Brinker's (EAT) Q1 Earnings Match, Revenues Miss Estimates

Brinker International, Inc. EAT reported mixed first-quarter fiscal 2020 results, wherein earnings were in line with the Zacks Consensus Estimate but revenues lagged the same. The top line lagged the consensus mark for the second straight quarter. Following the quarterly results, shares of the company jumped 3.2% yesterday.

Adjusted earnings of $41 cents per share declined 12.8% from the year-ago quarter, mainly due to increase in stock-based compensation expenses for newly retired executives. Quarterly revenues totaled $786 million, which missed the consensus mark of $788 million but improved 4.3% on a year-over-year basis. Its traffic-building strategies and revenues generated from the acquisition of 116 Chili’s restaurants aided the top line.

Moreover, the reported quarter marked the company’s 6th and 7th consecutive quarter of positive comparable restaurant sales and traffic growth, respectively.

Brand Performances

Brinker primarily engages in ownership, operation, development and franchising of various restaurant brands under Chili’s Grill & Bar (Chili’s) and Maggiano’s Little Italy (Maggiano’s).

Chili's

Revenues at Chili’s totaled $677.5 million in the reported quarter, up 5.8% from the prior-year period. The upside was driven by an increase in off-premise sales, led by comparable restaurant sales and revenues generated from the acquisition of 116 Chili's restaurants located in the Midwest United States from a franchisee. Notably, Chili’s opened 11 restaurants during the reported quarter.

The brand’s company-owned comps rose 2.9% on account of a 2.3% increase in pricing and 0.6% rise in mix, with no impact on traffic. In fourth-quarter fiscal 2019, company-owned comps rose 1.5% from the prior-year quarter.

Comps at Chili's franchised restaurants declined 0.3% compared with 0.4% decline registered in the year-ago quarter. At international franchised Chili’s restaurants, the same fell 1.3% compared with the year-ago quarter’s decline of 3%. Meanwhile, at the U.S. franchised units, comps increased 0.4% compared with 1.2% growth in the year-ago quarter.

At Chili's, domestic comps (including company-owned and franchised) grew 2.3% compared with the fourth quarter’s increase of 1.8%.

Maggiano's

Maggiano's sales decreased 1.8% year over year to $86.4 million, primarily due to a decline in comparable restaurant sales.

Comps dropped 1.8% year over year on a 3% decline in traffic.

Operating Results

Total operating costs and expenses jumped roughly 6.8% to nearly $754.8 million from $706.9 million in the year-ago quarter. However, restaurant operating margin — as a percentage of company sales — was 11% compared with 11.1% in the prior-year quarter.

Balance Sheet

As of Sep 25, 2019, cash and cash equivalents amounted to $29 million compared with $11 million on Sep 26, 2018.

Long-term debt was $1.3 billion as of Sep 25, 2019 compared with $1.2 billion on Jun 26, 2019. Total shareholders’ deficit in the reported quarter was $585.1 million compared with $778.2 million as of Jun 26, 2019.

Management approved a quarterly dividend of 38 cents per share of the company’s common stock in the fiscal first quarter, which is payable on Dec 26 to its shareholders of record on Dec 6.

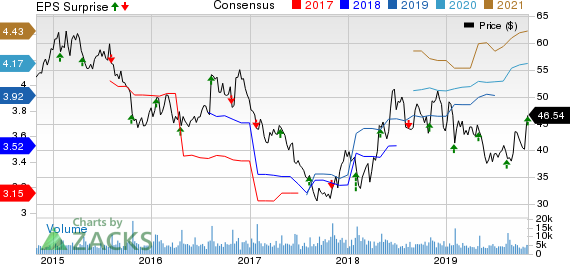

Brinker International, Inc. Price, Consensus and EPS Surprise

Brinker International, Inc. price-consensus-eps-surprise-chart | Brinker International, Inc. Quote

Zacks Rank & Other Key Picks

Brinker currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks from the Restaurant space include Chuy's Holdings, Inc. CHUY, Cracker Barrel Old Country Store, Inc. CBRL and Dunkin' Brands Group, Inc. DNKN. Chuy’s sports a Zacks Rank #1 (Strong Buy), while Cracker Barrel and Dunkin’ carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chuy’s, Cracker Barrel and Dunkin’ has an impressive long-term earnings growth rate of 17.5%, 10% and 9.8%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cracker Barrel Old Country Store, Inc. (CBRL) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance