Buyback Bonanza: 3 Companies Scooping Up Shares

Stock buybacks, or share repurchase programs, are commonly executed by companies to boost shareholder value.

A stock buyback occurs when a company purchases outstanding shares of its stock. In its simplest form, buybacks represent companies essentially re-investing in themselves.

In 2024, several companies – Caterpillar CAT, lululemon LULU, and NetApp NTAP – have recently unveiled repurchase programs. Let’s take a closer look at each.

Caterpillar

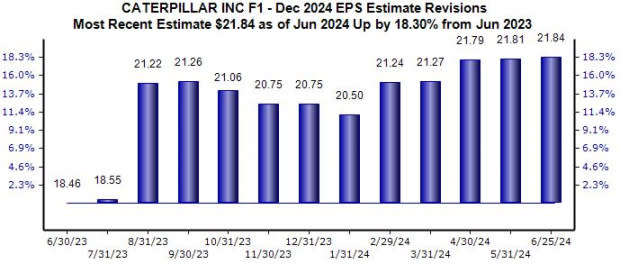

Construction heavyweight Caterpillar recently unveiled a sizable $20 billion buyback, representing nearly 13% of shares outstanding. Shares have modestly lagged in 2024, gaining 12% compared to the S&P 500’s 16% climb.

Nonetheless, the earnings estimate revisions trend for its current fiscal year has remained bullish, up 18% over the last year to $21.84 per share.

Image Source: Zacks Investment Research

Lululemon

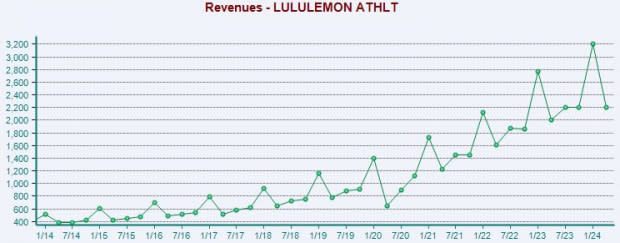

Apparel favorite LULU recently unveiled a $1 billion buyback, reflecting 2.5% of outstanding shares. Shares have lagged considerably in 2024, losing more than 40% in value.

Still, the company’s sales growth can’t be overlooked, with the company posting double-digit percentage year-over-year in each of its last ten releases. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

NetApp

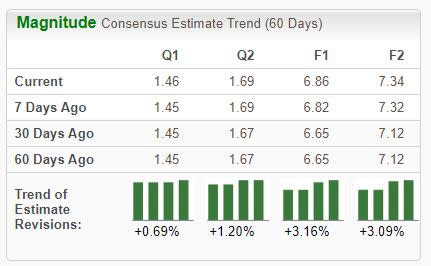

NetApp provides enterprise storage, data management software, and hardware products and services. NTAP recently announced an additional $1 billion in buybacks, reflecting 4% of its outstanding shares.

The company’s earnings outlook has shifted bullish amid the AI frenzy, enjoying positive earnings estimate revisions across the board.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies amplify shareholder value is through implementing share buybacks. They can provide a nice confidence boost for investors, indicating that the company is utilizing excess cash and can help put in a floor for shares.

And recently, all companies above – Caterpillar CAT, lululemon LULU, and NetApp NTAP – unveiled additional or fresh buyback programs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance