Buy the Dip in These Retail REITs?

With the recent selloff among the broader financial sector, many Real Estate Investments Trusts (REITs) have seen their stocks decline as well.

Prior to this many popular retail REITs such as Federal Realty Investment Trust (FRT) and Simon Property Group (SPG) had seen their stocks spike in 2023. Let’s see if it’s time to buy either stock after the most recent selloff.

Retail REITs

Malls and shopping centers are continuing their post-pandemic recovery as more and more consumers return. This is helping Simon Property Group and Federal Realty start to recover as well as owners and operators of these types of retail properties.

Simon Property Group is the largest mall operator in the United States and internatinally with Federal Realty managing, developing, and re-developing shopping centers and mixed-use properties in the Northeast and Mid-Atlantic U.S., Florida, and California.

Image Source: Zacks Investment Research

Growth & Recovery

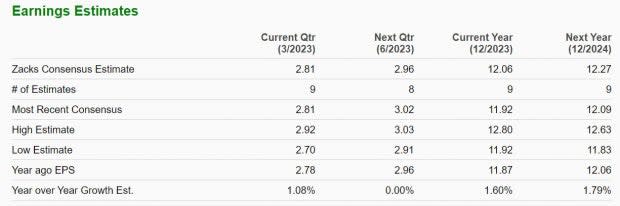

Looking at this year’s continued post-pandemic recovery, Simon Property Group’s fiscal 2023 earnings are projected to be up 1% and rise another 2% in FY24 at $12.27 per share. Earnings estimate revisions are slightly down over the last quarter.

On the top line, sales are forecasted to be up 3% in FY23 and rise another 2% in FY24 to $5.56 billion. More importantly, fiscal 2024 would only be 3% below 2019 sales of $5.75 billion as the company continues to move closer to pre-pandemic levels.

Image Source: Zacks Investment Research

Pivoting to Federal Realty, earnings are expected to edge up 2% this year and pop 4% in FY24 at $6.70 per share. Even better, earnings estimates have trended higher throughout the quarter.

Sales are projected to jump 5% in FY23 and rise another 4% in FY24 to $1.18 billion. More impressive, fiscal 2024 would represent 26% growth from pre-pandemic levels with 2019 sales at $936 million.

Image Source: Zacks Investment Research

Performance & Valuation

Simon Property Group and Federal Realty stock have given back any year-to-date gains after the most recent selloff among the broader financial sector. Simon Property Group is now down -7% year to date near Federal Realty’s -6% with both underperforming the S&P 500’s +2% and the REIT Equity Trust – Retail Markets -1%.

However, over the last three years, shares of SPG are up +85% to beat the S&P 500 and its Zack Subindustry’s + 28% although FRT’s +3% has lagged.

Image Source: Zacks Investment Research

Investors are hoping the recent market volatility created buying opportunities and both stocks can resume what had been strong performances to start 2023.

Looking at the valuation of both companies this certainly seems plausible. Simon Property Group stock trades at just 9.1X forward earnings which is nicely below its decade high of 20.9X, the median of 14.3X, and the industry average of 12X.

In comparison, Federal Realty stock trades above the industry average at 15X but still below its own decade-long high of 29.8X and median of 22X.

Image Source: Zacks Investment Research

Dividends

Simon Property Group and Federal Realty’s dividends could make up for the recent volatility and reward patient investors. In this regard, SPG’s 6.5% yield tops FTR’s 4.4% and the industry average of 4.7% but both are well above the S&P 500’s 1.6% average.

Image Source: Zacks Investment Research

Takeaway

At the moment, Federal Realty stock sports a Zacks Rank #2 (Buy) in correlation with earnings estimates revisions trending higher with Simon Property Group landing a Zacks Rank #3 (Hold). While Simon Property Group’s earnings estimates have slightly declined, its valuation and steady top and bottom-line recovery is intruiging and investors may be rewarded for holding shares at their current levels.

In terms of post pandemic recovery and growth, Federal Realty’s stock is starting to become attractive which also makes the recent selloff among shares of FRT look like a buying opportunity with investors hoping both stocks can get back to their impressive starts at the beginning of the year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance