senate is still in question with more than 42 bipartisan cosponsors on the bill, sponsored by Sen. Martin Heinrich (D-NM).

—

Anjalee Khemlani is a reporter at Yahoo Finance. Follow her on Twitter: @AnjKhem

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance