Is Boston Scientific's (NYSE:BSX) Share Price Gain Of 200% Well Earned?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on a lighter note, a good company can see its share price rise well over 100%. One great example is Boston Scientific Corporation (NYSE:BSX) which saw its share price drive 200% higher over five years. In contrast, the stock has fallen 9.8% in the last 30 days. We note that the broader market is down 0.7% in the last month, and this may have impacted Boston Scientific's share price.

Check out our latest analysis for Boston Scientific

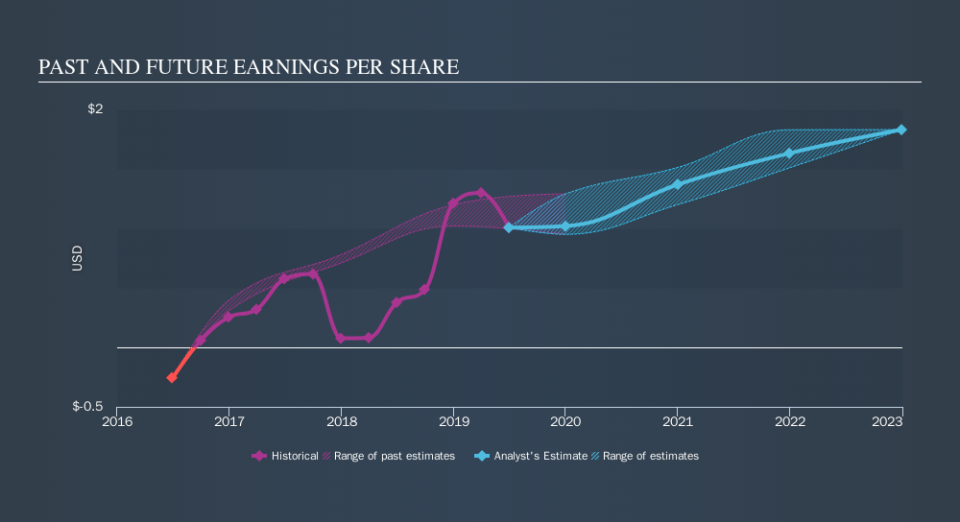

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, Boston Scientific moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Boston Scientific has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Boston Scientific's financial health with this free report on its balance sheet.

A Different Perspective

Boston Scientific shareholders gained a total return of 1.7% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 25% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Boston Scientific better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance