Is BOK Financial Corporation's (NASDAQ:BOKF) CEO Overpaid Relative To Its Peers?

In 2014, Steve Bradshaw was appointed CEO of BOK Financial Corporation (NASDAQ:BOKF). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

View our latest analysis for BOK Financial

How Does Steve Bradshaw's Compensation Compare With Similar Sized Companies?

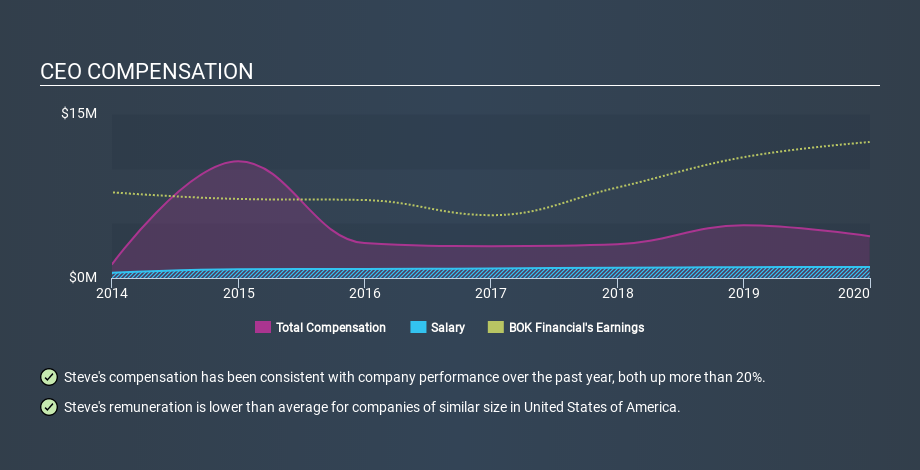

Our data indicates that BOK Financial Corporation is worth US$3.3b, and total annual CEO compensation was reported as US$3.8m for the year to December 2019. That's less than last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$1.0m. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from US$2.0b to US$6.4b, we found the median CEO total compensation was US$6.0m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where BOK Financial stands. On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. Non-salary compensation represents a greater slice of the remuneration pie for BOK Financial, in sharp contrast to the overall sector.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance. The graphic below shows how CEO compensation at BOK Financial has changed from year to year.

Is BOK Financial Corporation Growing?

Over the last three years BOK Financial Corporation has seen earnings per share (EPS) move in a positive direction by an average of 16% per year (using a line of best fit). In the last year, its revenue is up 2.6%.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. You might want to check this free visual report on analyst forecasts for future earnings.

Has BOK Financial Corporation Been A Good Investment?

Since shareholders would have lost about 38% over three years, some BOK Financial Corporation shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

It appears that BOK Financial Corporation remunerates its CEO below most similar sized companies.

Considering the underlying business is growing earnings, this would suggest the pay is modest. Despite some positives, it is likely that shareholders wanted better returns, given the performance over the last three years. So while we would not say that Steve Bradshaw is generously paid, it would be good to see an improvement in business performance before too an increase in pay. This sort of circumstance certainly justifies further research, because the investment returns might still come in the future. CEO compensation is an important area to keep your eyes on, but we've also identified 2 warning signs for BOK Financial (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance