‘Blessing in disguise’: Aussies celebrate latest rate cut

The Reserve Bank of Australia has slashed rates to a record low of 0.50 per cent, as the coronavirus outbreak takes its toll on the Australian economy.

And though dropping rates might not signal a healthy economy, it does signal a healthy bank account for homeowners.

“It’s a blessing in disguise,” Brisbane-based homeowner Jodie, a customer of Loans.com.au told Yahoo Finance.

“It means my principal will be paid off sooner rather than later - more money will go towards my principal, rather than interest. That just brightens my day.”

“We pay a little bit more off each week anyway, we’re always ahead, so any rate cut is welcome.”

Sanjiv from South Australia did the math after the latest rate cut, and found he would be saving between $60 and $70 per month, or around $750 each year.

Also read: Has your bank passed on the RBA’s March interest rate cut?

Also read: Reserve Bank makes interest rate decision amid coronavirus panic

“I was thinking of cutting my gym membership, but with the extra savings, I will be keeping it,” he told Yahoo Finance.

And Queensland couple Michela and Matthew are also celebrating the latest cut.

“While it doesn’t look like a huge amount of money when you look at the week-to-week expenditures, my yearly budgets are showing less interest paid, which means more money to spend or to save to offset my mortgage rates,” Michela told Yahoo Finance.

And they really do feel the difference.

“It’s nice to know that instead of rates going up, they’re actually being cut,” she said.

It also spells good news if the couple decides to offload their property.

“Low interest rates will also positively affect any future sale or any future purchase we might want to undertake.”

CoreLogic however, said perhaps low rates won’t have this desired effect.

“Lower interest rates would normally be a catalyst for an acceleration in housing demand and value growth, however there is less certainty that this will add fuel to the housing market in the current economic climate,” head of research, Tim Lawless said.

What does your new home loan look like?

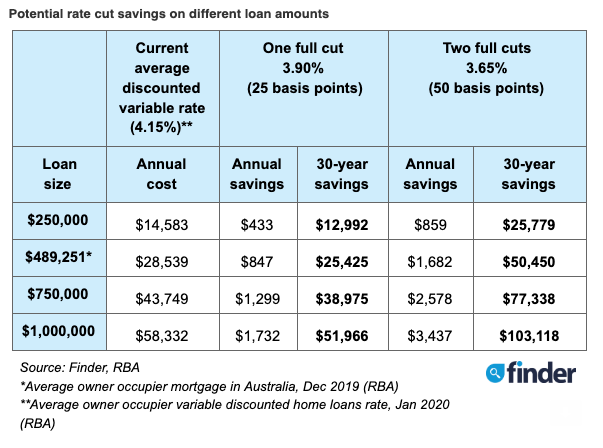

All big four banks passed on the entire 25 basis point cut, meaning the average mortgage holder could save thousands over 30 years on their mortgage, Finder data reveals.

On the average owner occupied mortgage of $490,000 over 30 years, this looks like annual savings of $847, and 30-year savings of $25,425.

In saying this, banking and insurance comparison site, Mozo, said by delaying delivering the cuts, and not passing on the full cut, the big four banks pocket billions: at least $23.3 billion since the RBA began cutting rates in 2011, to be exact.

“If the banks were to pass on today’s official interest rate cut in full, average variable home loan rates will be at their lowest level in history and owner occupiers could be $56 a month better off,” said Mozo director Kirsty Lamont.

My bank didn’t pass on the full interest rate cut

While most banks actually did pass the entire rate cut on this time around, some smaller lenders may not have.

If that’s the case, it could be time to switch banks.

“Keep an eye on your lender's website and digital channels to see how they are responding. If they aren’t passing on the cut, it might be time to shop for a new home loan,” Finder’s insights manager, Graham Cooke, said.

InfoChoice currently lists 22 three-year fixed rate products from independent lenders with rates under 3 per cent per annum.

If you’d prefer to stay with your current bank, you could try talking your way to a cheaper home loan too.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance