C3.ai Q4 Preview: Can AI Momentum Sustain?

As everybody is highly-aware by now, artificial intelligence (AI) has been Wall Street’s new shiny toy in 2023.

And it’s easy to understand why, as the technology allows us to achieve digital feats that otherwise felt impossible. It’s undoubtedly an incredible growth story that investors are clamoring over.

Interestingly enough, a popular company within the realm, C3.ai AI, is scheduled to unveil quarterly results tomorrow, May 31st, after the market closes.

C3.ai is an enterprise AI software provider for accelerating digital transformation. NVIDIA NVDA, the current winner of the AI craze, posted quarterly results that had the market ecstatic in its latest release.

How does C3.ai stack up heading into its quarterly release? We can use the results from NVDA as a small guide. Let’s take a closer look.

NVIDIA

The chip titan posted EPS of $1.09, crushing the Zacks Consensus Estimate by nearly 20%. Quarterly revenue totaled $7.2 billion, 10% above expectations but lower than the year-ago quarter.

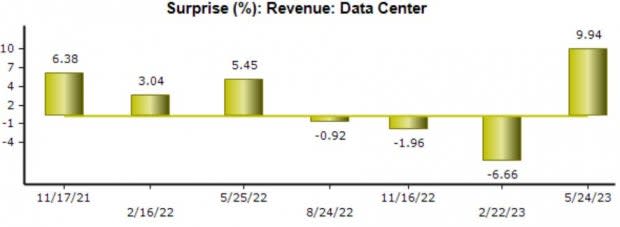

The real highlight came from the company’s Data Center segment, which includes AI operations. Data Center posted record revenue of $4.3 billion, climbing an impressive 14% from the year-ago quarter and 18% sequentially.

As we can see below, the $4.3 billion figure was nearly 10% above the Zacks Consensus Estimate, snapping a streak of negative surprises within the segment.

Image Source: Zacks Investment Research

C3.ai

Analysts have been bullish regarding the quarter to be reported, with the quarterly EPS estimate being revised nearly 6% higher over the last several months. The -$0.17 Zacks Consensus Estimate suggests an improvement of nearly 20% from the year-ago quarter.

Image Source: Zacks Investment Research

In addition, our consensus revenue estimate presently stands at $72.3 million, reflecting zero-change year-over-year. It’s worth noting that the quarterly revenue estimate has been revised roughly 1.5% higher since the end of March.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

C3.ai generates the bulk of its revenues through its Subscription segment, an area that the company has consistently positively surprised on. For the quarter, we expect AI to post Subscription revenue of $57 million, reflecting a slight uptick from the year-ago quarter.

Bottom Line

Many investors will be tuned into C3.ai’s release, as artificial intelligence has become the hot item on Wall Street. NVIDIA NVDA, the leader in the technology so far, posted quarterly results that had the market celebrating.

Heading into the release, C3.ai AI carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 6.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance