British Pound Range at Risk as BoE Inflation Report Comes Into Focus

Fundamental Forecast for British Pound: Bearish

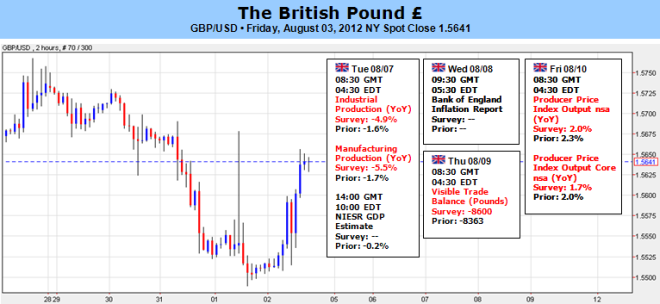

The British Pound continued to track sideways as the Bank of England preserved its current policy in August, but the fresh batch of central bank rhetoric may threaten the range-bound price action in the GBPUSD as market participants weigh the outlook for monetary policy. Indeed, the BoE refrained from releasing a policy statement after keeping the benchmark interest rate at 0.50% while maintaining the asset purchase target at GBP 375B, and the central bank’s quarterly inflation report on tap for the following week highlights the biggest event risk for the sterling as the Monetary Policy Committee retains a dovish tone for monetary policy.

According to a survey by Bloomberg News survey, an overwhelming majority of the 16 economists polled see the BoE lowering its forecast for growth and inflation and the central bank may sound increasingly cautious this time around as the U.K. faces a growing threat for a prolonged recession. In turn, we may see BoE Governor Mervyn King show a greater willingness to conduct additional quantitative easing, but the MPC may stick to the sidelines over the coming months as the Funding for Lending program gets underway. As the central bank and the U.K. government increases their effort to boost private sector activity, the new initiative limits the scope of seeing the BoE expand its balance sheet further, and the MPC may endorse a wait-and-see approach throughout the remainder of the year as the committee expects the recovery to gradually gather pace over the coming months. However, as the economic docket for the following week is expected to instill a weakened outlook for the U.K., a slew of dismal data may drag on the British Pound, and we may see the sterling struggle to maintain its current price range as currency traders increase bets for additional monetary support.

As the GBPUSD remains capped by the 100-Day SMA at 1.5572, we should see the rebound from 1.5489 taper off in the coming days, and the pair may threaten the 1.5400 figure should the BoE inflation report fuel speculation for more QE. A break below interim support would open the door for a test of the June low (1.5268), but the pound-dollar may continue to face range-bounce price action if we see the central bank scale back its willingness to further expand its non-standard measure. - DS

Yahoo Finance

Yahoo Finance