Should You Buy or Sell Kraft Heinz Right Now?

Going into 2019, few investors would have guessed that Kraft Heinz (NASDAQ: KHC) would see such a drastic decline. Shares of the packaged-foods giant fell by 27% on February 22 when it announced a $15.4 billion impairment charge that wiped out an otherwise profitable quarter. At the same time, the company also announced that the SEC had begun an investigation into its accounting practices, specifically calling into question Kraft Heinz's previous procurement practices. Soon after, the SEC filed an additional subpoena to investigate Kraft Heinz's goodwill assessments and asset impairments. While not necessarily related to the $15.4 billion writedown, the news that the SEC is investigating a company is rarely a good sign in the eyes of investors. Since then, shares have continued to plummet and are down 47% from its 2019 high.

Over the past few months, investors have continually wondered whether now is the right time to buy into the stock. While the fact that Warren Buffet is still holding onto his investment in Kraft Heinz has helped prevent a massive sell-off, it doesn't change the fact that investors holding onto its stock have continued losing money. Certain bulls on Wall Street recommended Kraft Heinz as a good deal after its stock price plunged. This hasn't turned out to be the case as in the past month alone prices have fallen by another 20.7%.

Investors now have to ask themselves whether the stock is getting close to bottoming out or if shares will continue to fall even more.

IMAGE SOURCE: GETTY IMAGES

Recent financial figures

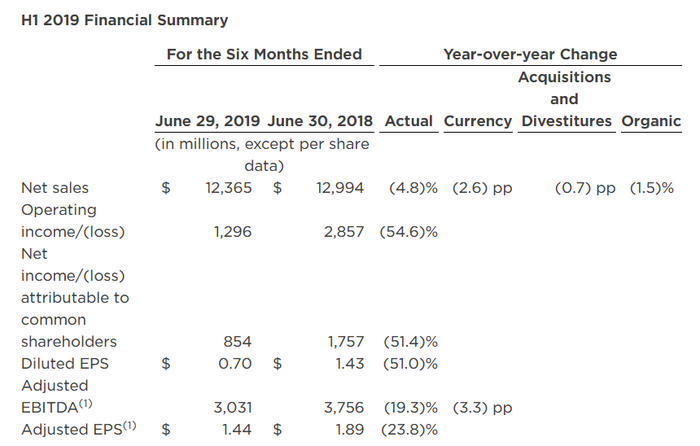

In early August, Kraft Heinz released its financial results for the first half of 2019. Operating income fell by 54.6%, while adjusted EBITDA and adjusted earnings per share both dropped by 19.3% and 23.8% respectively compared to the same period last year. While these figures surpassed analyst expectations, the main metric where Kraft disappointed shareholders was in sales, which came in at $12.36 billion. This was a $629 million decline from the same period last year and was less than the $12.68 billion consensus estimate from Wall Street.

DATA SOURCE: KRAFT HEINZ FINANCIAL REPORT

"The level of decline we experienced in the first half of this year is nothing we should find acceptable moving forward," said Kraft Heinz CEO Miguel Patricio in a press release in August. "We have significant work ahead of us to set our strategic priorities and change the trajectory of our business."

Potential recovery signs

While Kraft Heinz reduced its year-end guidance in light of these results, there are some early signs of improvement on the balance sheet. The main silver lining comes from its organic sales -- sales that are adjusted for currency, divestitures, and acquisitions – which have begun to stabilize. In comparison to Q1 2019, the decline in organic net sales stabilized in Q2, coming in at only at loss of 0.3% whereas the full six-month period came in at a loss of 1.5%.

Management also said in their conference call with analysts the company's sales declined because of trade negotiations in Europe alongside lower inventory levels in retail locations in North America. Specifically, Kraft mentioned that 80% of the decline in organic net sales mentioned above is attributable to retail inventory reductions in the U.S. and Canada.

What this means is that without the decline in retail inventories and the trade negotiations with Europe, sales might have even been showing signs of growth. While it's true that management pulled its guidance, it's also true that there's so much uncertainty in the markets right now that it makes sense for Kraft Heinz to cut back on its estimates for the future. Assuming that inventory stabilizes in the future, Kraft Heinz could see a surprising increase in sales over the next six to 12 months much to the surprise of skeptics.

As for the SEC investigation, Kraft Heinz announced in June that it will restate financial reports for the past three years to help fix errors due to mistakes by some of its employees. However, the company said that any misstatements were not "quantitatively material," and were mostly related to technicalities surrounding their supplier contracts. So far, an internal review from the company found $208 million worth of adjustments.

What should investors do right now?

Kraft Heinz is trading at a 7.55 P/E ratio, remarkably cheaper than competitors like General Mills, (NYSE: GIS) which is trading at 18.55 P/E. However, the stock is cheap for a good reason and even if someone's looking for a strong dividend stock, there are better alternatives to consider such as Nestle (OTC: NSRGY) or Kellogg (NYSE: K), both companies that have been doing very well so far in 2019.

It's true that there is some potential upside with Kraft Heinz, but it's not enough to justify a buy right now. Whether you're looking for a growth stock or a dividend/value investment, there are better companies out there to consider.

More From The Motley Fool

Mark Prvulovic has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance