Is Black Knight (NYSE:BKI) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Black Knight, Inc. (NYSE:BKI) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Black Knight

What Is Black Knight's Debt?

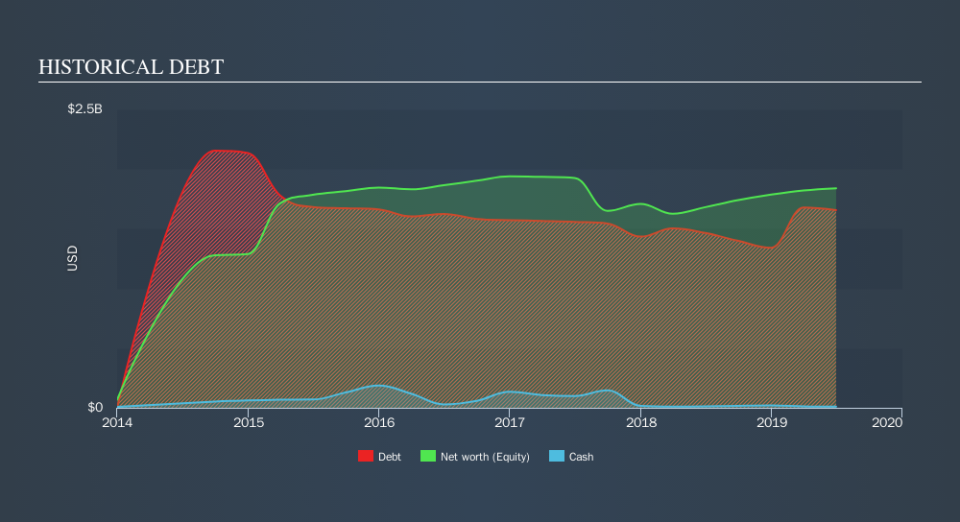

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Black Knight had US$1.66b of debt, an increase on US$1.46b, over one year. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Black Knight's Balance Sheet?

The latest balance sheet data shows that Black Knight had liabilities of US$208.7m due within a year, and liabilities of US$1.94b falling due after that. On the other hand, it had cash of US$9.30m and US$197.7m worth of receivables due within a year. So its liabilities total US$1.94b more than the combination of its cash and short-term receivables.

Black Knight has a market capitalization of US$9.37b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Black Knight has a debt to EBITDA ratio of 4.4 and its EBIT covered its interest expense 4.9 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Notably Black Knight's EBIT was pretty flat over the last year. We would prefer to see some earnings growth, because that always helps diminish debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Black Knight can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Black Knight actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

When it comes to the balance sheet, the standout positive for Black Knight was the fact that it seems able to convert EBIT to free cash flow confidently. However, our other observations weren't so heartening. To be specific, it seems about as good at managing its debt, based on its EBITDA, as wet socks are at keeping your feet warm. Considering this range of data points, we think Black Knight is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Black Knight insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance