CAC 40 Tests Support as European Equities Slide

DailyFX.com -

Talking Points

European Equities Decline, With the CAC 40 Trading Down -1.57%

Bearish Breakouts Begin Under Trendline Support

Sentiment Now Reads at an Extreme +2.58

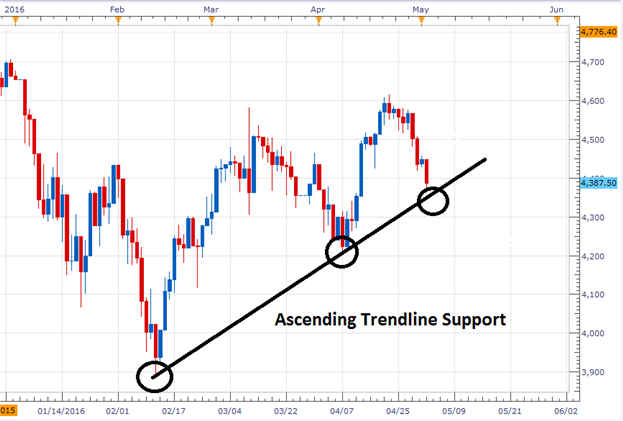

CAC 40 Daily Chart

(Created using Marketscope 2.0 Charts)

What’s next for the stock market? Find out more with our analysts Free forecast!

European equities markets are trading lower this morning, with the CAC 40 trading down -1.57%. Of the 40 listed CAC components, only 2 are currently trading up on the day. Lafarge Holcim is leading today’s decline, and is now trading down -4.98% on the day. In the absence of any major events on today’s economic calendar, traders are looking to tomorrow’s Euro-Zone Retail Sales figures to gain further insight into the health of the European economy. Figures are set to be released at an estimated 2.6% (YoY) (Mar). If these expectations are missed, it could provide a catalyst for a continued market decline.

Technically, the CAC 40 is now nearing an ascending trendline, which is currently acting for support for the Index. This trendline has been drawn by connecting the February 11 daily low at 3890.50 with the April 7 daily low at 4,211.80. If prices break below support, it would be expected that the CAC 40 continues its downward trend by creating a series of lower lows. This includes price action moving through the previous two lows mentioned above. Alternatively, in the even that prices remain supported, prices may bounce up towards previous values of resistance. This includes Aprils standing high at 4,616.50.

Find out real time sentiment data with the DailyFX’s sentiment page.

Sentiment Data for the CAC 40 (Ticker: FRA40) remains extreme with SSI (speculative sentiment index) currently reading at +2.58. As prices have declined in 3 of the last 4 sessions sentiment totals have continued to increase. If SSI readings remain at positive extremes, it may suggest further declines in price for the CAC 40.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance