Bull of the Day: Wynn Resorts (WYNN)

Overview

Based in Las Vegas, NV, Zacks Rank #1 (Strong Buy) stock Wynn Resorts (WYNN) was founded in 2002. The company, together with its subsidiaries, is a leading developer, owner and operator of casino resorts. The company currently owns and operates casino hotel resort properties in Las Vegas, and in Macau Special Administrative Region of the People's Republic of China.

Strong Growth Trajectory

Wynn Resorts, one of the leading companies in the gaming and lodging industry, is well poised to grow strategically. Given its strong brand name, Wynn Resorts is better positioned to command a premium rate relative to its peers in the gaming and lodging industry. Moreover, the addition of Encore Boston Harbor in Massachusetts, makes it an initiative placed in the right direction. The company reconfigured its casino and changed the casino loyalty program. Also, it emphasized on adding incremental parking, food and beverage and entertainment amenities. With group business returning back, the initiatives are likely to benefit the company in the upcoming periods. The company stated that it would upgrade Encore Boston Harbor to be the top-performing Casino in the northeast.

Sports Betting to Drive Growth

The company is focusing on sport betting expansion to drive growth. In an effort to focus on online betting, the company announced the merger of Wynn Interactive into Austerlitz Acquisition Corp. To drive growth the company will invest $640 million. Meanwhile, WynnBET sports betting and online casino application were operational in New Jersey for quite some time. During the fourth quarter of 2020, the company launched WynnBET online sports and casino offerings in Colorado and Michigan. It also secured market access in Arizona, New York, Indiana, Iowa and Ohio and received conditional licensing in Tennessee.

Fundamentals

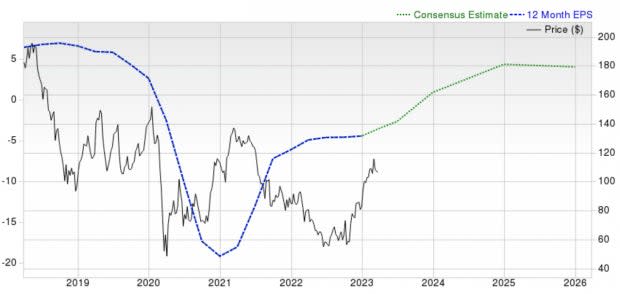

Zacks Consensus Analyst Estimates suggest that Wynn Resorts is on track to fully recover from the COVID-19-induced earnings slow down by 2025. Prior to the shock of the pandemic, WYNN shares were trading at $200 per share. Should Wynn meet or exceed analyst expectations in the next two years, we expect price to double and regain old, pre-pandemic levels.

Image Source: Zacks Investment Research

Technical View

Shares of Wynn are pulling into the 50-day moving average for the first time since breaking out. The first tag of the 50-day moving average tends to be a favorable area from a reward-to-risk perspective.

Image Source: Zacks Investment Research

Bottom Line

Wynn Resorts is firing on all cylinders and investors are currently being offered an opportunity to take advantage of a temporary market shock (the pandemic). Expect WYNN shares to outperform as the company takes advantage of growth drivers such as sports betting, Macau, and strong brand recognition.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance