I Built A List Of Growing Companies And Xcel Energy (NASDAQ:XEL) Made The Cut

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Xcel Energy (NASDAQ:XEL). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Xcel Energy

How Quickly Is Xcel Energy Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Xcel Energy has grown EPS by 6.2% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

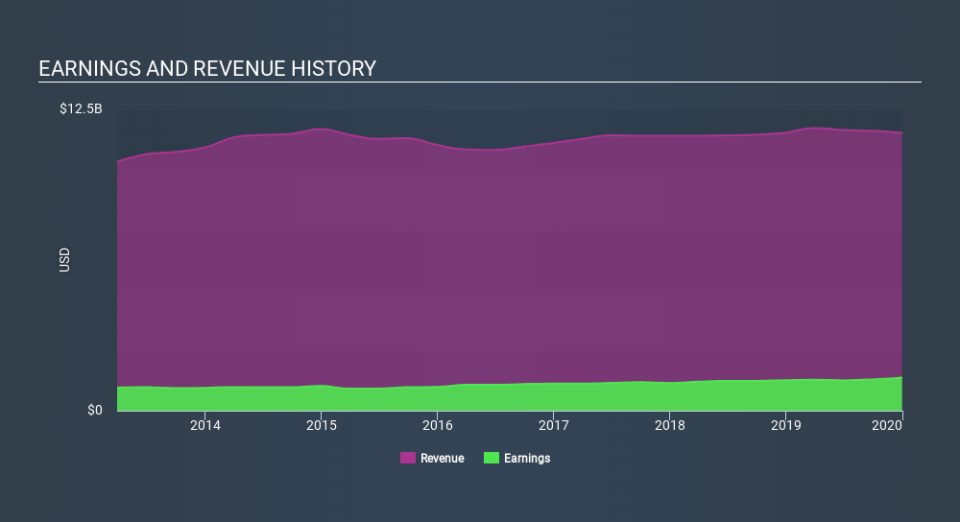

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. It seems Xcel Energy is pretty stable, since revenue and EBIT margins are pretty flat year on year. That's not a major concern but nor does it point to the long term growth we like to see.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Xcel Energy's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Xcel Energy Insiders Aligned With All Shareholders?

Since Xcel Energy has a market capitalization of US$36b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Given insiders own a small fortune of shares, currently valued at US$78m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Should You Add Xcel Energy To Your Watchlist?

As I already mentioned, Xcel Energy is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. What about risks? Every company has them, and we've spotted 1 warning sign for Xcel Energy you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance