Cabot (COG) Q4 Earnings Meet, Sales Lag Estimates, FCF Drops

Cabot Oil & Gas Corporation’s COG fourth-quarter 2019 net income per share — adjusted for special items — of 30 cents met the Zacks Consensus Estimate. The in-line results can be attributed to lower costs and slightly higher-than-anticipated production. Precisely, the company’s production totaled 226.1 billion cubic feet equivalent (Bcfe), just ahead of the Zacks Consensus Estimate of 224 Bcfe.

However, the bottom line fell 45.5% from the year-ago figure of 55 cents as natural gas prices declined.

The company’s quarterly revenues of $461.4 million missed the Zacks Consensus Estimate of $478 million. Further, the top line was 35.6% below the prior-year quarter’s revenues of $716 million.

Production, Prices, Costs & Drilling Statistics

In the quarter under review, Cabot’s overall production summed 226.1 Bcfe comprising 100% natural gas. The figure was 9.6% higher than the prior-year volume of 206.3 Bcfe.

Average realized natural gas price (excluding hedges) fell to $2.05 per thousand cubic feet from the year-ago quarter’s $3.22 and met the Zacks Consensus Estimate.

Total operating expenses were 18.02% lower than the figure reported in fourth-quarter 2018, decreasing to $308.5 million. While transportation and gathering costs were up 6.45% year over year to $149.9 million, Cabot did not incur any operating expense in brokered natural gas activity for which it spent $5.76 million in the year-ago period.

Notably, total average unit costs declined to $1.43 per thousand cubic feet equivalent (Mcfe) from the year-ago figure of $1.87.

Cabot drilled 25 wells and completed 28 during the quarter.

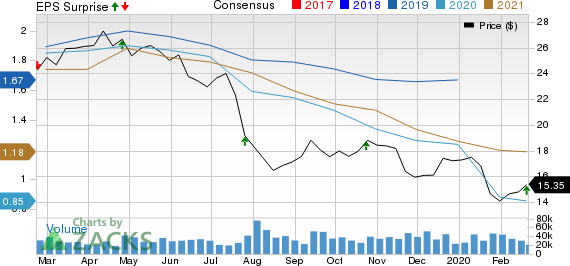

Cabot Oil & Gas Corporation Price, Consensus and EPS Surprise

Cabot Oil & Gas Corporation price-consensus-eps-surprise-chart | Cabot Oil & Gas Corporation Quote

Financial Position

Operating cash flows were $263 million (down 16.8% year over year) while capital expenditures totaled $167.7 million (down 32.1%). Free cash flow (FCF) — a key metric to gauge a company’s financial health — was $109.5 million during the fourth quarter, plunging 54.6% from the year-earlier number. As of Dec 31, 2019, the company had cash and cash equivalents worth $200.2 million and total debt of $1.2 billion with a debt-to-capitalization ratio at 36.2%.

Proved Reserves

As of Dec 31, 2019, the company had 12.9 trillion cubic feet equivalent (Tcfe) in proved reserves, reflecting a year-over-year increase of 11%.

Guidance

For the first quarter of 2020, Cabot provided its net production outlook in the range of 2,350-2,400 million cubic feet equivalent a day.

Meanwhile, this Houston-based company reiterates its recently declared scheme wherein it trimmed 27% of 2020 capital expenses year over year to $575 million that included non-drilling and completion capital. Also, the company adjusted its production prediction to 2.4 billion cubic feet (Bcf) per day for the full year from the earlier provided view of 2.1 Bcf.

Zacks Rank & Key Picks

Cabot has a Zacks Rank #5 (Strong Sell).

Some better-ranked players in the energy space are Contango Oil & Gas Company MCF, Devon Energy Corporation DVN and California Resources Corporation CRC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cabot Oil & Gas Corporation (COG) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Contango Oil & Gas Company (MCF) : Free Stock Analysis Report

California Resources Corporation (CRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance