Buy These Stocks on Improved Business Environments Ahead of Earnings

Along with recovering from the effects of high inflation, many businesses were also continuing their post-pandemic recovery.

Naturally, as tougher operating conditions subside, quite a few companies will start to stand out.

Here are two top-rated Zacks stocks that investors may want to consider as their business environment continues to strengthen ahead of earnings.

H&R Block (HRB)

Sporting a Zacks Rank #2 (Buy) H&R Block (HRB) stock looks attractive before its fiscal third-quarter earnings report on Tuesday, May 9.

While H&R Block is not immune to inflationary concerns, the end of prolonged tax extensions and delays following the pandemic has stabilized the company’s top and bottom lines. Notably, H&R Block’s Consumer Services-Miscellaneous Industry is in the top 30% of over 250 Zacks industries.

To that point, H&R Block is expected to post solid EPS growth as a leader in tax preparation services with operations in the United States, Australia, and Canada.

Image Source: Zacks Investment Research

As shown above, third-quarter earnings are projected to jump 10% year over year at $4.51 per share. Sales for the quarter are expected to be up 2% at $2.11 billion. Overall, earnings are forecasted to rise 10% this year and climb another 10% in FY24 at $4.26 per share.

Total sales are expected to be up 2% in FY23 and rise another 3% in FY24 to $3.65 billion. More impressive, FY24 would represent 38% growth from pre-pandemic sales of $2.64 billion in 2019.

What makes H&R Block's steady growth more attractive is the company’s price-to-earnings valuation. Trading at $32 a share, HRB stock trades at just 8.4X forward earnings. This is nicely beneath the industry average of 11.4X and the S&P 500’s 19X. Plus, HRB trades 57% below its decade-long high of 19.7X and offers a 36% discount to the median of 13.1X.

Image Source: Zacks Investment Research

Wynn Resorts (WYNN)

Another stock that looks intriguing as its business environment strengthens is Wynn Resorts (WYNN). Sporting a Zacks Rank #2 (Buy) Wynn is set to release its first-quarter results on May 9 with its Gaming Industry in the top 29% of all Zacks industries.

Headquartered in Las Vegas, 70% of Wynn’s revenue actually comes from its casino resorts in China with three establishments in Macau. Wynn’s revenue is beginning to rebound as the Chinese economy continues to stabilize and accelerate following the reopening of the country’s borders and the end of its Zero-Covid policy last December.

Image Source: Zacks Investment Research

Wynn’s first-quarter sales are expected to leap 31% from the prior-year quarter to $1.25 billion. On the bottom line, earnings are projected at -$0.18 per share, a vast improvement from EPS of -$1.21 in Q1 2022.

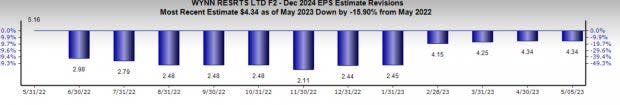

Furthermore, annual earnings are forecasted to soar to $1.05 per share in FY23 compared to an adjusted loss of -$4.47 a share in 2022. Better still, FY24 EPS is anticipated to skyrocket another 313% at $4.34 per share.

What is most intriguing about Wynn’s stock at the moment is the trend in earnings estimate revisions. As we can see from the nearby chart Wynn’s FY24 EPS estimates of $4.34 per share are almost where they were a year ago, before inflationary concerns crippled the outlook for most companies.

Plus, total sales are now projected to climb 45% this year and jump another 17% in FY24 to $6.43 billion. More importantly, fiscal 2024 sales would only be 3% below pre-pandemic levels with 2019 sales at $6.61 billion and China's reopening offers much more room for growth.

Image Source: Zacks Investment Research

Takeaway

Stronger business environments have made H&R Block and Wynn Resorts stock more attractive ahead of their quarterly results. This also makes it quite possible that both companies will offer positive guidance during their quarterly reports which could lead to more near-term upside in their stocks.

On top of that, the strengthening of their broader economic environments is starting to make H&R Block and Wynn Resorts look like very viable investments for 2023 and beyond.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

H&R Block, Inc. (HRB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance