I Built A List Of Growing Companies And 8I Holdings (ASX:8IH) Made The Cut

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like 8I Holdings (ASX:8IH). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for 8I Holdings

How Fast Is 8I Holdings Growing Its Earnings Per Share?

In the last three years 8I Holdings's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. It's good to see that 8I Holdings's EPS have grown from S$0.011 to S$0.013 over twelve months. I doubt many would complain about that 14% gain.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of 8I Holdings's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While 8I Holdings did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

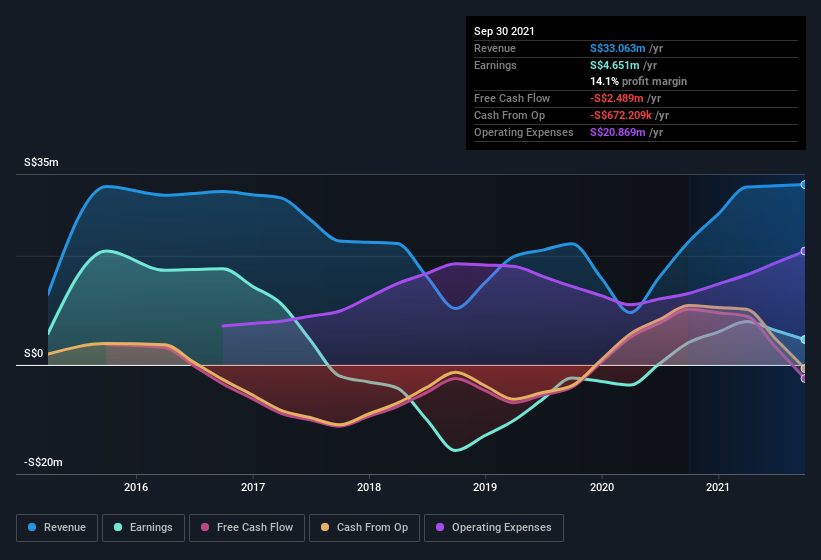

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

8I Holdings isn't a huge company, given its market capitalization of AU$45m. That makes it extra important to check on its balance sheet strength.

Are 8I Holdings Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling 8I Holdings shares, in the last year. With that in mind, it's heartening that Yiowmin Chay, the Non-Executive Director of the company, paid S$20k for shares at around S$0.26 each.

On top of the insider buying, we can also see that 8I Holdings insiders own a large chunk of the company. Actually, with 49% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. In terms of absolute value, insiders have S$22m invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does 8I Holdings Deserve A Spot On Your Watchlist?

As I already mentioned, 8I Holdings is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for 8I Holdings (1 makes us a bit uncomfortable) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of 8I Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance