Broadcom And Two More US Stocks Possibly Priced Below Their Estimated True Value

As the U.S. stock market exhibits fluctuations with indices like the S&P 500 and Nasdaq retreating from record highs, investors are keenly observing market trends for potential opportunities. In such a landscape, identifying stocks that may be undervalued becomes particularly compelling, offering a strategic avenue for those looking to potentially enhance their portfolios amidst prevailing economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

SouthState (NYSE:SSB) | $76.42 | $151.58 | 49.6% |

Orrstown Financial Services (NasdaqCM:ORRF) | $27.36 | $53.19 | 48.6% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.50 | $32.13 | 48.6% |

Oddity Tech (NasdaqGM:ODD) | $39.26 | $76.33 | 48.6% |

Marriott Vacations Worldwide (NYSE:VAC) | $87.32 | $169.56 | 48.5% |

Victory Capital Holdings (NasdaqGS:VCTR) | $47.73 | $92.59 | 48.5% |

AppLovin (NasdaqGS:APP) | $83.22 | $166.06 | 49.9% |

Uber Technologies (NYSE:UBER) | $72.68 | $140.51 | 48.3% |

Vasta Platform (NasdaqGS:VSTA) | $3.05 | $5.90 | 48.3% |

HealthEquity (NasdaqGS:HQY) | $86.20 | $165.65 | 48% |

Let's take a closer look at a couple of our picks from the screened companies

Broadcom

Overview: Broadcom Inc. is a global company that designs, develops, and supplies a range of semiconductor devices, specializing in complex digital and mixed-signal CMOS-based devices and analog III-V based products, with a market capitalization of approximately $747.36 billion.

Operations: The company's revenue is generated from two primary segments: Infrastructure Software, which brought in $13.76 billion, and Semiconductor Solutions including Intellectual Property Licensing, contributing $28.86 billion.

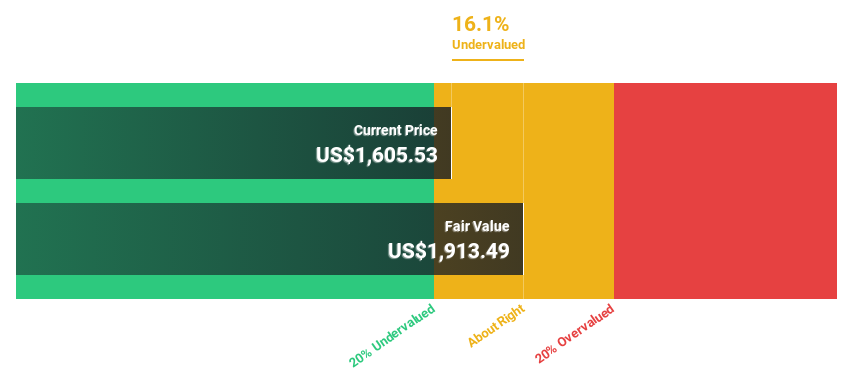

Estimated Discount To Fair Value: 16.1%

Broadcom Inc., currently priced at US$1605.53, is trading below our estimated fair value of US$1913.49, suggesting undervaluation based on discounted cash flow analysis. Despite a high debt level and shareholder dilution over the past year, Broadcom's return on equity is expected to be very high at 41.6% in three years. The company's earnings are projected to grow by 27.51% annually, outpacing the U.S market forecast of 14.7%. Recent product updates and federal approvals highlight ongoing innovation and expansion into secure cloud services, supporting its financial growth trajectory despite a recent dip in profit margins from 38.7% to 24%.

Marvell Technology

Overview: Marvell Technology, Inc., along with its subsidiaries, offers data infrastructure semiconductor solutions from the data center core to the network edge and has a market capitalization of approximately $60.51 billion.

Operations: The company generates its revenue primarily through the design, development, and sale of integrated circuits, totaling approximately $5.35 billion.

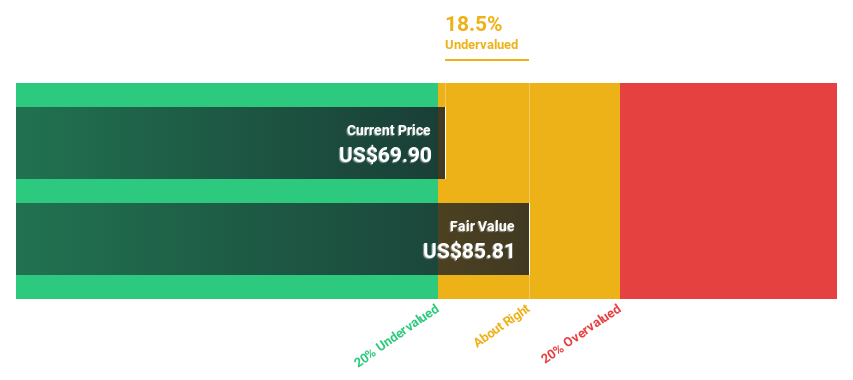

Estimated Discount To Fair Value: 18.5%

Marvell Technology, priced at US$69.9, is currently valued below its calculated fair value of US$85.81, indicating a potential undervaluation based on cash flow analysis. Despite this, the company is not significantly undervalued as it trades just 18.5% under fair value. Analysts predict a price increase of 28.4%, reflecting optimism in its financial trajectory as Marvell transitions to profitability with expected robust revenue growth (16.6% annually) outpacing the U.S market average (8.6%). However, substantial insider selling over the past quarter could signal caution among investors about its near-term prospects.

Shopify

Overview: Shopify Inc. is a global commerce company that offers a platform and services for businesses across regions including North America, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately $85.15 billion.

Operations: The company generates $7.41 billion from its Internet Software & Services segment.

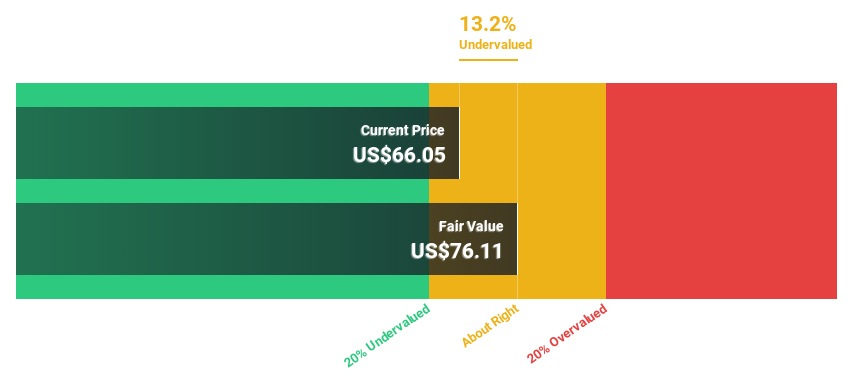

Estimated Discount To Fair Value: 13.2%

Shopify, currently trading at US$66.05 against a fair value of US$76.11, appears modestly undervalued based on discounted cash flow analysis. Expected to achieve profitability within three years, the company's revenue growth forecast at 16.9% annually is nearly double that of the broader U.S market. Recent strategic partnerships and expansions into new markets like Target Plus could enhance its business model and market presence, potentially supporting its financial growth trajectory despite a current net loss reported in Q1 2024.

Our growth report here indicates Shopify may be poised for an improving outlook.

Navigate through the intricacies of Shopify with our comprehensive financial health report here.

Summing It All Up

Delve into our full catalog of 179 Undervalued US Stocks Based On Cash Flows here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:AVGO NasdaqGS:MRVL and NYSE:SHOP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance