Buy 5 Investment Bankers for Sparkling Returns in the Near Term

The investment bank industry is set to flourish in 2024 following a rebound in corporate debt and equity issuances and deal-making activities, which is expected to increase investment banking fees.

After a sustained weakness in underwriting, IPOs and deal-making activities since 2022 due to geopolitical tensions, global supply-chain disruptions, aggressive monetary policy tightening worldwide to control inflation and potential recession risks, green shoots in advisory and underwriting businesses are visible with the deal pipeline looking healthy.

The macroeconomic environment appears steady and corporates worldwide are adjusting to the high-rate regime. Consequently, global underwriting and M&A activities are expected to rebound in 2024. The improving operating backdrop should support industry players’ revenue growth.

The Zacks Investment Bank industry consists of firms that provide financial products and services that include advisory-based financial transactions to corporations, governments and financial institutions worldwide.

The industry players work mainly through three product segments — investment banking (M&As, advisory services and securities underwriting), asset management (AUM-related activities), and trading and principal investments (proprietary and brokerage trading).

The Zacks-defined Financial – Investment Bank Industry is currently in the top 7% of the Zacks Industry Rank. In the past year, the industry has provided 39.3% returns, while its year-to-date return is 17.8%. Since it is ranked in the top half of Zacks Ranked Industries, we expect the consulting services industry to outperform the market over the next three to six months.

Moreover, innovative trading platforms, the use of artificial intelligence (AI) and investments in technology and advertising are likely to aid the operations of investment banks. While investment banks will likely face increasing technology-related expenses in the near term, these initiatives are expected to improve operating efficiency over time.

Our Top Picks

We have narrowed our search to five investment bank stocks that have strong growth potential for 2024. These stocks have seen positive earnings estimate revisions in the last 30 days. Each of our picks sports either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

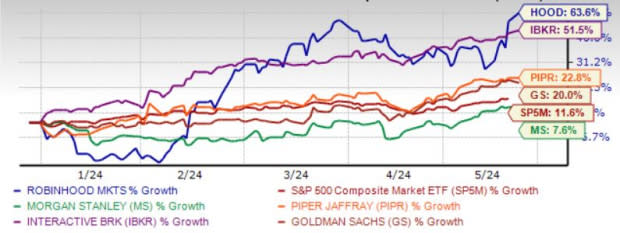

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

The Goldman Sachs Group Inc. GS intends to refocus on the core strengths of investment banking (IB) and trading businesses. Improvement in global deal-making and underwriting activities and GS’ leading position are likely to offer leverage and drive IB fees. We expect the metric to grow 8.8% in 2024. Also, the decent liquidity of GS aids sustainable capital distribution.

Zacks Rank #1 The Goldman Sachs Group has an expected revenue and earnings growth rate of 12.1% and 60.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.7% over the last 30 days.

Morgan Stanley’s MS new strategic alliance with Mitsubishi UFJ will bolster its presence in Japan and support footprint diversification efforts. Also, MS’ initiatives to become less dependent on capital-markets-driven revenue sources, inorganic expansion efforts and high rates should aid the top line. The resurgence of the investment banking business and MS’ solid pipeline in the business will aid financials.

Zacks Rank #1 Morgan Stanley has an expected revenue and earnings growth rate of 6.8% and 25.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.9% over the last 30 days.

Piper Sandler Companies PIPR is a securities-centric investment bank dedicated to delivering superior financial advice, investment products and transaction execution within selected sectors of the financial services marketplace.

PIPR operates through two primary revenue-generating segments: Capital Markets and Private Client Services. Investment Research, an independent group reporting to the CEO, supports clients of both segments. PIPR serves corporations, government and non-profit entities, and institutional investors.

Zacks Rank #1 Piper Sandler has an expected revenue and earnings growth rate of 11.9% and 27.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 5.8% over the last 30 days.

Interactive Brokers Group Inc. IBKR is a global automated electronic broker. IBKR’s efforts to develop proprietary software, low compensation expenses relative to net revenues, an increase in emerging market customers and higher rates are expected to support financials. We project total net revenues (GAAP) of IBKR to grow 4.5% this year.

Further, consolidation of operations in the European Union is expected to bolster IBKR’s operational efficiency. IBKR executes, processes and trades in cryptocurrencies too. IBKR’s commodities futures trading desk offers customers a chance to trade cryptocurrency futures.

Zacks Rank #2 Interactive Brokers Group has an expected revenue and earnings growth rate of 9.6% and 12.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days.

Robinhood Markets Inc. HOOD operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies using its Robinhood Crypto platform.

Zacks Rank #2 Robinhood Markets has an expected revenue and earnings growth rate of 28.5% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Piper Sandler Companies (PIPR) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance