BrightView Holdings Inc (BV) Q2 Fiscal 2024 Earnings Overview

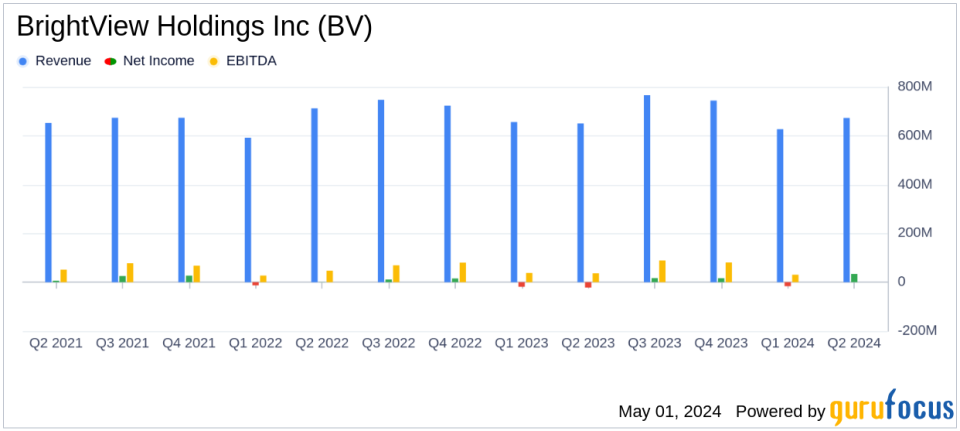

Revenue: Reported at $672.9 million for Q2, a 3.5% increase year-over-year, slightly below the estimated $683.80 million.

Net Income: Surged to $33.7 million, a significant increase from a loss in the previous year, far exceeding the estimated $10.76 million.

Earnings Per Share (EPS): Recorded at $0.17, substantially above the estimated $0.07.

Free Cash Flow: Year-to-date figure rose dramatically to $89.4 million, up from $15.9 million in the prior year, indicating robust operational efficiency.

Adjusted EBITDA: Increased by 38.5% to $64.8 million, with the margin expanding by 240 basis points, reflecting improved profitability.

Guidance Update: Revised total revenue forecast for FY 2024 to $2.740 - $2.800 billion, with increased free cash flow projections of $55 - $75 million.

Debt Management: Total net financial debt reduced to $753.9 million, with a lower debt to EBITDA ratio of 2.4x, enhancing financial stability.

BrightView Holdings Inc (NYSE:BV), the leading commercial landscaping services provider in the United States, announced its financial results for the second quarter ended March 31, 2024, in its recent 8-K filing. The company reported a robust increase in both revenue and net income, significantly exceeding analyst expectations for the quarter.

Company Profile

BrightView Holdings Inc offers a comprehensive range of commercial landscaping services across the United States. These services include landscape maintenance, enhancements, tree care, and landscape development. Operating primarily through its Maintenance Services and Development Services segments, BrightView has established a strong market presence, with the majority of its revenue generated from Maintenance Services.

Financial Highlights

For Q2 2024, BrightView reported a revenue of $672.9 million, marking a 3.5% increase year-over-year. This growth was primarily driven by a $34.3 million increase in snow removal revenue and an $8.8 million increase from development services, although partially offset by a $21.5 million decrease in commercial landscaping. Notably, net income saw an impressive rise, reaching $33.7 million compared to a loss in the previous year, translating to a net income margin expansion of 840 basis points.

Adjusted EBITDA for the quarter stood at $64.8 million, up 38.5% from the previous year, with the margin expanding by 240 basis points. This improvement reflects effective cost management and revenue growth. Year-to-date, the company has generated a free cash flow of $89.4 million, a significant increase from the prior period, alongside a net cash provided by operating activities of $109.5 million.

Updated Fiscal 2024 Guidance

In light of these results, BrightView has updated its fiscal year 2024 guidance. The company now expects total revenue to be between $2.740 billion and $2.800 billion, with adjusted EBITDA projected to be between $315 million and $335 million. Additionally, the free cash flow forecast has been raised to between $55 million and $75 million.

Management's Perspective

CEO Dale Asplund commented on the quarter's achievements, stating:

"During the quarter we continued to advance our strategy on profitable growth and a unified go-to-market offering under One BrightView. Our ability to deliver on these key initiatives resulted in an increase in revenue, and robust EBITDA growth and margin expansion. I am pleased to report we are reaffirming our breakthrough EBITDA guidance for fiscal 2024, while raising our Free Cash Flow guidance."

Strategic and Operational Developments

The quarter also saw BrightView record a $43.9 million gain on the divestiture of its non-core U.S. Lawns Business, highlighting its strategic focus on core operations and efficiency. The company's ongoing cost management initiatives, particularly in payroll and overhead costs, have played a crucial role in bolstering profitability and operational efficiency.

In conclusion, BrightView's Q2 fiscal 2024 results not only surpassed analyst expectations but also demonstrated the company's resilience and strategic prowess in navigating market dynamics. With revised upward guidance, BrightView is positioned to continue its growth trajectory, supported by strong operational performance and strategic initiatives.

For more detailed information and future updates, investors and interested parties are encouraged to visit BrightView's investor relations website.

Explore the complete 8-K earnings release (here) from BrightView Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance