The Aussie city headed for a housing bubble

The pandemic has changed the world forever – and if it’s also changed your living arrangements, you wouldn’t be alone.

In fact, there are some cities you might not want to live or buy a house in at the moment, with Covid-19 putting added pressure on some of the largest cities around the world where affordability was already pushed to the brink.

“Despite the current global recession, on average, inflation-adjusted house price growth in these 25 cities accelerated in the last four quarters, which we consider unsustainable,” said UBS in a research note.

“In addition, the pandemic amplifies some long-term uncertainties surrounding urban housing.”

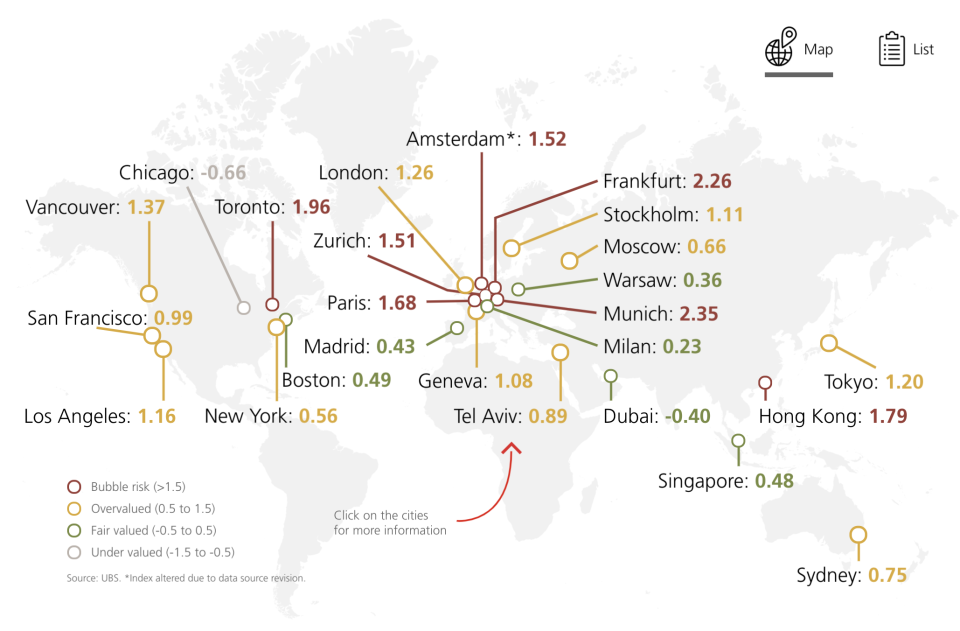

Among 25 of the world’s biggest cities, German cities Munich and Frankfurt are at greatest risk of a housing bubble, followed by Canada’s Toronto and Hong Kong, according to UBS’ global real estate bubble index 2020.

Paris, Amsterdam and Zurich rank fifth, sixth and seventh respectively for being at greatest risk of a housing bubble.

Sydney, the only Australian city to make the list, features 16th on the list under “overvalued”.

But it is still ahead of New York (18th), Boston (19th) and Singapore (20th).

Meanwhile, Chicago property was deemed to be undervalued by UBS.

UBS global wealth management chief investment officer Mark Haefele indicated that house prices were moving into “unsustainable” levels.

“It is uncertain to what extent higher unemployment and the gloomy outlook for household incomes will affect home prices. However, it’s clear that the acceleration over the past four quarters is not sustainable in the short run,” he said.

“Rents have been falling already in most cities, indicating that a correction phase will likely emerge when subsidies fade out and pressure on incomes increase.”

The most recent data from CoreLogic reveals that national house prices only dipped 0.1 per cent in September, marking what seems to be the end of the coronavirus-triggered downturn in the property market.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance