Cadence (CDNS) Expands Partnership With TSMC & Microsoft

Cadence Design Systems CDNS is expanding its partnership with Taiwan Semiconductor Manufacturing Company (“TSMC”) and Microsoft to accelerate the physical verification of giga-scale digital designs.

The collaboration will likely help customers minimize design schedules and compute costs using the Cadence Pegasus Physical Verification System and CloudBurst Platform coupled with TSMC technology and Microsoft Azure cloud.

Designers are always under pressure to meet design schedules and compute budgets as physical verification on large digital designs usually consumes large computing resources for long periods and requires high-performance machines with large and expensive physical memory. This is where Cadence’s Pegasus Verification System comes into play, added Cadence.

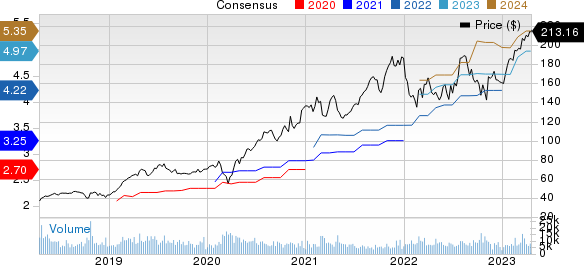

Cadence Design Systems, Inc. Price and Consensus

Cadence Design Systems, Inc. price-consensus-chart | Cadence Design Systems, Inc. Quote

The Pegasus Verification System's FlexCompute technology offers dynamic, automated central processing unit (CPU) management, which eliminates the need to define precise CPU needs by customers. Additionally, FlexCompute optimizes CPU usage and delivers a balance between turnaround time and cloud compute resources, added the company. According to preliminary findings, the Pegasus Verification System in the cloud offered “optimal performance” and a 20% decrease in cloud compute expenses, added the company.

Overall, the collaboration enables customers to manage large-scale designs efficiently, achieve significant runtime speed and shorten product launch time. The digital and cloud portfolios have been designed to support the Cadence Intelligent System Design strategy and can enable system-on-chip design improvement.

Cadence offers products and tools that help customers to design electronic products. The company continues to invest heavily in verification and digital design products, helping it launch products that address the ever-growing needs of electronics and semiconductor companies.

In April, the company announced the launch of a new technology called Cadence EMX Designer, which offers passive device synthesis and optimization capabilities. The technology can provide design rule check-clean parametric cells and electromagnetic models of passive devices, like inductors, transformers and T-coils, at a fast rate.

Prior to that, the company unveiled the Cadence Allegro X AI technology, a new system design tool that offers significant improvements in performance and automation.

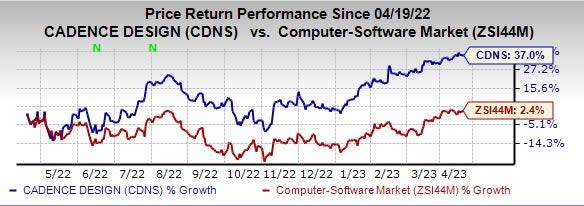

CDNS currently holds a Zacks Rank #2 (Buy). Shares of the company have gained 37% compared with the sub-industry’s growth of 2.4% in the past year.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the broader technology space are Arista Networks ANET, Asure Software ASUR and Salesforce CRM. Asure Software and Salesforce currently sport a Zacks Rank #1 (Strong Buy), whereas Arista Networks carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2023 earnings has increased 6.4% in the past 60 days to $5.85 per share. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 26.9% in the past year.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings has increased 25% in the past 60 days to 35 cents per share. The long-term earnings growth rate is anticipated to be 25%.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 445.8%. Shares of ASUR have increased 187.8% in the past year.

The Zacks Consensus Estimate for Salesforce’s 2023 earnings has increased 21.5% in the past 60 days to $7.11 per share. The long-term earnings growth rate is anticipated to be 16.8%.

Salesforce’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 15.6%. Shares of the company have increased 3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance